Despite cancellation of trades after spot nickel reached $100,000 per tonne on Tuesday, March 8, 2022, volatility of the metal increased by staggering 10 standard deviations based on the available sample since 1993. The weekly return was an extreme 12 standard deviations move.

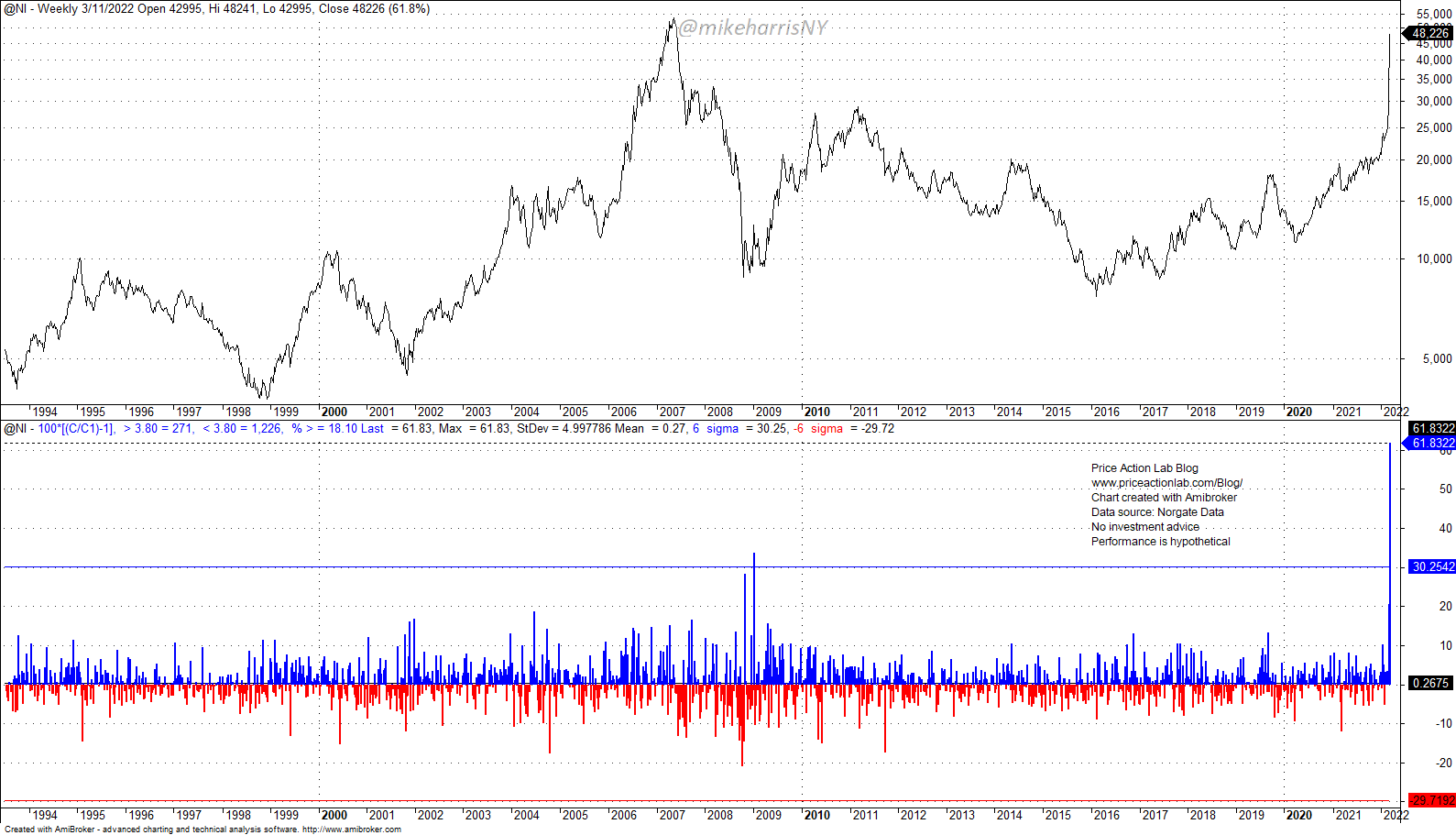

The spike in volatility is shown in the chart below.

Average 21-day annualized volatility is 30.14% and the standard deviation is 12.67%. Volatility rose to 152.46% by the end of the week, or by about 10 standard deviations based on the available historical sample.

Note that volatility due to the plunge in nickel prices during the 2008 recession rose to about 120%. This can be acceptable volatility in the context of falling prices but a spike of volatility to 154.46% due to rising prices is serious extreme event.

A weekly return of 61.8% translates to a 12-standard deviations event based on available sample of weekly returns since 1993.

The average of weekly returns is 0.27% and standard deviation is 5%. The 61.8% gain for the week was a 12-standard deviations move.

LME cancelled all trades that caused prices to rise to about $100,000 per tonne with face value of more than $2 billion. Market was then halted. Spot nickel ended with a gain of 61.8% for the two days of trading, Monday and Tuesday, and price was fixed at $48,226 per tonne for the rest of the week.

The 10-stanard deviations rise in volatility was an extreme tail event that could have caused severe contagion if there was a chain reaction of broker defaults.

On the other hand, the long traders who saw their profits disappearing after the cancellation of trades have a right to be upset.

At these volatility levels and while the geopolitical conflict and war continue, it may be difficult to restart trading in nickel in the short term.

Premium Content 10% off for blog readers and Twitter followers with coupon NOW10

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

If you found this article interesting, you may follow this blog via RSS or Email, or in Twitter.