Long/short and price action anomaly detection has good performance on Tuesday, July 6, 2021. Below are the results.

For long/short we use DLPAL LS software and for price action anomaly detection we use DLPAL DQ software.

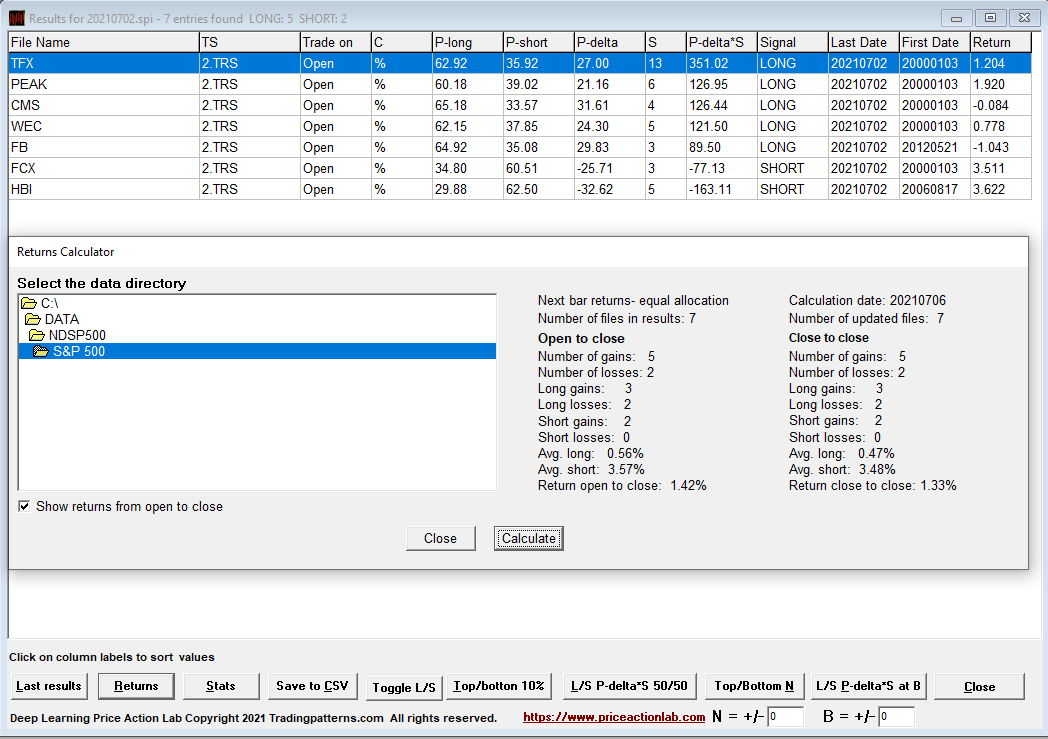

1. S&P 500 long/short with bias

For S&P 500 long/short with bias we instruct DLPAL LS to filter the results for both long (P-long) and short (P-short) greater than 65. Below are the results as of the close of Friday, July 2, 2021, along with the returns from open to close of the next trading day, Tuesday, July 6, 2021 (Monday was a holiday.)

There were signals for 5 long and 2 short stocks. Both shorts gained and 3 of the longs also gained. The average gain from open to close of the day was 1.42%.

