Almost daily, another charlatan claims the market uptrend will continue and stocks will rise this year or in the next few years. These forecasts have no value since the longer-term upward bias of the stock market is known. Investors do not need another bullish charlatan but someone who can warn them of a coming bear market.

This article is along the lines of an article I wrote on November 18, 2015, with the title “The Charlatan Narrative” (Edit: a more recent article can be found here.). In that article, I call charlatanism the act of forecasting a longer-term uptrend in the market. Even individuals with no professional connection to markets know stock indexes go up in the long term because this is what they are designed to do. In a massive economy with an $18.6 trillion GDP, there will always be companies to add to an index to maintain its upward bias as long as the economy generates wealth.

What is even more peculiar is that professionals and some from major investment banks and hedge funds make bullish forecasts. Who is paying them to make naïve forecasts? Of course, some know they are acting naively but want to motivate the public to invest. In that case, it is better to say, “The long-term stock market uptrend is up” rather than “I am forecasting a longer-term uptrend.” Charlatans do the latter, and smart people (rarely) do the former.

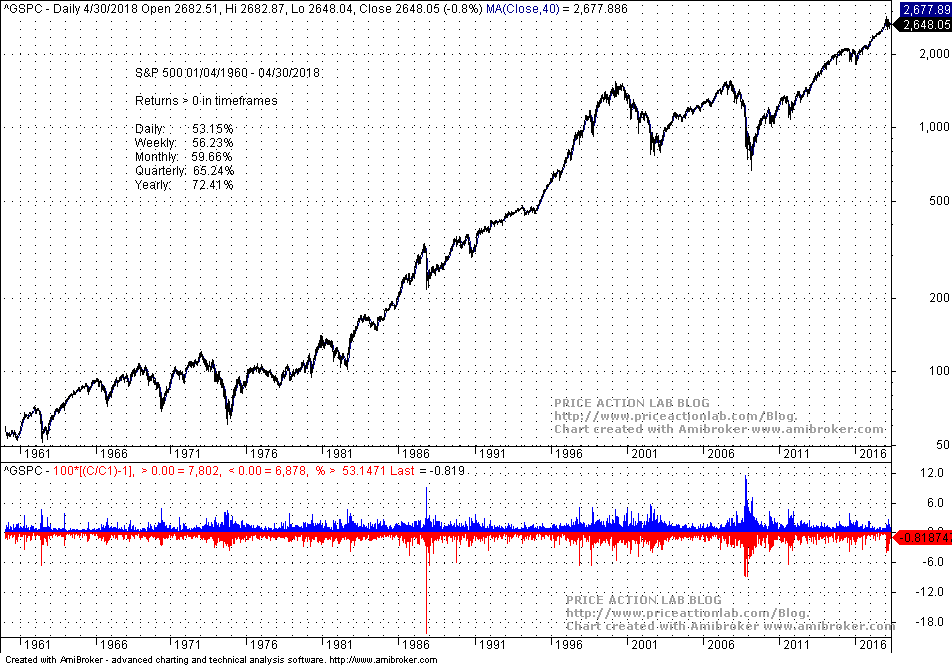

Below is the chart from the 2015 article for the period between 01/04/1960 to 04/30/2018.

The chart shows daily arithmetic returns and the percentage of winning returns for various timeframes. For example, 53.15% of daily returns were positive but in the yearly timeframe, 72.41% of years were positive.

The above proportions allow us to calculate odds after assuming sufficient samples. This assumption is weak but here we are measuring only proportions and not average returns of fat-tailed distributions. In the case of fat tails, the averages may never converge to a mean because the latter may not exist at all. In other words, if those charlatans, in addition to forecasting uptrend continuation, also offer the past mean return as the expected return for the next year, then they are twice charlatans since the true expectation is not known and the expected alpha may never be realized. Many longer-term investors were ruined in the past. But before explaining what we mean by ruin, let us first look at the odds of being right in various timeframes.

The odds that a bullish charlatan will be correct on average are given by:

Odds = p/ (1-p)

where p is the probability of success.

The table below shows the odds for the returns of the various time frames mentioned:

| Timeframe | Success rate % | Odds in favor |

| Daily | 53.15 | 1.13:1 |

| Weekly | 56.23 | 1.28:1 |

| Monthly | 59.66 | 1:48:1 |

| Quarterly | 65.25 | 1.88:1 |

| Yearly | 72.41 | 2.62:1 |

It is clear from the above table that the odds of an up year are way in favor of a bull. Odds increase as the timeframe increases. Therefore, since the odds favor the bulls, bullish forecasts are not informative. What investors need are sound bear market forecasts so they can protect their capital. However, not many have been consistently successful in making such forecasts because of the bullish upward trend.

The risk of investor ruin

Investors are not ruined only when they lose all of their capital but when they reach uncle point during a bear market. The uncle point is when an investor cannot withstand any more losses, economically or psychologically, and gets out with a large loss. This is what happened to many investors in the last 20 years during the dot com and financial crisis bear markets. It will happen again with probability 1. Therefore, investors do not need another charlatan who takes advantage of the longer-term bias and high odds to claim that the market will go up but a serious and competent analyst who can forecast major market downtrends.

Needless to say, there are not many of those. Forecasting is a difficult subject. Not many of those who try to make forecasts by conflating fundamental and/or technical indicators ever had formal training on the subject. Most of those clueless individuals have only read a few books by clueless authors on technical and fundamental analysis and repeat the same mistakes found in those books. Making sound forecasts and analyzing their significance requires an advanced level of understanding of probability and statistics. Forecasting is not a technical analysis, as the latter is a description of what has already happened and can only be elevated to the forecasting level via wishful thinking and confirmation bias. Apparently, the less someone knows about forecasting, the more able they think they can make forecasts with trivial methodology. This is the curse of ignorance. On social media, this ignorance is widespread.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS or Email, or on Twitter

Price action Lab premium Content: By subscribing, you have immediate access to hundreds of articles. Premium Insights subscribers have immediate access to more than a hundred articles, Premium Articles and Market Signals subscribers have immediate access to hundreds of articles that include the trader education section; and All in One subscribers have access to all past premium content. Click here for more details.