There’s plenty of optimism during bear markets, usually by those who were pessimists during bull markets. Here are two examples from the past.

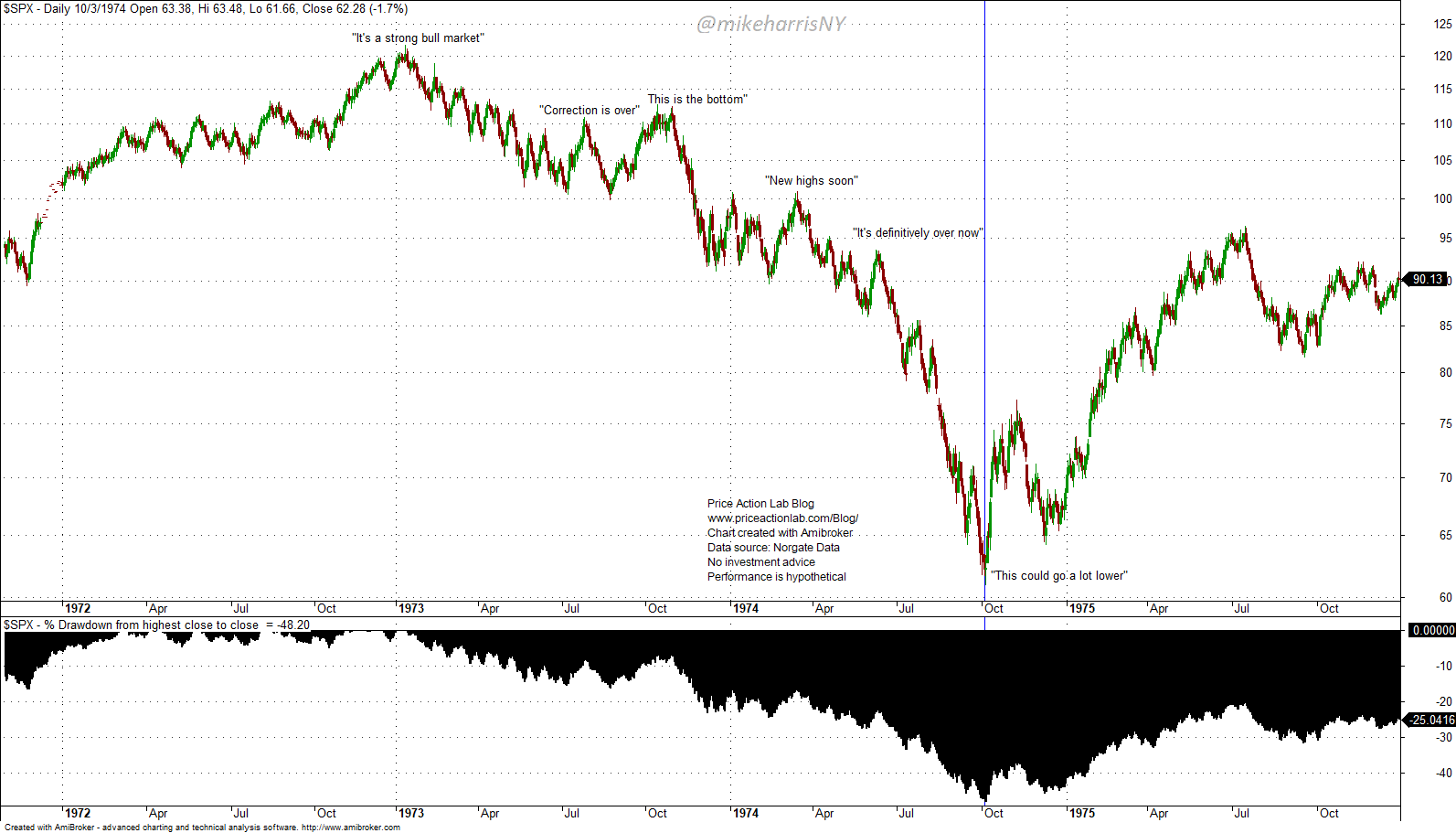

70’s Bear Market

The top was put in place on November 1, 1973, when the bull market looked strong. There were at least four attempts to find a bottom until the final one on October 3, 1974, when optimism gave way to extreme pessimism. Then a new uptrend started.

