There is widespread misconception that tail risk hedge can offer protection from black swans. This is unlikely since depending on the severity of a black swan there may be impact on financial transactions. Tail risk hedges may be useful under certain conditions. Diversification is not tail hedging.

The recent market crash due to the pandemic was a white swan, i.e., an anticipated event that eventually occurs given enough time. A black swan comes as a surprise; it is observer dependent and has significant negative impact on some of the observers but may be beneficial for other observers.

Depending on the nature of a black swan, a financial hedge may not be useful. For example, an unexpected catastrophic event may impact financial transactions and a hedger of a passive equity index portfolio may never get paid for put options appreciation. In this case, a physical hedge, such as gold, may act as a better hedge. Therefore, let us concentrate on white and grey swans tail risk hedges. Are they appropriate and under what conditions?

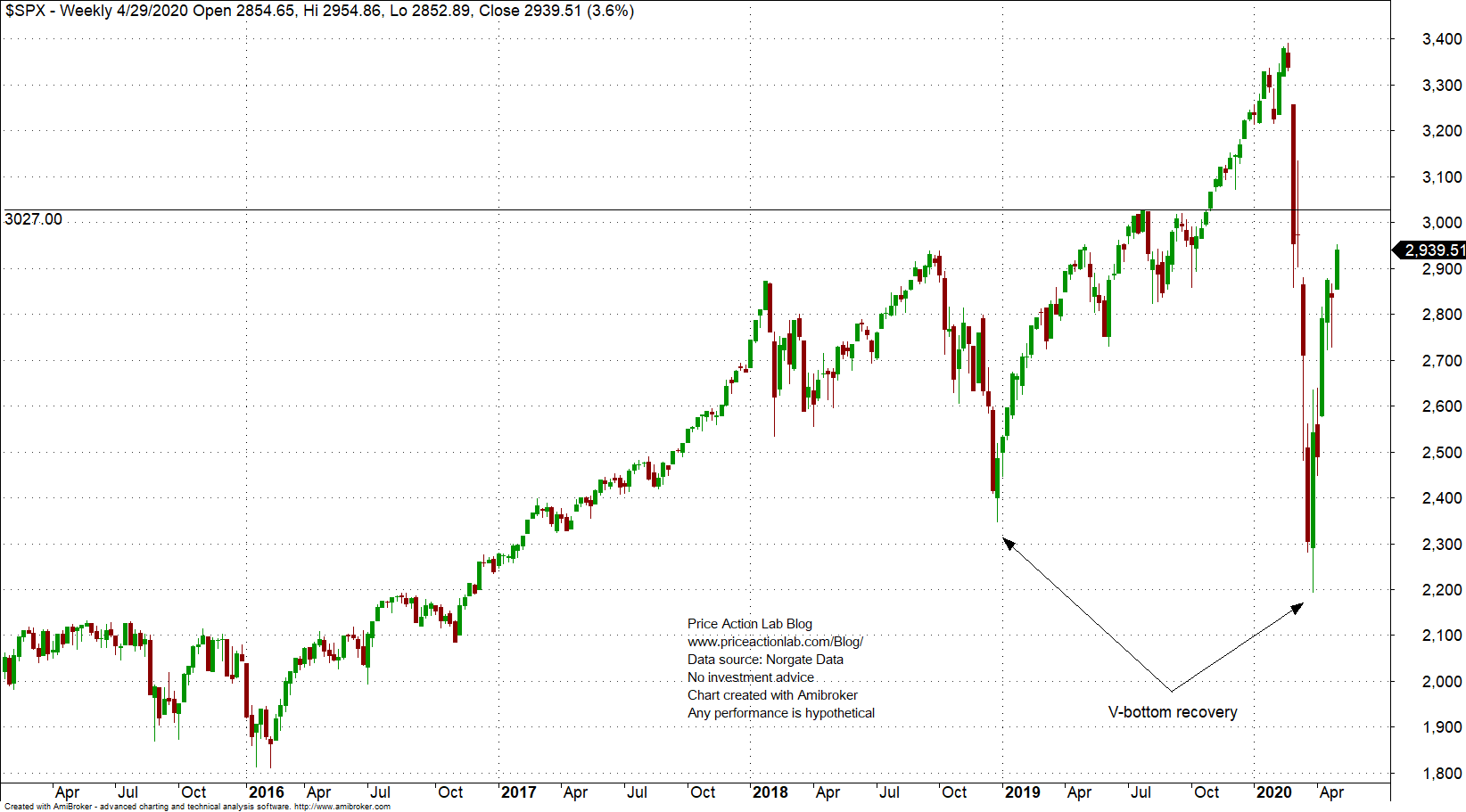

To start with let us first take a look at the weekly S&P 500 chart below.

If V-bottom recoveries are going to be the modus operandi of the market due to central bank interventions after white or grey swans, then this poses certain difficulties in realizing gains from tail risk hedges.

Although in hindsight one could determine where a tail risk hedge should have been removed and profits realized, in reality no one knows that except market timers, i.e., traders with advanced forecasting ability and more importantly no liquidity constraints. Wrong timing results in excessive “theta burn” for most hedges based on options.

Large funds and especially the passive indexing type will probably not be able to take advantage of tail risk hedges under conditions of quick V-bottom recoveries both due to not using timing models but also due to liquidity constraints; if they try to reverse a tail risk trade they will move the market against them.

The main question is the following: would proceeds from a tail risk hedge cover enough of the cost incurred during extended bull markets?

Before looking at an example note that simulations are crude since these are highly non-linear stochastic systems with many parameters, known and unknown. In addition results are path-dependent and the past may not resemble the future even close.

