Applying pre-filtering to stock universe based on suitable criteria is often important before generating long/short signals. Below is an example from daily returns on January 6, 2021.

We use DLPAL LS software to generate daily long/signal for S&P 500 stocks. The entry is on the open of a day and the exit at the close. No positions are held open overnight. More details on 2020 performance can be found in this article.

Daily ranking

We use the product of two features generated by DLPAL LS, Pdelta and S, to rank securities and then select top five stocks for long and bottom five for short. Pdelta is the directional bias and S is a measure of its significance.

Rank = Pdelta × S

Before the features are generated and ranking is applied, we pre-filter the stocks according to a few criteria. Customers with a license of DLPAL LS can contact us for details about the specific pre-filtering.

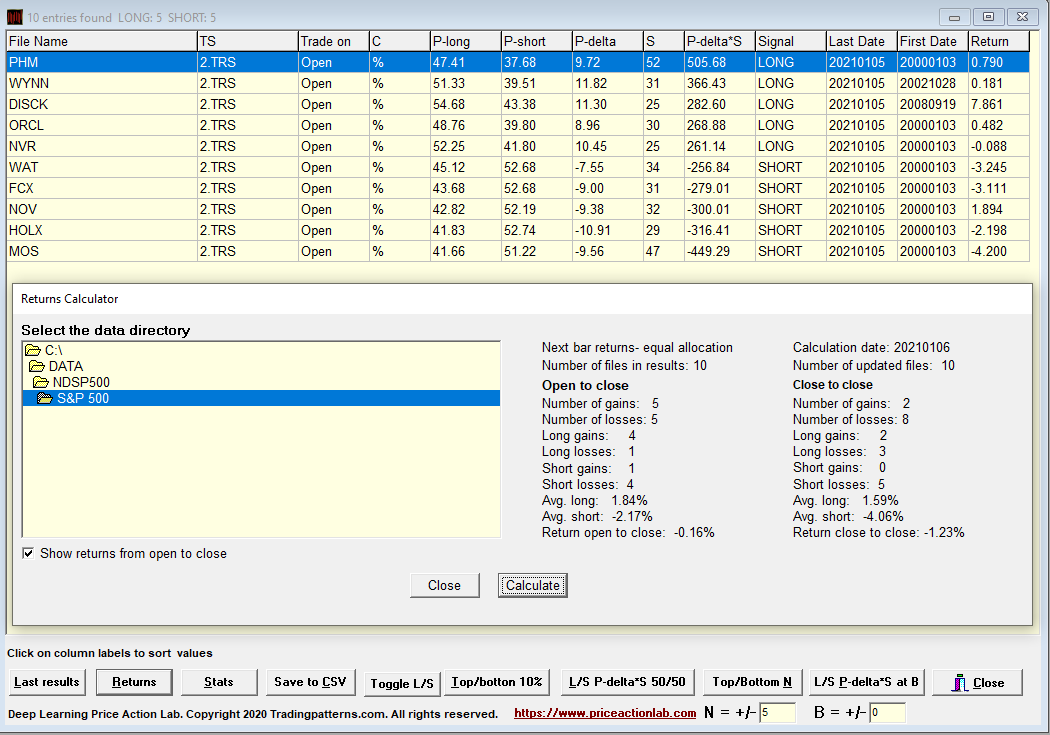

Below are the results for January 6, 2020, based on the features calculated after the close of the previous day and with no pre-filtering applied to S&P 500 universe of stocks.

The average return for the day was -0.16% from open to close.

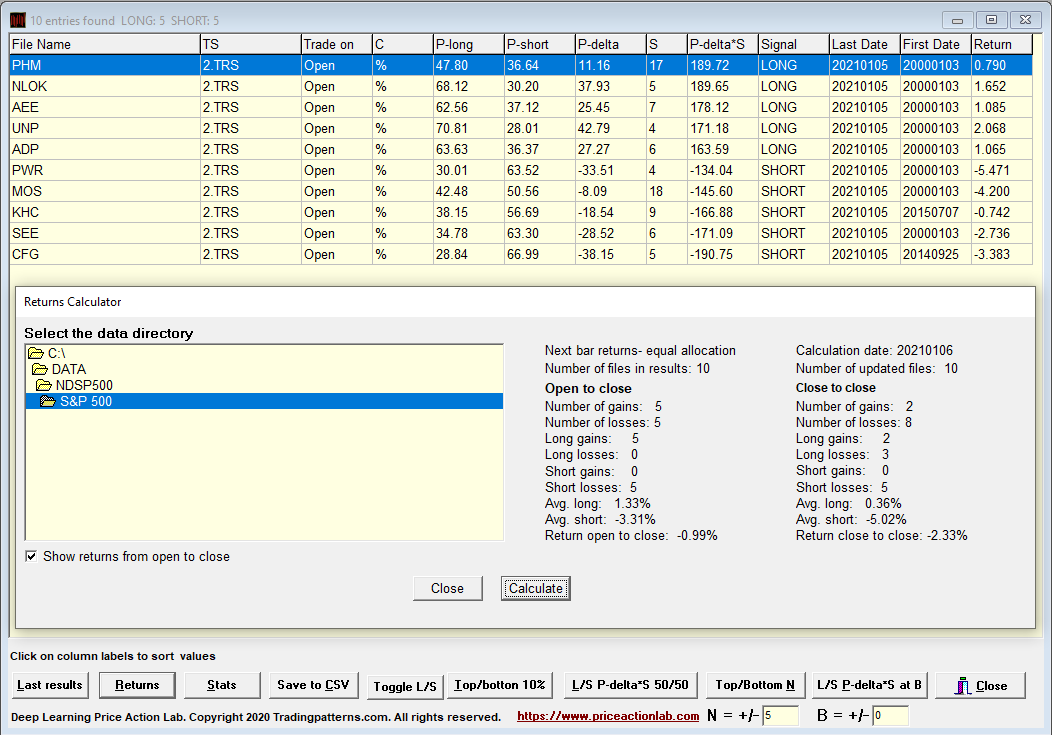

Below are the results after pre-filtering was applied. The number of stocks under consideration was reduced from 502 to 73 but this number changes daily and may assume any value between about 30 and 500.

The average return from open to close was 1.04%. This is a big difference from -0.16%.

Smooth features did not perform as well. Without pre-filtering the average return from open to close was -0.99%.

However, after applying pre-filtering, the average return was 0%. The gain is about the same as with normal features.

As it may be seen, pre-filtering can affect results significantly but it is not a panacea and at times generates worst results. However, so far we have determined based on forward analysis that overall generates better results than when using the whole S&P 500 stock universe.

DLPAL LS offers a different way of developing trading strategies that does not rely on traditional indicators. This software is used by fund managers around the world to develop long-short but also directional strategies in a variety of markets.

More details and articles about DLPAL LS can be found here.

If you have any questions or comments, happy to connect on Twitter: @priceactionlab

Strategy performance results are hypothetical. Please read the Disclaimer and Terms and Conditions.