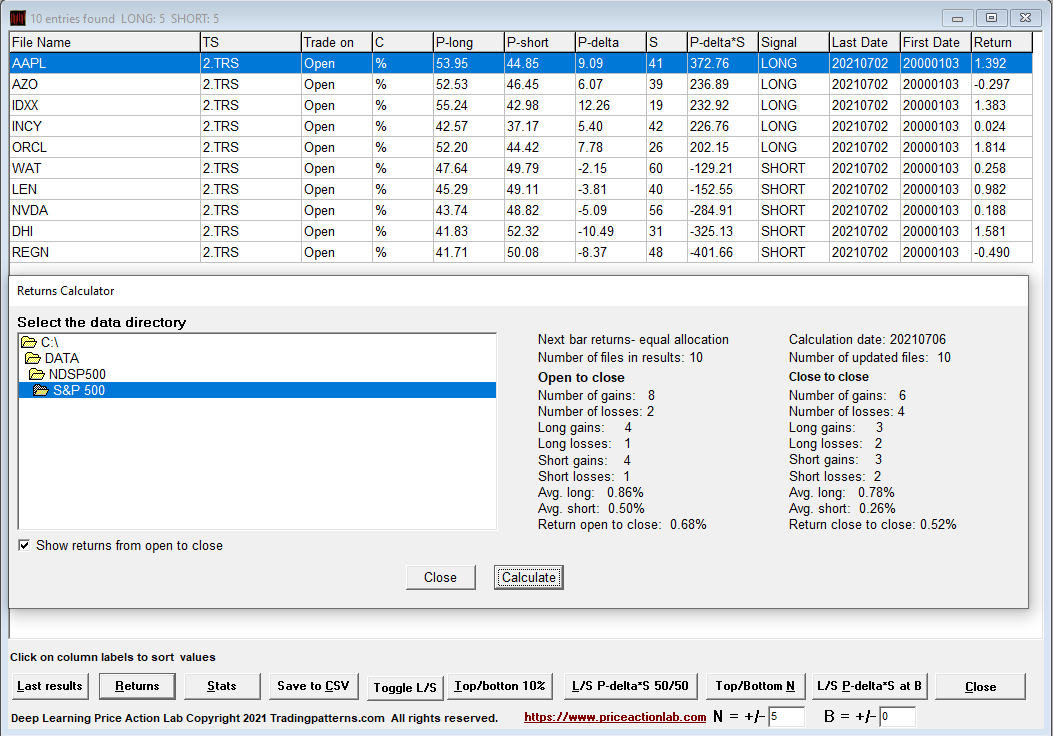

2. S&P 500 long/short (no bias) with pre-filtering.

In this case we use pre-filtering to generate a sub-set of S&P 500 stocks, then use DLPAL LS with no filters and select the top 5 long and bottom 5 short according to highest product of directional bias P-delta and significance S. Below are the results as of the close of Friday, July 2, 2021, along with the returns from open to close of the next trading day, Tuesday, July 6, 2021 (Monday was a holiday.)

Four longs and four shorts gained for an average return from open to close of 0.68%.

