It is now 2020 and I still see backtests in financial blogosphere with 30% or even higher annualized returns. There are many backtest billionaires.

Before showing to an audience a backtest with 30% annualized return, it is maybe a good idea to consider the following:

- Are annualized returns that high realistic outside of backtesting?

- Who is willing to pay for those high returns anyway?

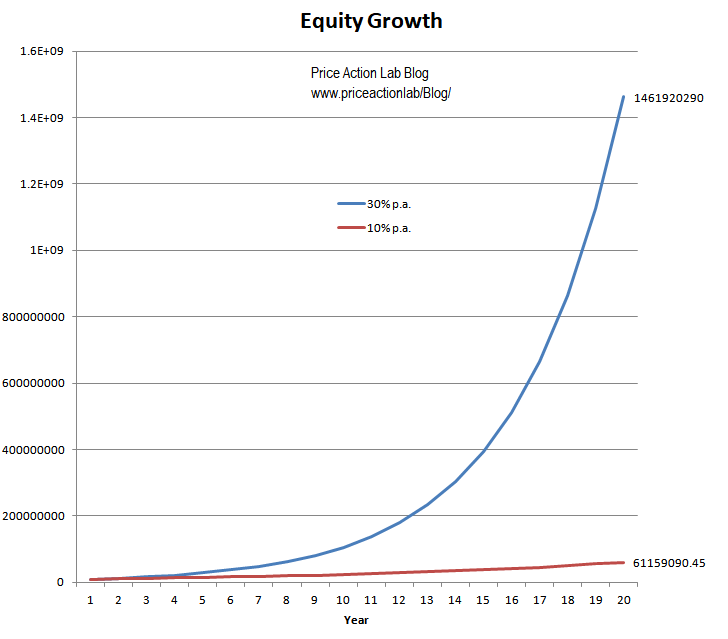

Before commenting briefly on the above, below is a chart that shows the relative growth of an investment of ten million dollars at 10% and 30% annualized returns in 20 years (including the first year.)

The red line (10% annualized return roughly equal to SPY ETF annualized return since inception in 1993) appears almost linear when compared to the explosive blue line (30% annualized return.)

Maybe the market is willing to pay someone with $10 million about $51 million in 20 years under some strict conditions but it is highly unlikely it will pay about $1.4 billion based on a backtest.

1. At this point, very high annualized returns are found only in backtests. A realistic threshold is about 15%–18%, and above those levels, results are suspicious.

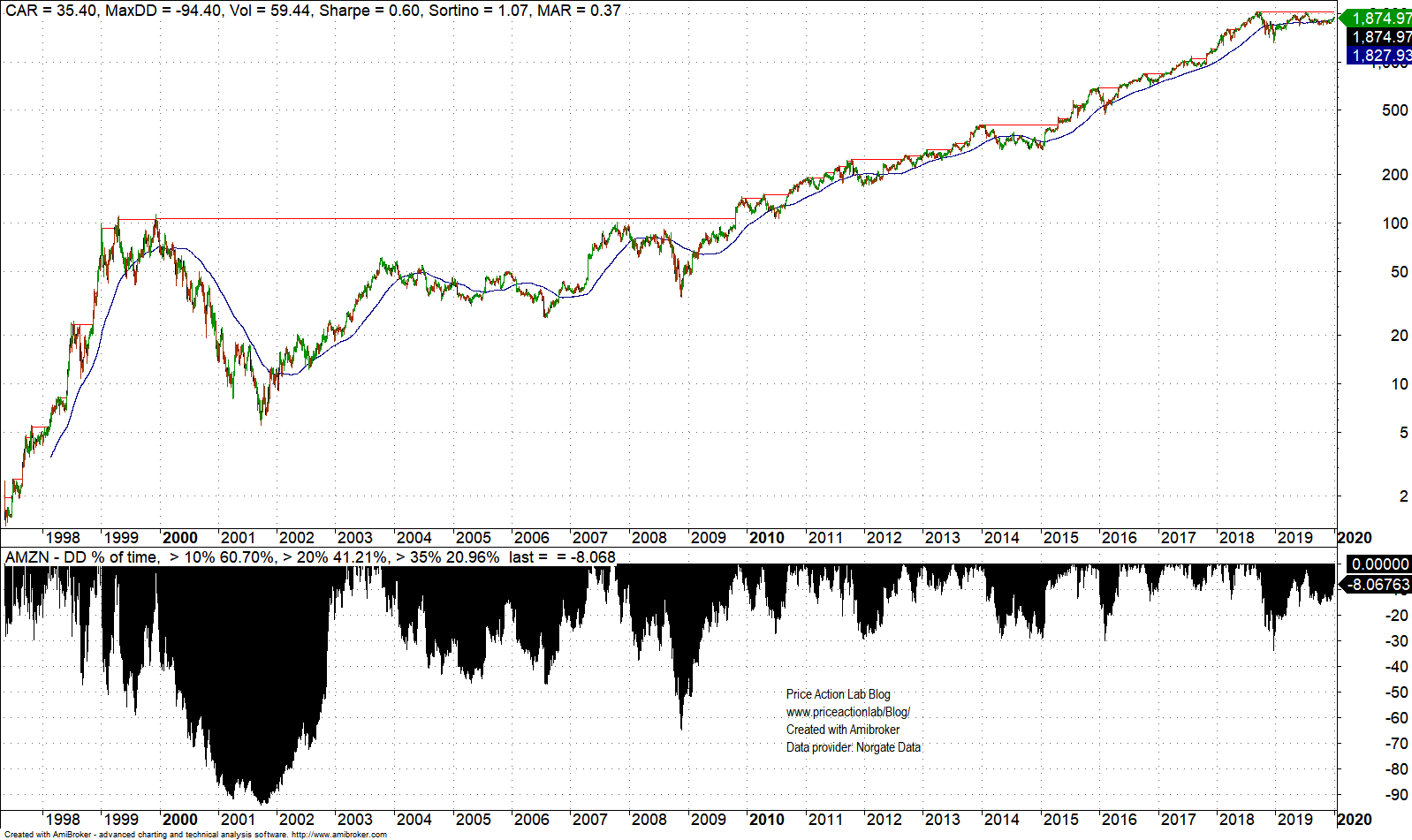

2. Markets have become way more sophisticated and there is no massive influx of unskilled traders as in 80s and 90s to fulfill dreams of billionaire status from trading. In addition, market participants are nowadays paying closer attention to risk management than before. The conditions that made fortunes to CTAs in the past simply do not exist now. Same holds for all major markets. Annualized return for AAPL since IPO is a little less than 20% and for AMZN it is about 35% but that has come at drawdown in excess of 90% as shown in chart below. No one shows any 30% annualized return backtests with 90% drawdown.

When I see backtests with 20% annualized returns, I become skeptical. Above that, I start questioning the understanding of the markets of those who produce them. At 30% annualized return and given enough time, someone can own the market. This is simply not possible; the market will react accordingly and invalidate the process that is trying to do that.

Charting and backtesting program: Amibroker

Data provider: Norgate Data

Technical and quantitative analysis of major stock indexes and 34 popular ETFs are included in our Weekly Premium Reports. Market signals for position traders are offered by our premium Market Signals service

If you found this article interesting, you may follow this blog via RSS or Email, or in Twitter