Many market analysts but also traders think there is a stock market bubble if judging from messages in social media and articles in blogs. Bubble calls appear to conflate higher prices with higher returns. More importantly, a bubble state is not necessary for a large market correction; any white swan event will do despite valuations.

There is no stock market bubble. Usually bubble arguments come from those who look at absolute and not relative price levels.

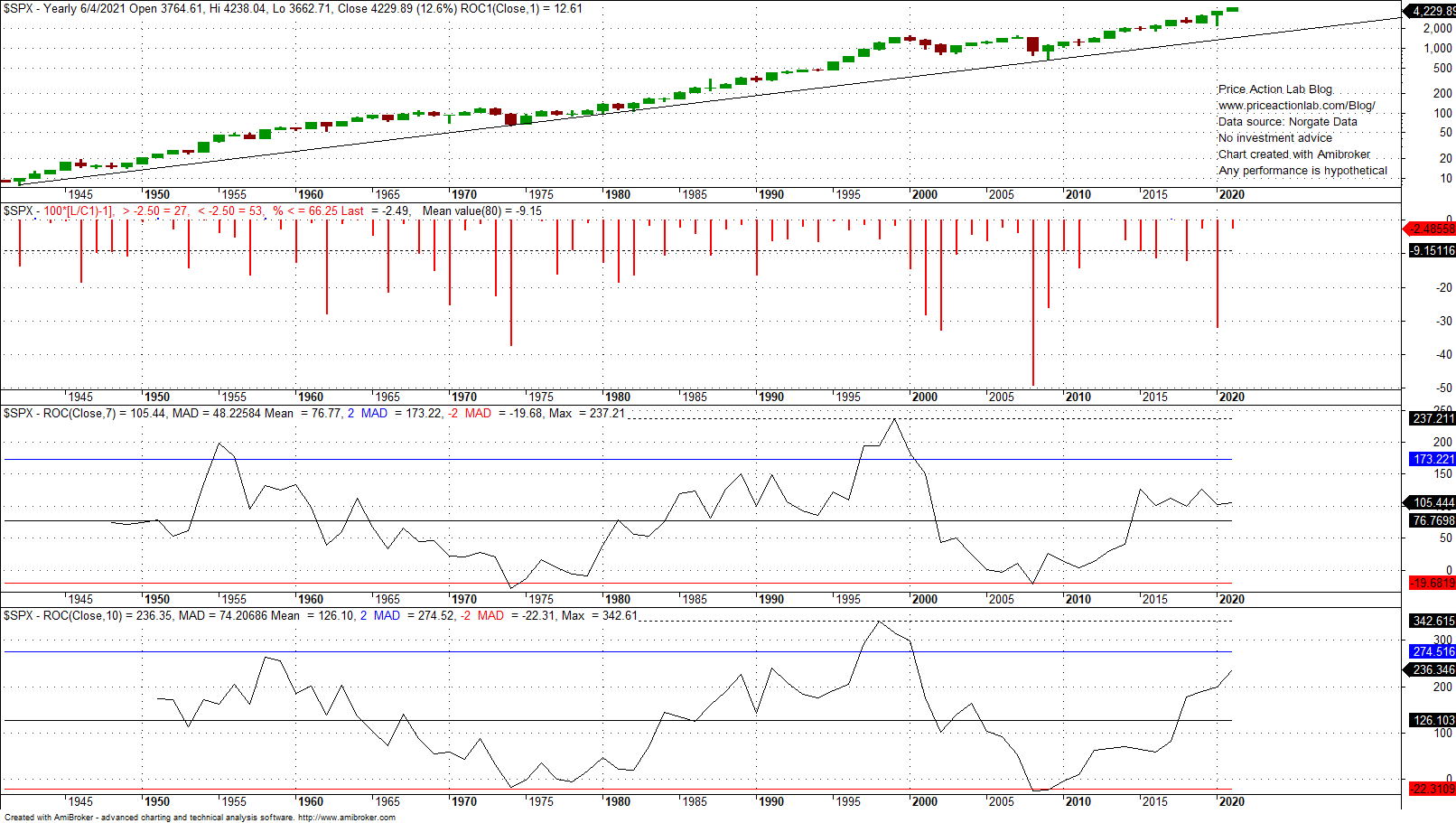

The first pane of the above yearly chart of S&P 500 index since 1941 shows that the low of this year has fallen 2.5% below the close of the previous year. This is a strong bull market. But it is also shown that in the last 80 years, the low fell less than 2.5% from the close of the previous year in 27 of those years. Therefore, lack of a correction measured from the close of the previous year is not necessarily an indication of a bubble market but has occurred about 34% of the time. Also note that the low of a year never fell below the previous close in the case of seven years. But there is a better measure of the “bubble state” of a market.

The next pane shows the rolling 7-year rate-of-change. Based on this measure, the stock market performance has been virtually flat since 2015. The current value is 105.4% versus 237.2% in 1999 and before dot com top. Two-mean absolute deviations are at 173.2%.

The last pane shows the rolling 10-year rate-of-change. Current value is 236.3% versus 342.6% in 1998 and before the dot com top. Two-absolute mean deviations are at 274.5% and about 40% above current levels.

According to relative performance measures then, there is no state of bubble. Prices are higher because this is an absolute effect. If bubbles were dependent on absolute price levels, then the market would be in a state of permanent correction after reaching one of them.

What is important is to realize that the bubble claim is a red herring. Markets can crash even when they are not in a bubble state. Valuations are always high with respect to some arbitrary metric. Leverage is always high although nowadays it is higher than in the past. A bubble is not required for a bear market. If fact, calling the market a bubble reinforces the bull case.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker

Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS or Email, or in Twitter