Some pundits and financial media analysts get too excited about a 150 drop in the Dow because of cognitive biases and failure to adapt to recent conditions.

On the last trading day of 2017 the Dow Jones Industrial Average fell 118 points and some analysts and bloggers started making noise about a large drop in the index.

A drop of 100 points was significant when the index was at 2500 and amounted to a 4% plunge, or before that. But nowadays, 100 points down is a mere -0.4%.

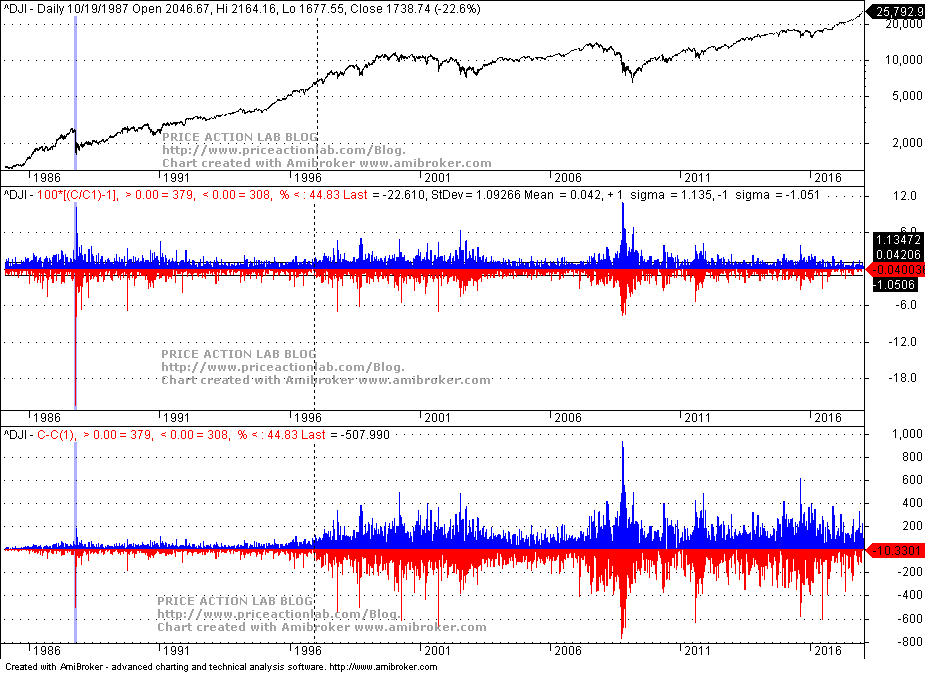

The chart below shows daily returns in percentages and changes from previous close in points. I have placed a vertical marker on Black Monday and a dotted line when point changed started losing their significance.

Although daily returns are comparable across time since 1986 other than the outlier of the 1987 crash, daily changes are not. Naturally, daily changes must increase to keep up with daily returns. This is obvious.

But is it really obvious? What are all these people on financial TV and blogs doing when they are over emphasizing the fact that the Dow fell 100 points when the index is now at around 26000 points?

There is a problem here. I do not think all these people are stupid although there is a small probability they are and I would not be surprised if that is the case. A lot of people with no relation to markets and no understanding of finance, trading, even basic math, appear as competent analysts because that is easy to do, to appear as, I mean.

However, there are other explanations apart from the stupidity scenario. One is that they know they are targeting many older people who were used to think that a 100 points drop is a significant event. In this way they can attract their attention for any reasons they have in mind, either click-bait or even to inject some panic. One can think of many possibilities but that does not alter the facts.

In my opinion, the financial media should stop reporting point changes in equity markets. I do not even have them in my charting software and I have to insert a special function to do that. Point changes are only useful in the case of some futures contracts and forex.

If you found this article interesting, I invite you follow this blog via any of these methods: RSS or Email, or follow us on Twitter

If you have any questions or comments, happy to connect on Twitter: @mikeharrisNY

Charting and backtesting program: Amibroker

Quantitative analysis of Dow-30 stocks and 30 popular ETFs is included in our Weekly Premium Report. Market signals for longer-term traders are offered by our premium Market Signals service. Mean-reversion signals for short-term SPY traders are provided in our Mean Reversion report.