The bulk of trading strategies are random because they are either overfitted to noise or are the result of selection bias. However, there are ways of even profiting from random strategies. In this article I outline the general idea and offer an example.

Traders are aware that the bulk of trading strategies do not offer profit potential due to data-mining bias and, as a result, most of them generate losses.

As it was shown in another article, identifying a consistently losing strategy to invert and profit from is as difficult as identifying a consistently winning strategy.

However, if one can identify random strategies that are at the end of a drawdown phase, there may be profit potential for limited time due to mean-reversion. This is because the longer-term expectation of a random strategy is 0.

This type of trading is of course highly risky because a losing strategy can continue to generate losses for an extended period of time before the expectation reverts toward 0. The probability of identifying strategies that are about to mean revert can be maximized if there if a sufficient trade sample is available and payoff is symmetric. Therefore, this idea of trying to profit from losing strategies does not apply to small samples generated by momentum and trend-following algos, especially on weekly and monthly data; it is more suitable for intraday and daily timeframes.

An example of profiting from random strategies

The example below involves identifying SPY price patterns in daily data using Price Action| Lab software. The in-sample is from inception of SPY to 12/30/2010 and the strategy performance will be tested for mean-reversion in 2011 when the market corrected and there was significant whipsaw.

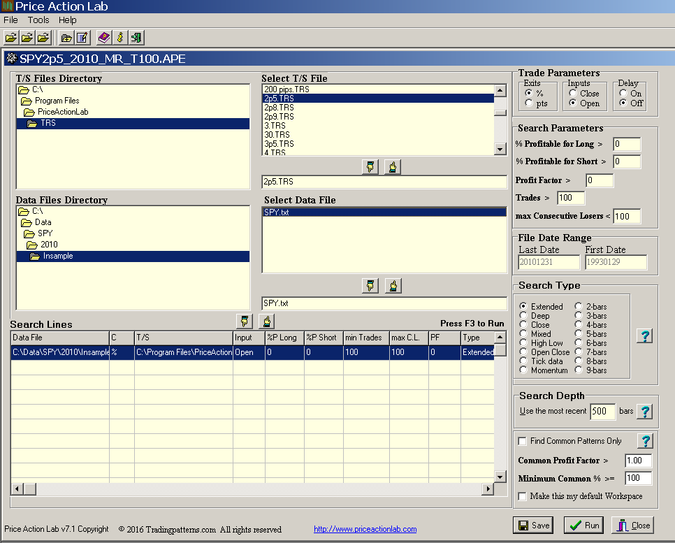

We instruct Price Action lab software to identify price patterns that satisfy the following criteria:

Win rate P > 0%

Number of trades > 100

Profit factor > 0

Maximum consecutive losers < 100

Profit target = stop-loss = 2.5%

Type of search: Extended

The above criteria will result in a large number of patterns that are random. Below is the search workspace:

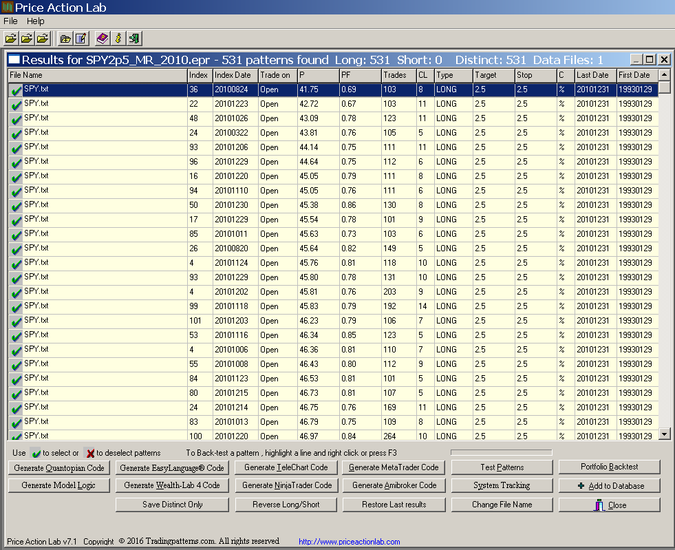

The results of this search are shown below:

Each line on the results corresponds to a price pattern that satisfies the performance parameters specified by the user. Trade on is the entry point, in this case the Open of next bar. P is the success rate of the pattern, PF is the profit factor, Trades is the number of historical trades, CL is the maximum number of consecutive losers, Type is LONG for long patterns and SHORT for short patterns, Target is the profit target, Stop is the stop-loss and C indicates % or points for the exits, in this case it is %. Last Date and First Date are the last and first date in the historical data file.

Price Action lab found 531 long patterns that satisfied the performance criteria specified on the search workspace (patterns are all long because we set P > 0.)

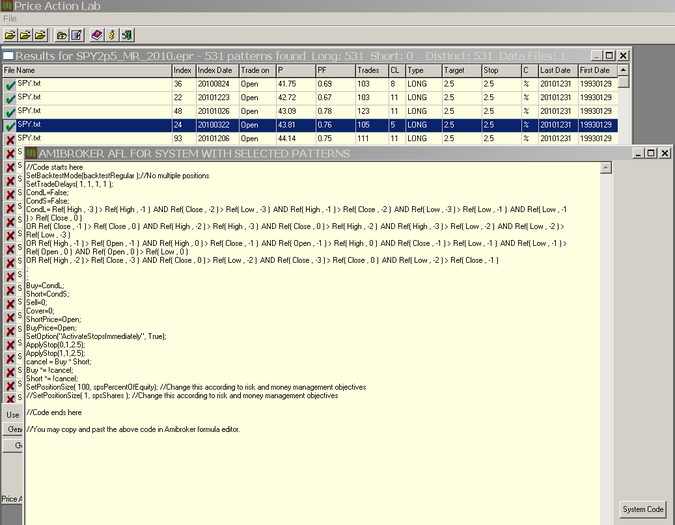

Next we sort the patterns by lowest win rate P, select the top four and generate system code for Amibroker, as shown below:

