The medium to longer-term trend is more important that any intermediate counter-trend rallies.

Yesterday, Josh Brown made a reference to a fact about the market most have already forgotten or even never experienced as investors or traders.

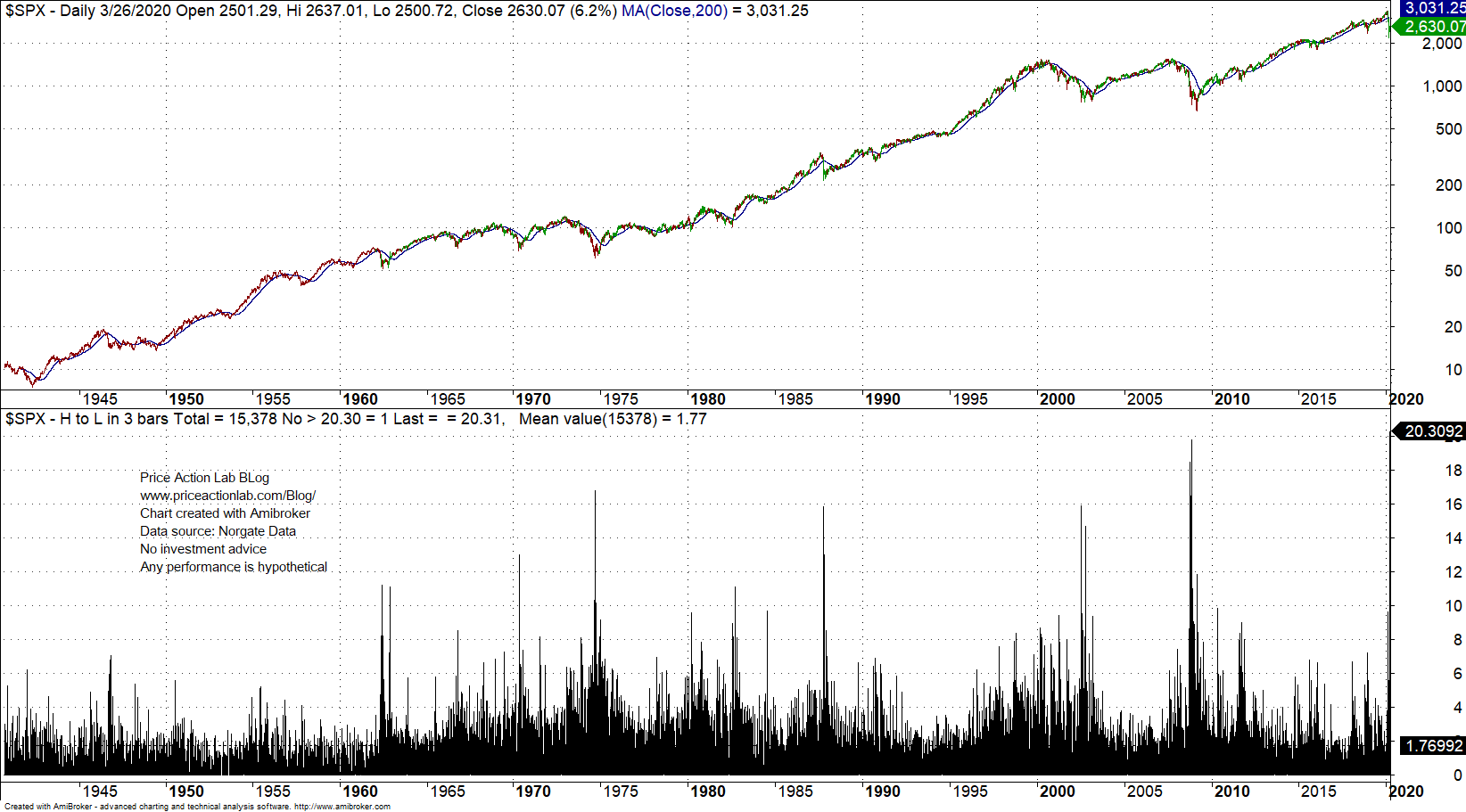

I remember those bull markets but I was trading commodity futures and currencies then and did not pay much attention. Here is the S&P 500 chart that confirms what Josh wrote above.

Medium to longer-term trend is what counts most. Making decisions based on intermediate rebounds was obviously not a good idea then and maybe also now.

As a side note, there are some “gurus” around that tout trading records from the 90s uptrend when it is known that monkeys throwing darts were more profitable on the average than technical analysts. Those “gurus” never say how much of those profits were lost in subsequent attempts to enter long again after those three bull markets shown in the chart above. I have an estimate: all profits were lost and even more.

