The overnight effect appears to be under normalization this year. A diminishing impact of the effect on returns is probably good for the market.

It appears the overnight effect is in the process of being arbitraged out but this may take long time. The overnight effect anomaly in SPY but also other ETFs and many stocks is known to many traders since the late 1990s. There are many articles in this blog about this anomaly in SPY ETF and in several other markets and securities.

Due to a large influx of new traders to the market last year, which was mainly facilitated by broker apps offering zero commissions, there were numerous references to the overnight price action anomaly in financial social media and blogs by those who had just discovered it.

Naturally then, when many traders try to profit from a price action anomaly, any edge will slowly disappear. This is what’s been happening in my opinion but full arbitrage may take a while. Furthermore, normalization of the effect may be good for the market; it was quite strange that 100% of the gains of SPY ETF from inception until 2020, or about, were due to overnight changes and regular trading hours had contributed next to nothing.

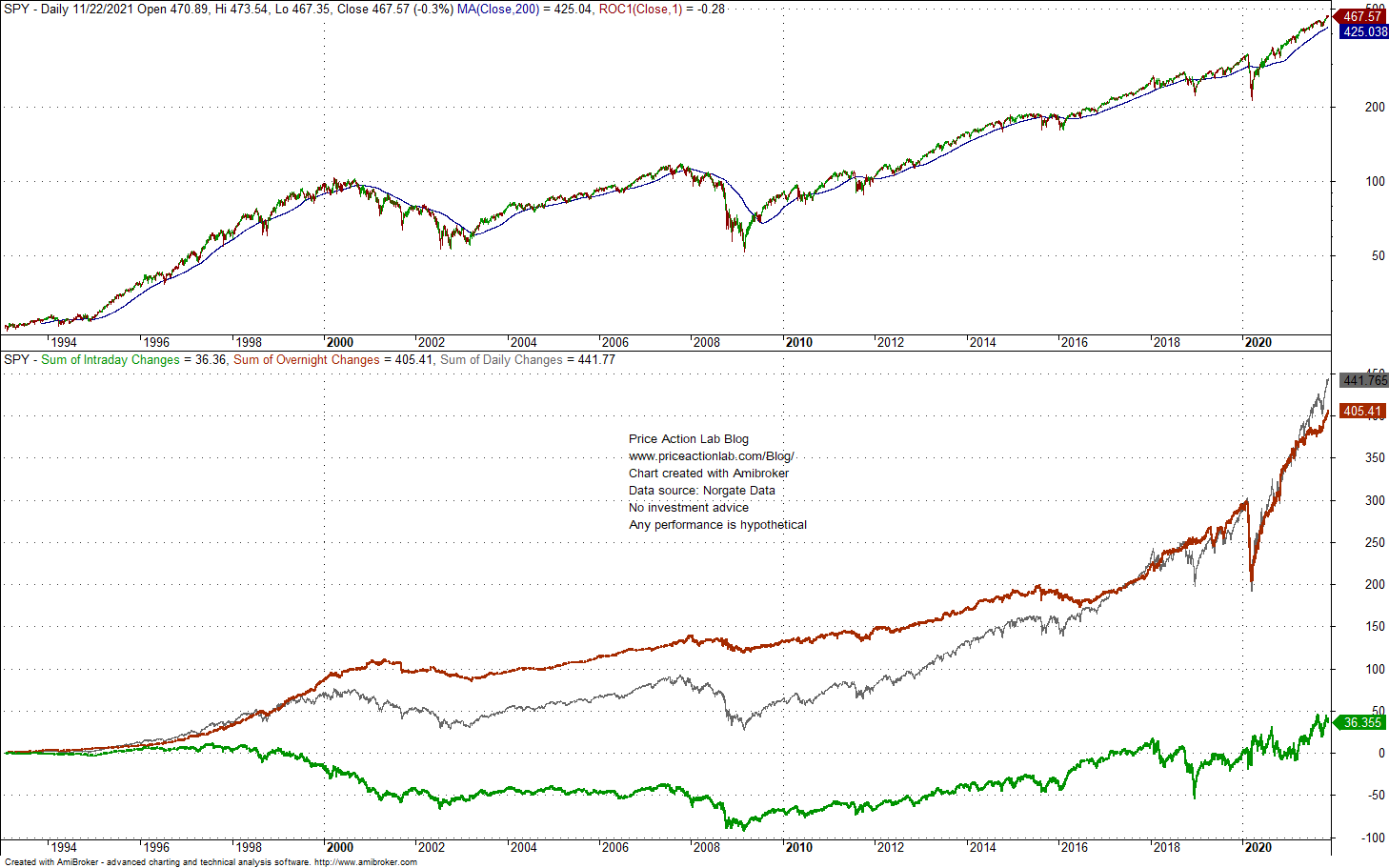

The red line is the overnight accumulation (close of a day to open of next day), the green line is the regular trading hours (RTH) accumulation (open to close of the day) and the gray line is the accumulation of daily changes (previous close to close). RTH has contributed nothing to SPY total return until about March of this year and overall contribution since ETF inception is only 36.4 points vs. 405.4 points for overnight, or about one order of magnitude higher.

However, after the publicity the overnight effect has received since last year, it seems some normalization has started.

Overnight and RTH contributions are comparable year-to-date. It appears that after an extended period of time, RTH returns are having a contribution to total return of the ETF.

Even if arbitrage of the edge that overnight gains offered for many years has already started, it may take many years for full normalization and in the process there may also be a reversal of the effect, i.e., overnight gains falling to zero. But this is speculation at this point although it is highly unlikely a price action anomaly such as the overnight effect will survive under arbitrage conditions.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

You may follow this blog via RSS or Email, or in Twitter. Disclaimer

10% off for blog readers and Twitter followers with coupon NOW10