Bitcoin’s high correlation with stocks is another indication that no alternative asset can escape the perils of financialization. There is a “simple” explanation.

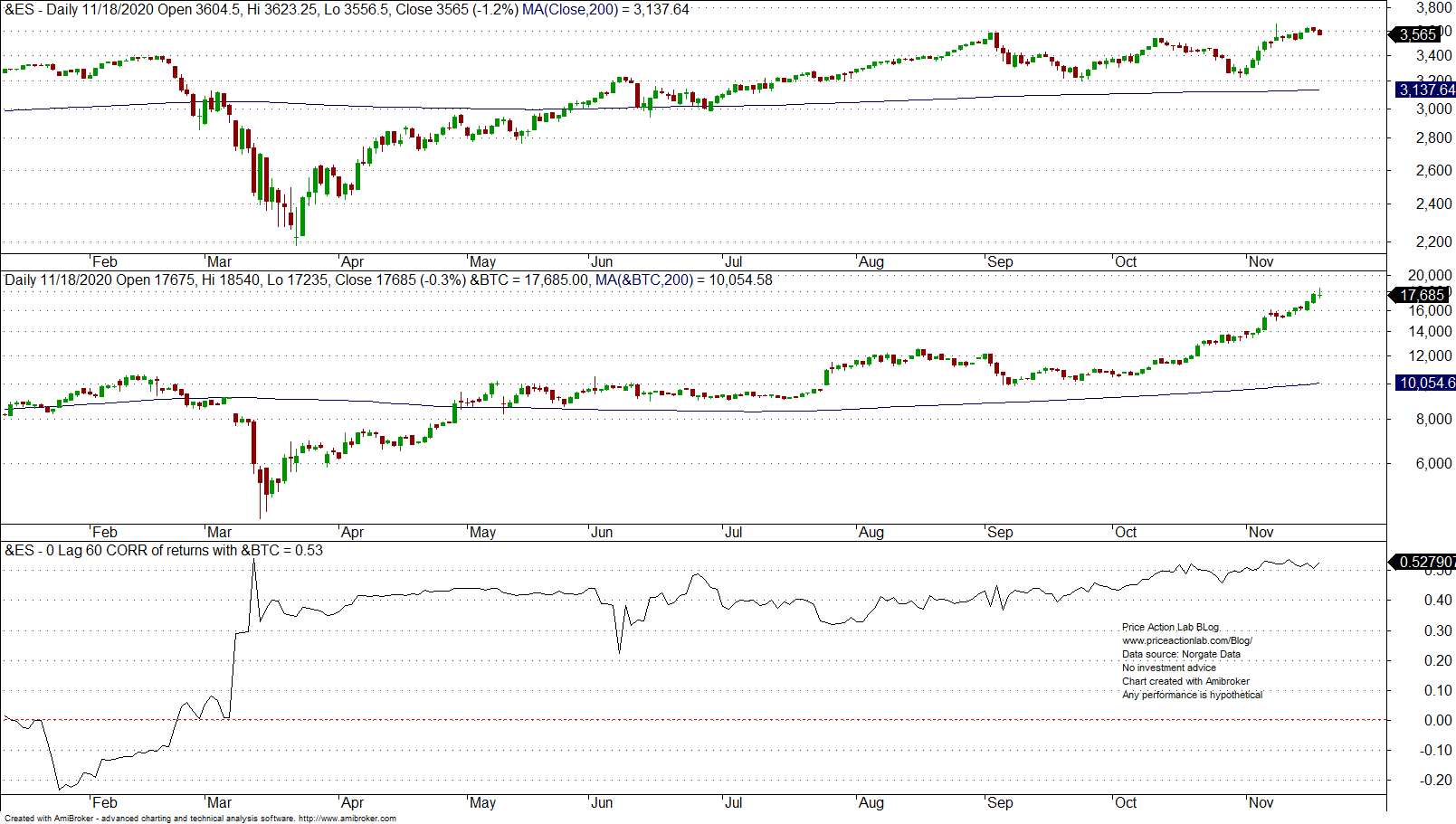

The 0-lag, 60-day correlation between S&P 500 mini and bitcoin futures contracts was at +0.53, as of the close of Wednesday, November 18, 2020.

During the February – March stock market crash there was a spike and since the correlation has remained elevated. It is puzzling that a digital asset followed the short-term trends in equity markets closely; bitcoin fell along with falling equities in March and then recovered after equities bottomed.

Although causes of price action are often not verifiable hypotheses, there may be a “simple” explanation for the high correlation between stocks and bitcoin: the US dollar and the fact that bitcoin is quoted in US dollars.