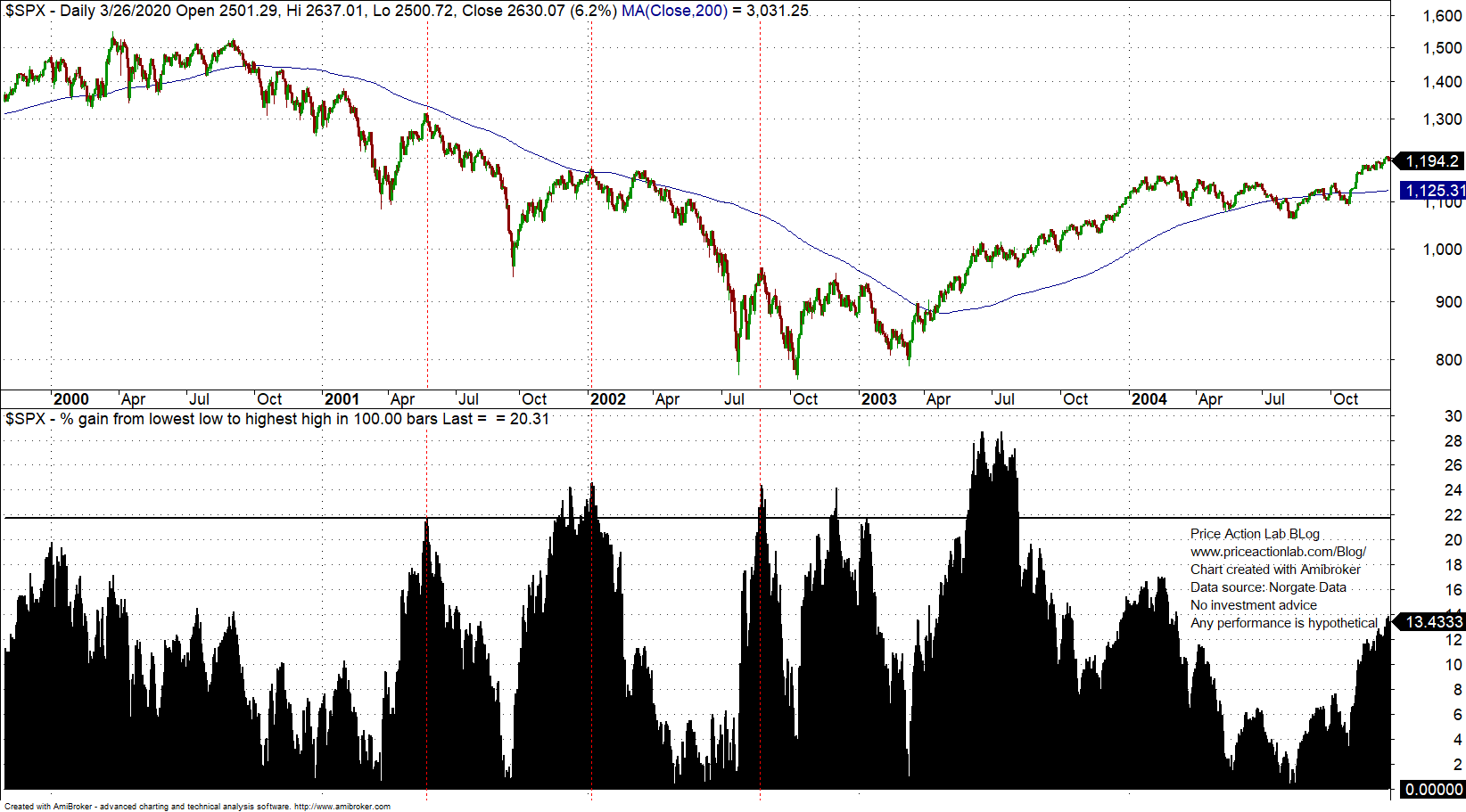

Below is the chart that shows the 3-day return from low to high in S&P 500 as of yesterday.

The index rose 20.3% in the last three days from low to high and 17.6% on a closing price basis. Both gains are new records since 1940. However, it is not fair to compare periods when the market relied on its own resources to current period with central banks flooding the market with liquidity. Therefore, a 5% or 6% performance in three days in the 70s may be equivalent to more than 17.6% and I would make a guesstimate: more than 50% in current terms.

Is this rebound just an intermediate bull market in a medium to longer-term bear market? I have no idea. Proper diversification is what matters for investors and for traders what matters is having a robust timing method. The future market trajectory is unknown but given the data it cannot be “too optimistic.” Of course, there is the possibility that central banks will start buying index ETPs. In that case, pay attention to strategy signals. Now, more than ever, it is time to be careful with the discretionary approach; it may be the case that “this time is different.”

Charting and backtesting program: Amibroker

Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS or Email, or in Twitter