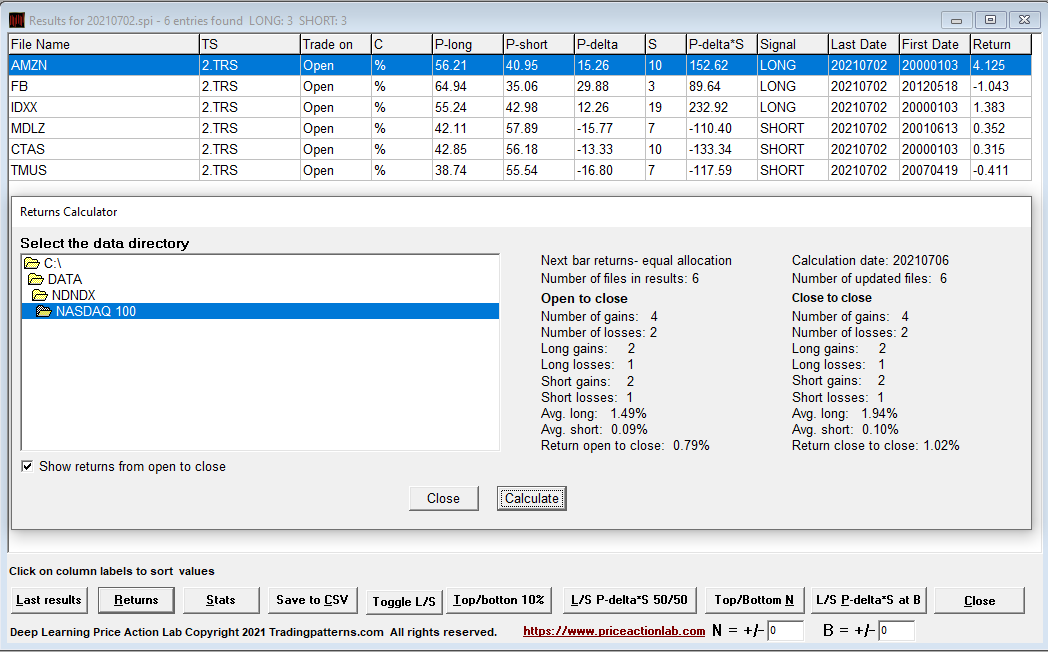

3. NASDAQ-100 long/short with bias

For NASDAQ-100 long/short with bias we instruct DLPAL LS to filter the results for long (P-long) and short (P-short) bias greater than 55. Below are the results as of the close of Friday, July 2, 2021, along with the returns from open to close of the next trading day, Tuesday, July 6, 2021 (Monday was a holiday.)

There were signals for 3 long and 3 short stocks. Two longs gained and also two shorts gained. The average gain from open to close of the day was 0.79%.

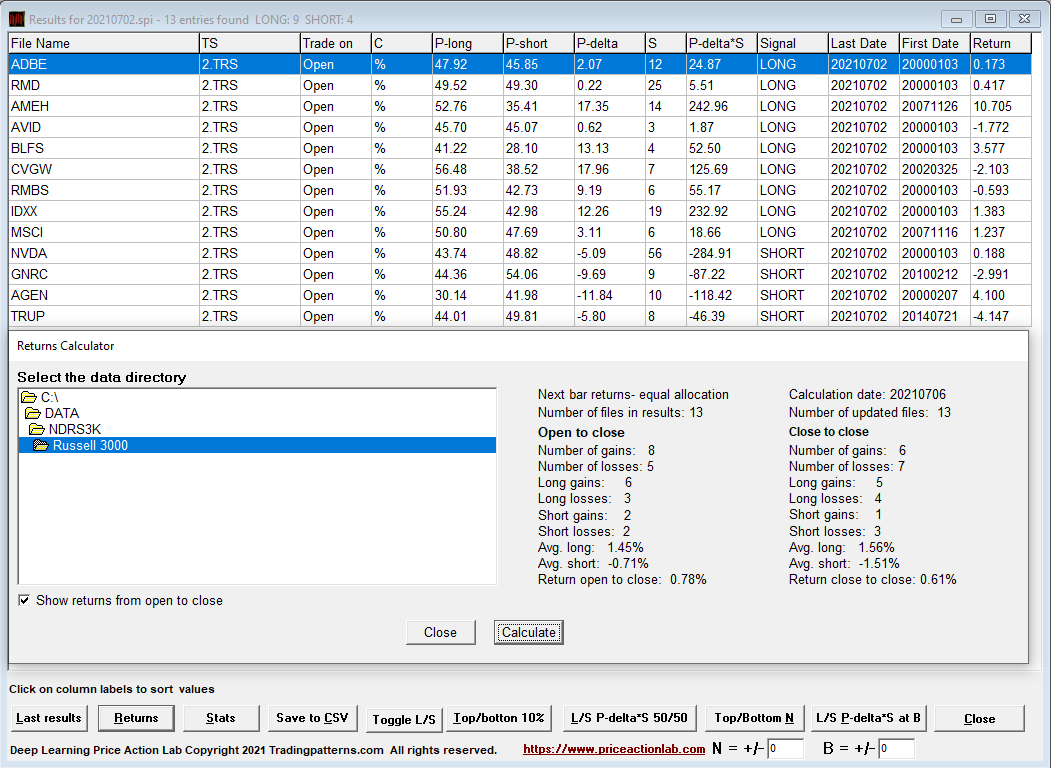

4. Russell 3000 highly overbought/oversold stocks

The highly overbought/oversold stocks are included in a service we offer to Premium Insights and Market Signals premium subscribers.

We scan Russell 3000 stocks in Amibroker and generate a subset of highly overbought/oversold stocks according to specific criteria. Then we use DLPAL LS to generate long and short signals according to the sign of directional bias P-delta. Below are the results as of the close of Friday, July 2, 2021, along with the returns from open to close of the next trading day, Tuesday, July 6, 2021 (Monday was a holiday.)

There were signals for 9 long and 4 short stocks. Six longs gained and also the two shorts gained. The average gain from open to close of the day was 0.78%.