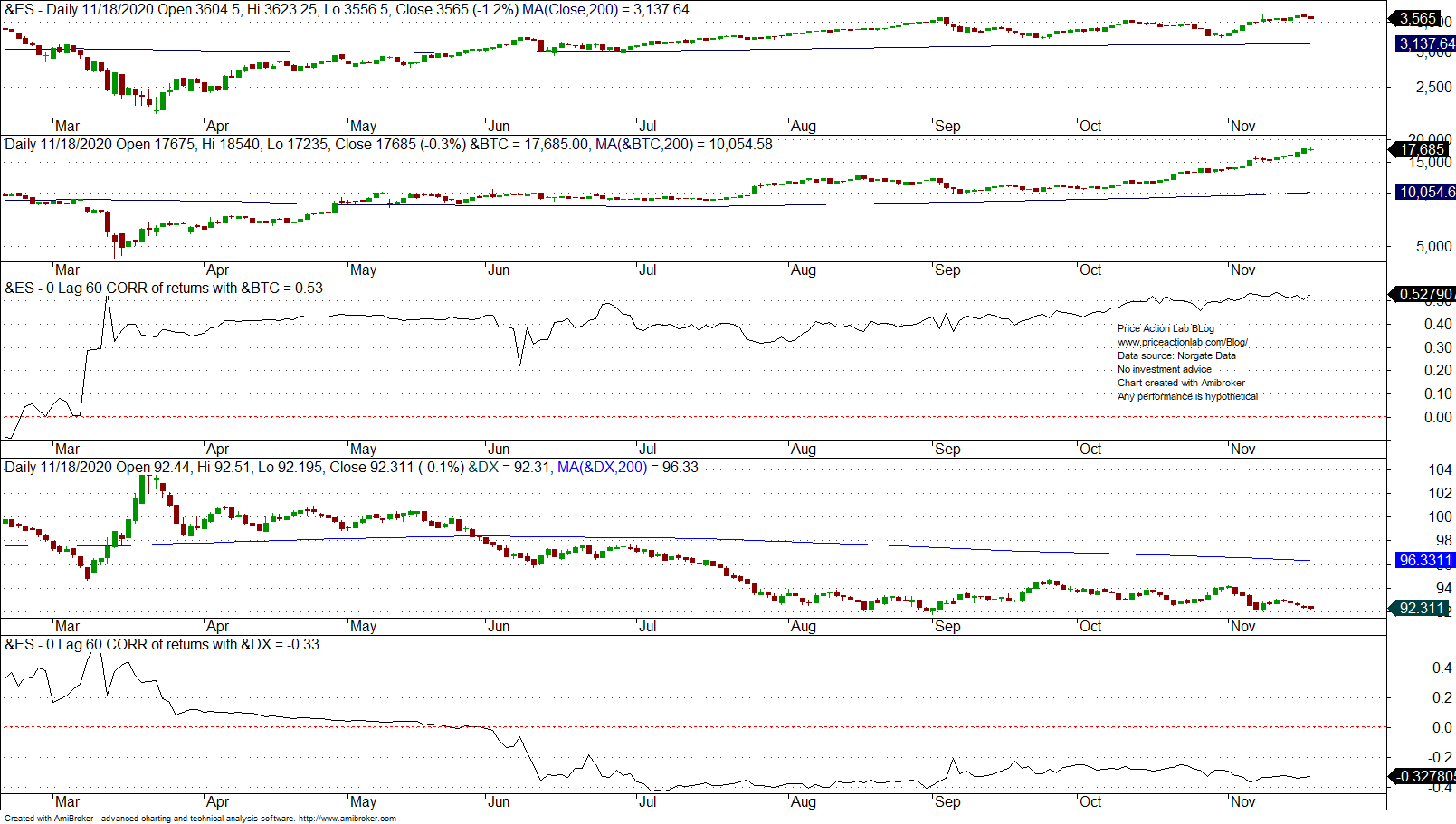

The chart below also includes US Dollar index futures and the correlation with the ES-mini.

US Dollar index rose when equities and bitcoin fell during the market crash earlier this year. Then, after equities bottomed, US Dollar index entered a downtrend and remained anti-correlated with stocks and bitcoin.

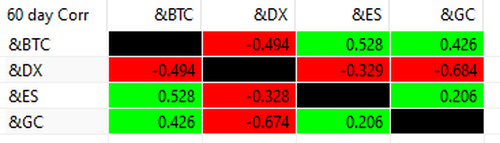

Below is a correlation table for S&P 500 mini, Bitcoin, Gold and UD Dollar index futures contracts.

US Dollar index highest anti-correlation is with gold as expected, then with bitcoin and with stocks. However, note that correlations are dynamic and constantly change depending on market conditions. The above correlation table reflects the state of correlation at a particular instant in time.

One conclusion is that bitcoin and even gold at this time are far from good hedges against a market decline but the US dollar may serve that purpose. Often the best hedge is the asset that is used as a hedge the least. This makes sense, if you think about it for a moment.

Charting and backtesting program: Amibroker

Data provider: Norgate Data

If you found this article interesting, you may follow this blog via push notifications, RSS or Email, or in Twitter