The Efficient Market Hypothesis (EMH) says that market timing can not give you consistent risk-adjusted excess returns because security prices take into account all the information that is available and only react to new information that is not available to fundamental or technical analysis.

Although there are several variations of EMH, known as weak, semi-strong, and strong, one thing is certain: this could be the biggest farce in the history of finance and economics. First, I will mention George Soros, one of the most famous opponents of EMH, in his books and articles.

Events have conclusively demonstrated the inadequacy of the efficient market hypothesis.

and

…the efficient market hypothesis has been conclusively disproved

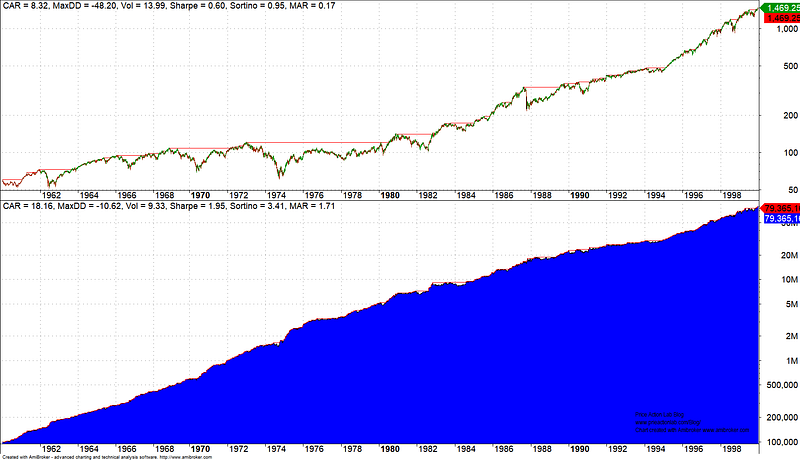

On December 10, 2018, I had the opportunity to present some ideas about reflexivity in financial market forecasting during the M4 Conference in New York City. My presentation included the following chart:

What you see on the above chart is a daily price series of the S&P 500 from 01/1960 to 12/1999 and the equity curve (before commissions) when buying at the close price if it is higher than the closing price of the previous day and selling when the reverse occurs. This is also equivalent to buying when the daily return is positive or when the price is higher than its two-day moving average and selling when the reverse occurs, as stated below:

Buy: P(t+1) > Pt <=>P(t+1)/Pt -1 > 0 <=>P(t+1) > [P(t+1)+Pt]/2

Sell: P(t+1) < Pt <=>P(t+1)/Pt -1 < 0 <=>P(t+1) < [P(t+1)+Pt]/2

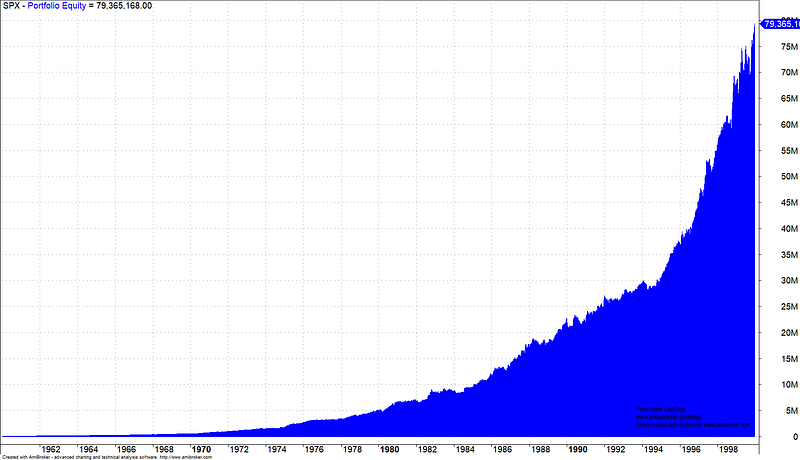

It may be seen that Sharpe for the trivial strategy is 1.95 versus 0.60 for buy and hold in the 40 years consider. The annualized return for the trivial strategy is 18.16% versus 8.32% for buying and holding. The steady growth in log scale corresponds to exponential growth on linear scale, as shown below:

By using MAR, the risk-adjusted return is 1.70 as opposed to 0.17 for buy and hold. Below are a few comments:

- Obviously, in the real world, the strategy would incur transaction costs. The trading frequency is about one trade per week but the important consideration is that before 1993, when the SPY ETF was launched, it was possible to trade the index only via the use of a tracking portfolio that would reduce transaction costs due to a smaller number of securities.

- Despite the transaction cost issue, the point is that a trivial forecast based on the last two traded daily prices consistently outperformed buy and hold on both an absolute and risk-adjusted basis.