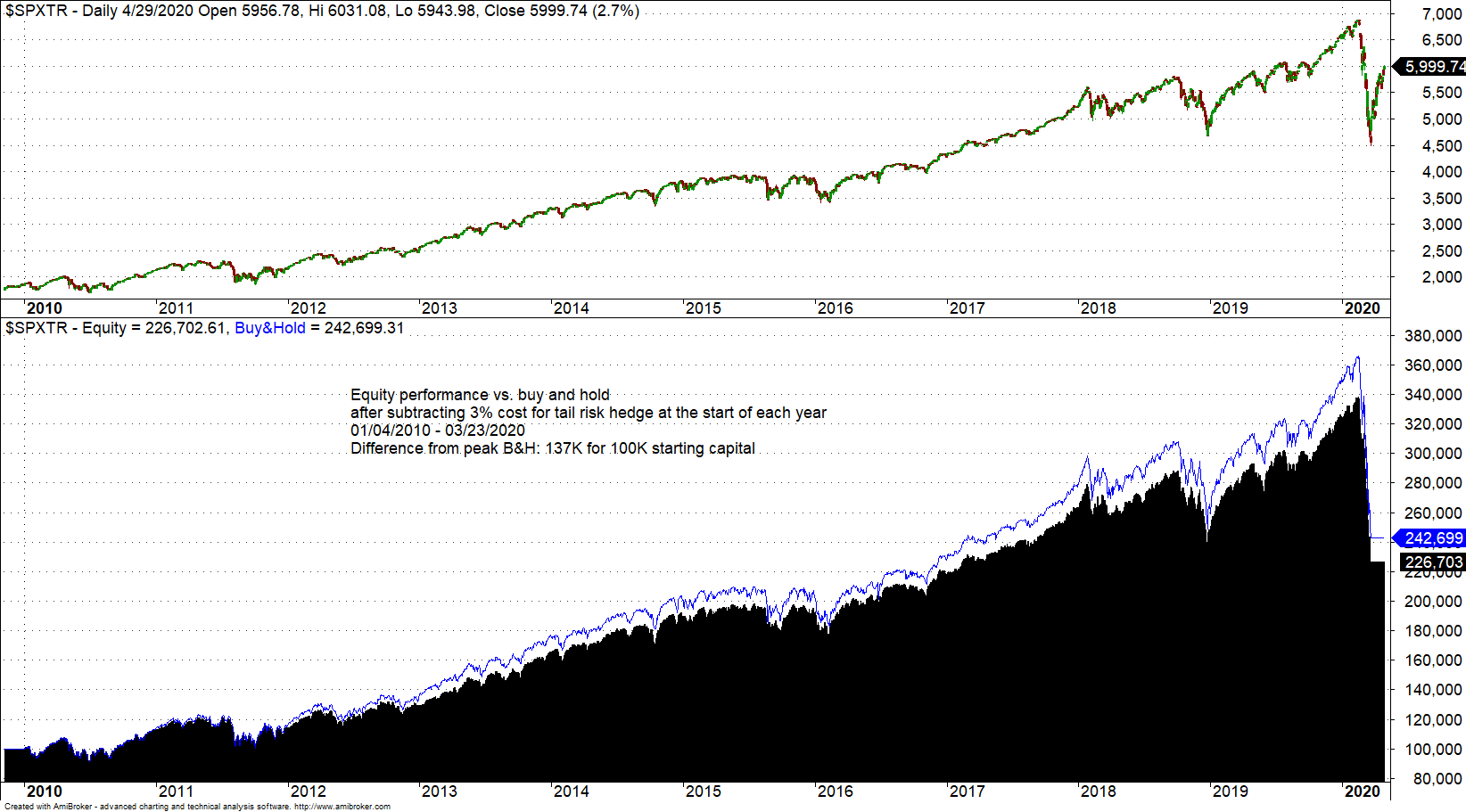

With the above understanding, let us look at an example for 3% annual cost of the tail hedge on equity from 01/04/2010 to 03/23/2020, i.e., at the bottom of the correction due to pandemic. We use the S&P 500 total return as the underline buy and hold asset.

It may be seen that there is steady buy and hold underperformance due to the hedge cost and at the low of the market it was about 16K based on 100K starting capital. But the difference from the equity buy and hold top on February 19, 2020, is about 137K

Now, a savvy investor or trader could have probably recovered the equity loss due to market crash by investing in puts or other synthetic financial instruments. Even funds with AUM of one billion at the top of the market could have realized about 0.37 billion in gains from a hedge to fully recover losses. or even a good fraction of the losses as to outperform the index, assuming near perfect timing.

But what about a 100 billion fund at the top of the market? That would require 37 billion of gains from a hedge to fully recover. Could the market provide those gains to that fund and every other large fund hedging tail risk? The answer is no, there is no free lunch of that kind.

Therefore, the question is what constitutes a proper hedge for each fund based on liquidity constraints and whether any fractional gains are higher than the losses realized due to executing it over the longer-term. This is a hard question to answer in general and it is actually an exceedingly complex problem for quants.

For small funds and proprietary traders, tail risk hedges make sense and if executed properly can offer significant protection. Market punishes size when it comes to hedging and for large funds execution of these strategies may not viable or even be beneficial.

Finally and to conclude this brief account of a very complex topic, diversification is not tail hedge. Investing in a stock/bond portfolio may or may not provide a hedge while at the same time impact returns in comparison to buy and hold. Same is true for investing in alternative assets, such as commodities and currencies.

Charting and backtesting program: Amibroker

Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS or Email, or in Twitter