Maintaining a constant profit factor while lowering the payoff ratio requires a strategy with higher win rate. In general, high win rate strategies are more difficult to develop but when combined with lower payoff ratio usually perform better during times of uncertainty. In this article I present an example of a strategy and its performance results for 2015.

A few definitions:

Profit factor: The profit of winners divided by the loss of losers

Payoff ratio: The average winning trade divided by the average losing trade

Win rate: the percentage of winning trades based on the number of total trades

Note that the following holds (profitability rule):

win rate = 100 × profit factor / (profit factor + payoff ratio) (1)

The derivation of equation (1) can be found in this article.

It may be seen from equation (1) that for constant profit factor, the win rate is an inverse function of the payoff ratio. Thus, as the payoff ratio decreases, the win rate increases. The limiting case is when the payoff ratio is 0, in which case the win rate must be 1. This is impossible because payoff ratio of 0 means there are no winners. However, when the payoff ratio becomes very low, a win rate close to 100 is required for profitability.

A high win rate – low payoff ratio strategy

We will look below at the performance results for 2015 of a high win rate – low payoff ratio strategy for trading SPY, which was machine designed by Price Action Lab on April 2, 2015 using the following data samples:

- In-sample: 01/29/1993 – 12/31/2008

- Out-of-sample 01/02/2009 – 04/02/2015

More details about the machine design process with the in-sample and out-of-sample results can be found in this article. Note that the system has a theoretical payoff ratio of 0.5 since the profit target (2%) is half the stop-loss (4%.) The minimum win rate of the price patterns that comprise the strategy is 85%. The theoretical profit factor is about 2.83 given these requirements.

Below are the original out-of-sample results generated on April 2, 2015:

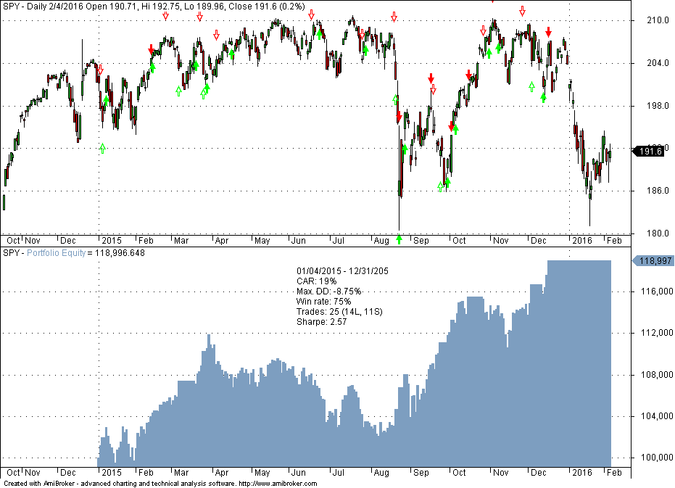

Amibroker system code was generated by Price Action Lab to test the strategy with data from 2015. Below is the equity curve with $0.01 per share commission and fully invested equity:

Results are hypothetical and are NOT an indicator of future results. Please read the full disclaimer at the end of this article.

This high win rate – low payoff strategy returned 19% in 2015 with a low maximum drawdown of less than 9%. The buy and hold return of SPY for 2015 was 0.82% with a 12% maximum drawdown.

The above results illustrate the potential of high win rate – low payoff ratio strategies during periods of uncertainty, volatility and whipsaw. Of course, we may not know in advance when such market periods will develop but there are always some signs that include rising volatility and loss of momentum. Regardless, in current environment, high win rate strategies are preferable but often harder to develop.

Subscribe via RSS or Email, or follow us on Twitter.

Charting and backtesting program: Amibroker

Disclaimer

Detailed technical and quantitative analysis of Dow-30 stocks and popular ETFs can be found in our Weekly Premium Report.