- As I have shown in a paper, all moving averages with a period ranging from 2 to 20 outperformed buy and hold before commission in the period considered. For example, a 10-day moving average would have resulted in a frequency of about one trade per month, making this a more viable strategy under transaction costs.

The above result contradicts directly EMH since the simplicity of the strategy alludes to a structural dynamic in the period considered that allowed market timing and potential consistent outperformance of the market.

I argued at the M4 Conference that the cause of this dynamic distortion was reflexivity: forecasts for higher prices resulted in higher prices, and in turn, higher prices resulted in forecasts for higher prices.

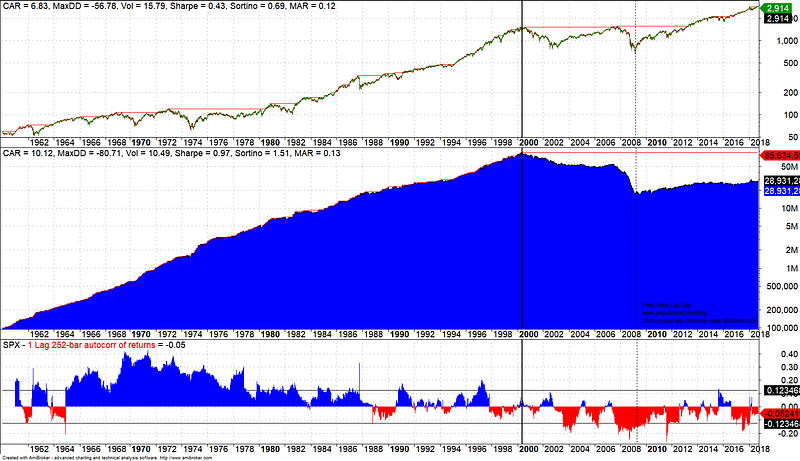

This dynamic persisted until the trade became unsustainable due to liquidity constraints, among other things. The chart below shows what happened to this trivial strategy after 1999:

The strategy stopped working suddenly in 2000 but regained some momentum after central bank intervention in 2009. The chart below the equity curve shows the 1-lag, 252-day autocorrelation of daily returns of the S&P 500. It may be seen that the autocorrelation was high in the 60s and 70s and then started decaying. By the late 1990s, the autocorrelation became negative and this was the reason this trivial strategy described above stopped working as the market became primarily mean-reverting.

There are some hypotheses about the cause of the high autocorrelation in the 1960s and 1970s that fueled the momentum of the trivial strategy. George Soros has mentioned the rally in conglomerates but a simpler explanation is that the high autocorrelation was a random outcome that nevertheless persisted due to reflexivity and until arbitrage removed it from the market.

The above results show what farce EMH has been; while professors at prestigious universities were sharing prizes about EMH, the market was undergoing one of the most distorted phases in its history, while a trivial strategy provided a timing tool for potential outperformance. We are not talking about one or two years of distortion: this is a 40-year period of persistent anomalous behavior in direct contradiction to EMH.

The side effects of this distortion were important. As I noted in the conference:

- Market participants attributed success to models or skills, when in fact it was due to a specific market regime — monkeys throwing darts could profit

- They thought over-optimized models work better in forward samples

- They underestimated fat tails and associated risks

- After the regime change, they thought more complex models must be able to generate better predictions (Machine Learning)

My full presentation for the M4 conference can be found here. The challenge we face nowadays is how to time markets in the presence of mean-reversion and lack of serial correlation. The good times are over long ago and people do not realize that most technical methods developed in the past century were fooled by the high autocorrelation, or were essentially over-fitted on some special market conditions that are not going to occur again. This applies to classical forecasting methods and technical analysis. Alpha under current market conditions can be generated only via idiosyncratic methods based on predictors that have economic value.

Summary

EMH was probably the biggest farce in the history of finance and economics. It was more of a wish than a reality at that time. As data show, even trivial forecasting methods based on simple moving averages outperformed buy and hold for 40 years until the trade became unsustainable.

After the emergence of cryptocurrencies, reflexivity effects have shifted to those markets, and equity markets are slowly losing their appeal to traders. The inability or increased difficulty of market timing in equity markets is not so much due to efficiency but to a lack of liquidity, as the bulk of participation is in passive indexing products and ETPs. Recent cryptocurrency dynamics have demonstrated that the reflexivity phenomenon can falsify EMH if markets have sufficient participation. EMH was probably a farce and those who promoted it were in a way detached from the reality of markets.

If you found this article interesting, I invite you to follow this blog via any of the methods below.

Subscribe via RSS or Email, or follow us on Twitter

If you have any questions or comments, happy to connect on Twitter: @mikeharrisNY