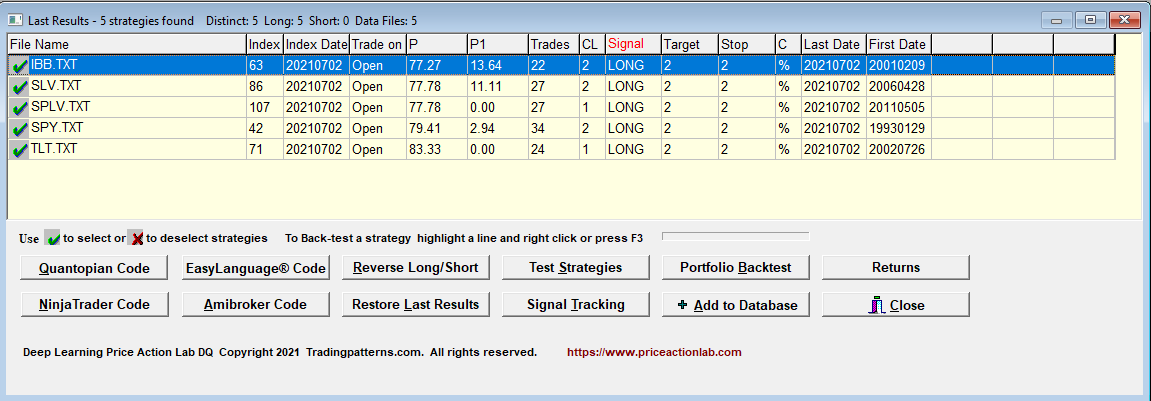

5. Price action anomaly detection in 35 ETFs

We use DLPAL DQ to scan for price action anomalies in a group of 35 ETFs. Below are the results as of the close of Friday, July 2, 2021.

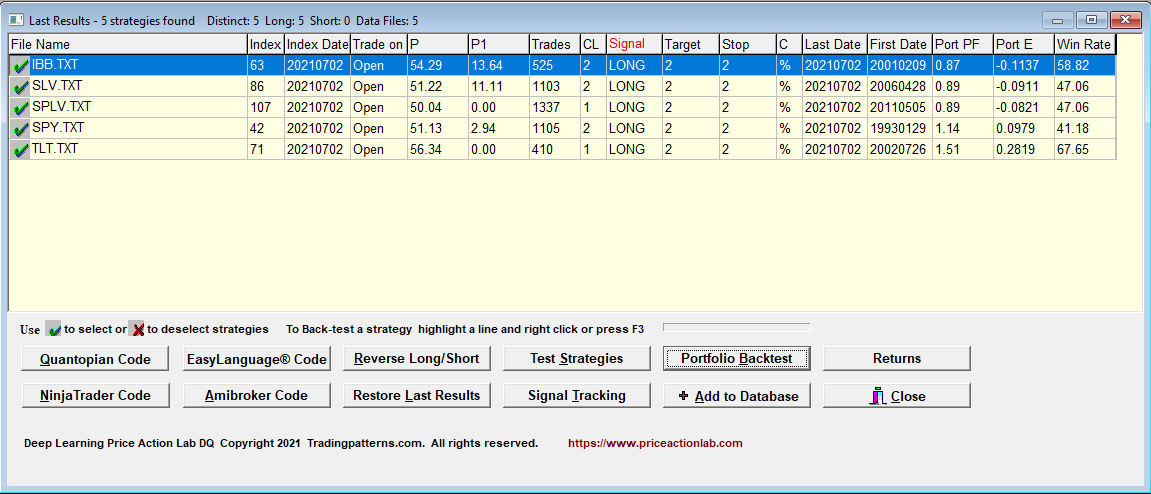

We then use portfolio backtest to validate each detected anomaly on the whole group of ETFs with data since inception. Below are the results.

Only the anomaly for TLT long passed our validation test with 1.51 portfolio profit factor and 67.65% portfolio win rate. TLT gained 0.7% from open to close of the next trading day, Tuesday, July 6, 2021 (Monday was a holiday.)

The above are only a few examples of how long/short and price action anomaly detection can be used as part of quantitative trading.

If you have any questions about the software used contact us.