Is trend-following and especially managed futures convexity gone forever? We will try in this brief article to answer this question, but first we will offer a simple definition of convex returns without any mathematical obfuscation.

There are many reports from managed futures firms about the convexity of these programs, but readers not being able to follow the math and statistical analysis are eventually driven to accept that this is the case, i.e., that these programs that are mainly based on trend-following offer convex returns.

But what does convexity of returns mean in practical terms, and without the math, only a few quants are able to follow?

As it turns out, convexity means that when compared to a benchmark index, usually the S&P 500, these programs also offer positive returns on average when the index falls and especially during bear markets.

Convexity was an indisputable feature of managed futures and trend-following in the past when these programs generated large returns even when stocks were on a bear market. But is this phenomenon, or assumed property of these programs, persisting?

The answer is no. Due to several structural changes in the markets, it appears that convexity is lost. These are the most important changes:

- A crowded trend-following space

- Lack of influx of dumb money

- Change in trend dynamics

For more information, please see: Trends And Trend-Following Are Not The Same Thing

There are many funds that manage investor hard-earned money with relatively simple trend-following algorithms. The market may be unforgiving to this. These funds may lose a lot of money in this new market environment. After presenting some data, we will discuss the alternative routes.

Equity trend-following

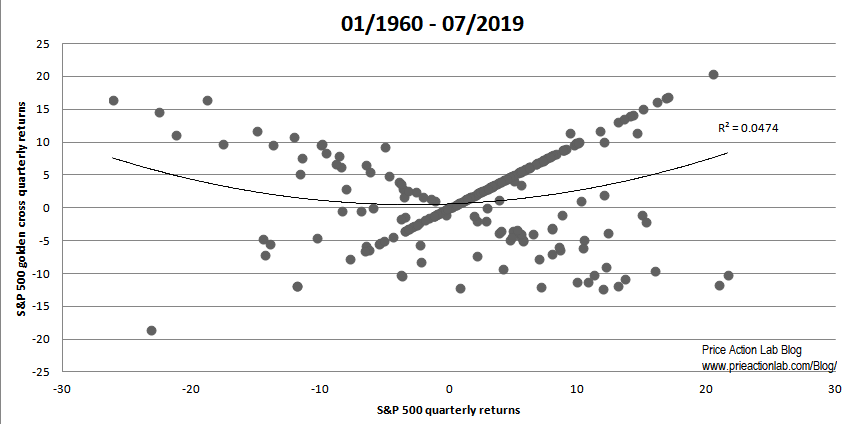

It is known for several years that equity trend-following no longer works as expected or as in the past. Below is a plot of the quarterly returns of the 50-sma/200-sma cross against S&P 500 quarterly returns from 1960 to present. There is no convexity.

What you see in the above chart is lack of convexity since, according to our simple definition without mathematical obfuscation, there are many quarters with negative S&P 500 returns and also negative trend-following returns.

Managed futures (Data from BarclayHedge)

But what about managed futures, many of which use trend-following methods?

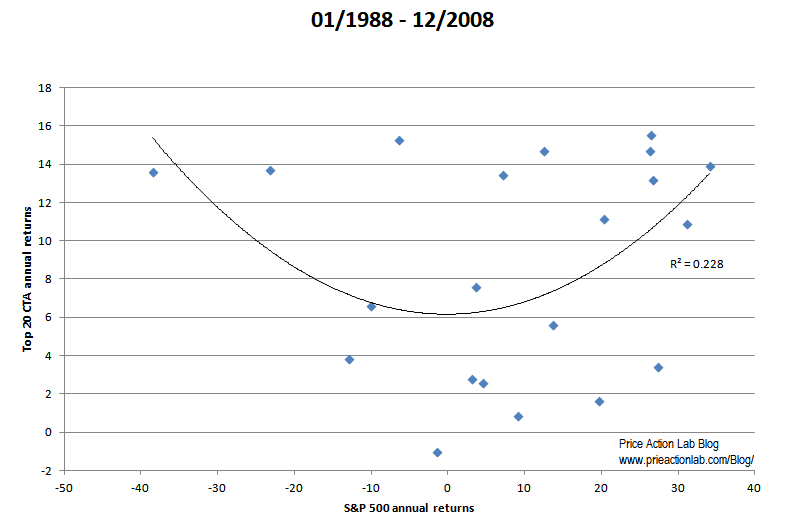

Below is a plot of annual top 20 CTA returns versus S&P 500 returns from 1988 to present.

The convexity is evident since, according to our simple definition, there is only one small negative return for managed futures with S&P 500 negative. Note that 2008 was a very good year for managed futures with large gains versus large losses for equities.

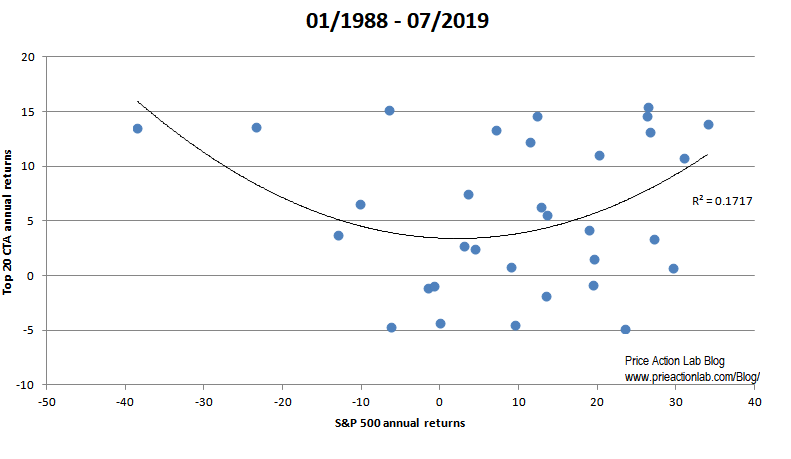

But what about after 2008? Below is how convexity has been affected in the last 11 years in addition.

It appears that convexity has weakened significantly. According to our simple definition designed to enlighten the reader rather than obfuscate with math, three more negative years in managed futures while the S&P 500 fell were added in addition to the one before, which was in 1994: specifically in 2011, 2015 and 2018.

Is convexity gone forever?

We cannot be 100% sure but we can say that convexity has deteriorated to the point that it is questionable whether it can offer the tail risk diversification it is advertised for.

Alternatives

Our discussions with fund managers indicate that many are looking for tail risk diversification in equity long/short.

Here is an example of long/short equity strategy with no losing years since 2008 based on features (rank metrics) developed by our DLPAL LS software.

Please note development and execution of equity long/short strategies are not trivial and require substantial knowledge and infrastructure. Problem can arise in fast down markets when there is inability to short stocks.

Another alternative is tail risk hedging with options, usually puts. This is also complex area and the cost is high but in the medium-term can be a more cost-effective strategy than using tail risk diversification with managed futures or equity long/short.

In our opinion is it unlikely that managed futures convexity is coming back to levels before 2008. Hedge fund managers should look for alternatives to this exceptional property that was available in the past. Those who fall victims of marketing schemes will probably pay a heavy price.

If you found this article interesting, I invite you follow this blog via any of the methods below.

Subscribe via RSS or Email, or follow us on Twitter

If you have any questions or comments, happy to connect on Twitter: @mikeharrisNY

Charting and backtesting program: Amibroker