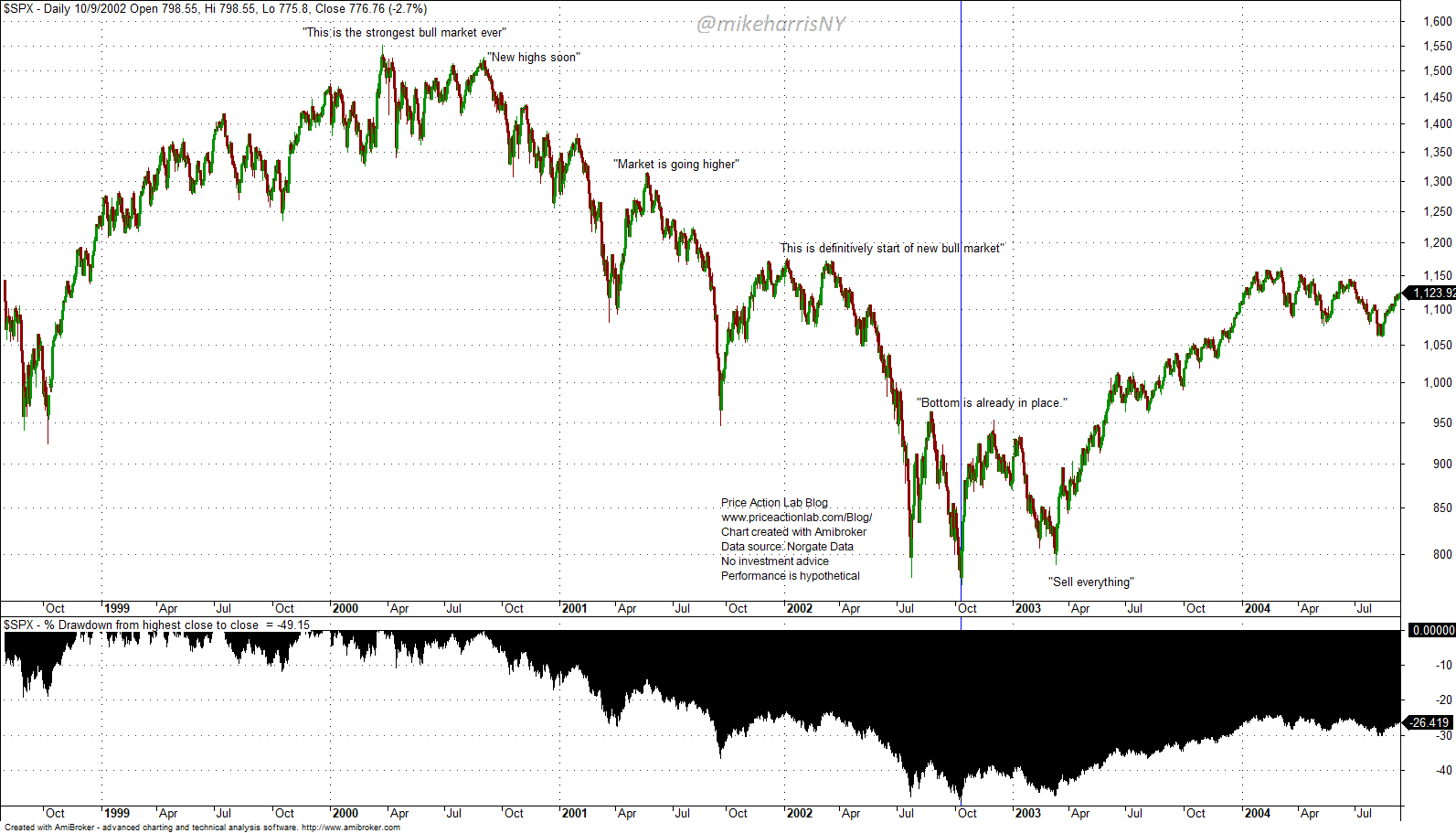

Dot Com Bear Market

Maybe the best example, and one many remember, is the dot-com bear market.

The top was on March 24, 2000, and afterwards there were several false signals of a final bottom marked by optimism. The last two false signals of a bottom in July and October 2002 were a blow to the bulls, and many hit an uncle point in March 2002, just before the final bottom.

Bear markets are tricky because the market usually succeeds in fooling bulls that it has bottomed. Several of these false bottom signals are usually required before a final reversal. In the same way that bull markets fool bears, bear markets fool bulls.

No one knows if equities are in a bear market at this point. However, the price action is reminiscent of a market that may go a lot lower. When in doubt, some diversification, or even tail-risk hedging, may help.

If you found this article interesting, you may follow this blog via RSS or Email, or in Twitter.

Premium Content 10% off for blog readers and Twitter followers with coupon NOW10

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.