It is an empirical fact that trends develop in financial price series. But it is also an empirical fact that profiting from trends has not been easy in recent years. People with skin-in-the-game know that trends and trend-following are not equivalent terms.

Below is an excerpt from Chapter 3 of a book I wrote in 2005 and published by Wiley under the title Profitability And Systematic Trading (Note that this book is out-of-print and some material in it is now outdated but you can find a free copy in Traders Education section of our website.)

Trends develop in all markets and their presence, although it can be established with certainty only in hindsight, is an empirical fact. But experience with particular market conditions refers only to the past, which is irreversible. Time direction cannot be reversed and experience can be useful only as far as making decisions regarding future market conditions.

It is peculiar that many traders equate the existence of trends to the efficacy of trend-following and use the two terms interchangeably. The market is unforgiving of such misconceptions. It is one thing to have trends and another to be able to profit from them as anyone with skin in the game knows. However, it is also a fact from social media posts that the level of misconception in this area is very high.

Markets are dynamic and when many participants try to exploit the same edge they respond accordingly. In the 1980s and 1990s, trend-followers, i.e., traders who are exploiting the trend anomaly in prices, were able to profit from many markets. This is a fact given the actual past performance of Commodity Trading Advisors (CTAs.) However, in the last 13 years, CTAs have had a rough ride although there have been significant trends in commodity, fixed-income and financial futures. One reason for the performance deterioration of trend-following is liquidity constraints and competition. The markets cannot deliver profits to all participants and volatility adjusts to reduce returns. Other factors include a large number of publications documenting the trend anomaly and the proliferation of technical tools.

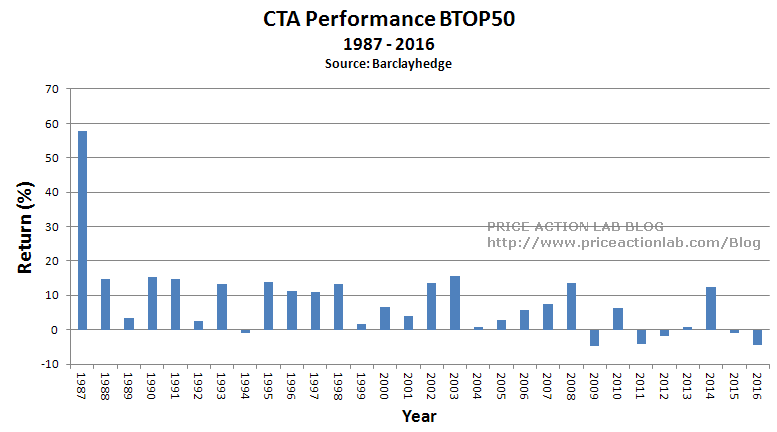

Below is a chart of the performance of the top 20 CTAs, most of which are systematic trend-followers.

In the last 13 years, CAGR is 2.42%. The S&P 500 total return CAGR in the same period is about 8%. This low performance of CTAs is a disappointment.

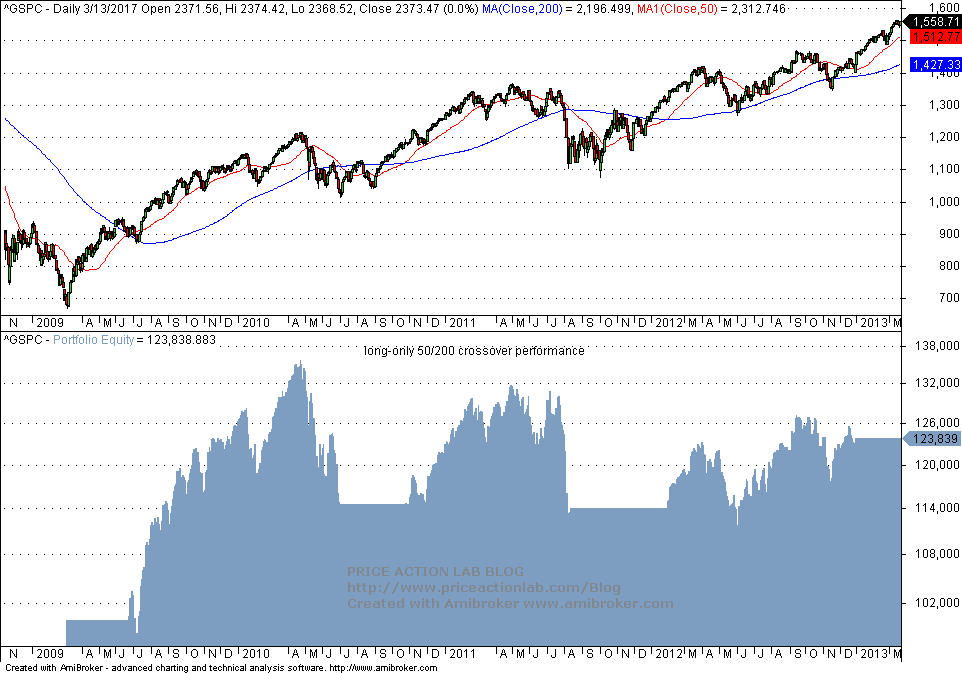

But why are so many people confused and equate trends to trend-following? There are several reasons for that but it is mainly due to a combination of cognitive biases. Let us consider an example: the uptrend in the S&P 500 from the bottom of the financial crisis on March 6, 2009, to the end of 2012, as shown in the chart below.

Many in the financial blogosphere think that the bull market in stocks started at the bottom of 2009. Unfortunately, this is a problematic view, as explained in this article. But more importantly many see an uptrend from the bottom of March 2009 to the end of 2012. Can we equate this uptrend to successful trend-following?

One problem with trend-following is that its execution requires a model unless one is a passive investor and then things are simpler. But a model is an approximation of reality. Markets always try to defeat models. Markets do not like models of markets. For example, below is the performance of the popular moving average crossover, known as a golden cross. The fast-moving average period is 50 days and for the slow, it is 200 days.

The net return (no dividends included) of the model is 24% as compared to 108% for buy and hold. This example demonstrates that trend is NOT equal to trend-following.

But why do some people fail to realize that trends and trend-following are not the same things? The answer may be found in a combination of the following cognitive biases.

- Anchoring: Relying on past information and interpreting everything around it

- Backfire effect: Tendency to even more strongly hold a position and ignore facts

- Confirmation bias: Looking only at information that confirms beliefs

- Hindsight: The dangerous tendency of perceiving past events as predictable

- Ostrich effect: Pretending that facts do not exist

- Selective perception: The tendency to perceive only what favors own views

- Survivorship bias: Focusing only on winners and ignoring the losers

The above cognitive biases may explain why some people equate trends to trend-following. No one is bashing trend-followers. There are successful trend-followers and profitable models. This article was not about the potential of any trend-follower in particular but the perils of confusing trends and trend-following.

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter.

If you have any questions or comments, be happy to connect on Twitter: @mikeharrisNY

Charting and backtesting program: Amibroker