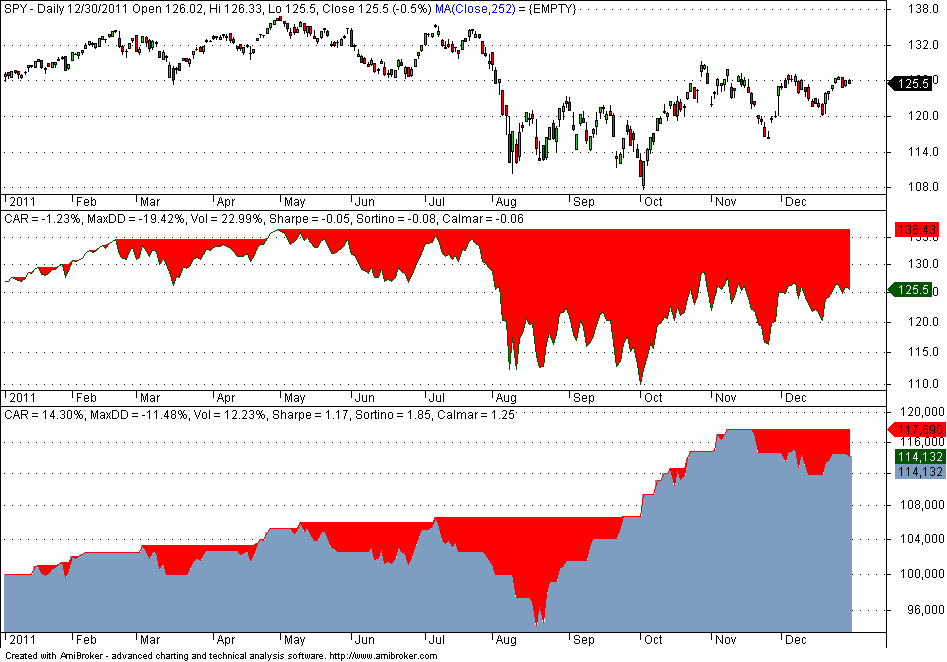

Next we insert the code in Amibroker to get the performance of the strategy for 2011:

The return of the strategy is 14.3% versus -1.23% for SPY total return. Sharpe is 1.17 versus 0.05 for buy and hold. Drawdown is also much lower, -11.5% for the strategy of four long random patterns versus -19.5% for buy and hold.

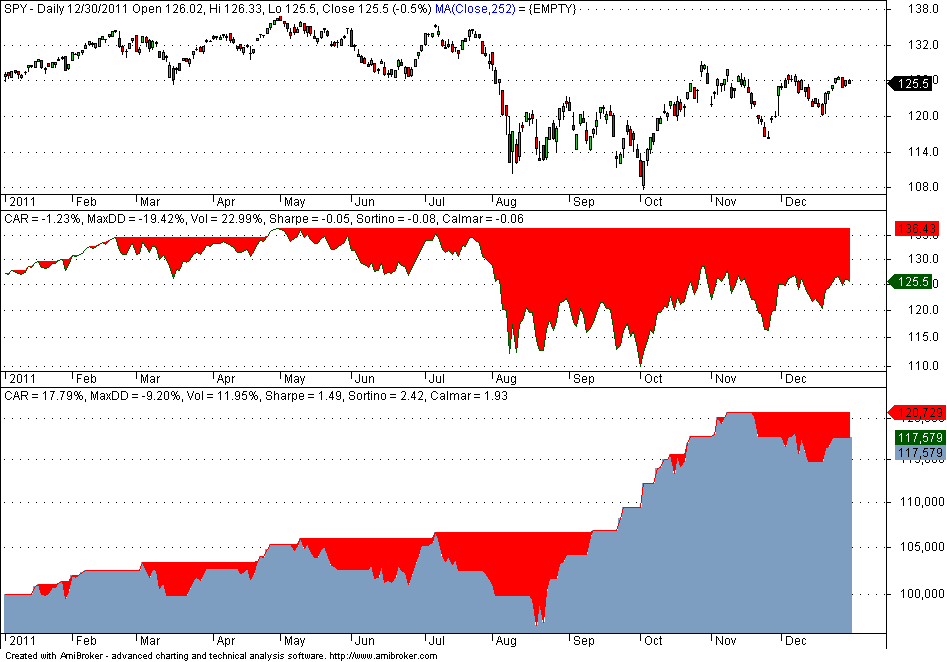

Note that we have selected on the worst four patterns. The smaller the number of selected patterns, the lower the probability that some of them will continue losing money. For example, had we selected three patterns, the performance would be better, as shown in the Amibroker chart below:

In this case of three random patterns, return is 17.79% versus 14.3% for four patterns. Also the drawdown is much lower.

There are several metrics that can be used to increase the probability that the performance of a selected random pattern, or strategy in general, is about to mean-revert but this is specific to strategy type. For price patterns, it may suffice to look at individual performance to determine whether mean-reversion has already started or is about to start.

One important consideration involves the time that the random strategies should be used. That depends on the timeframe and nature of the strategy. For example, for price patterns on daily data, they should not be used for more than a year and the procedure must be repeated to identify new random patterns.

I hope that you found the above ideas useful.

Subscribe via RSS or Email, or follow us on Twitter.

Charting and backtesting program: Amibroker

Disclaimer

Technical and quantitative analysis of Dow-30 stocks and 30 popular ETFs is included in our Weekly Premium Report. Market signals for longer-term traders are offered by our premium Market Signals service.