Failure of central banks to deal with rising commodity prices due to a supply shock caused by the pandemic and now due to a war in the heart of Europe has brought the global economy on the brink of stagflation.

This is primarily a failure of central banks and their wishful thinking about “transitory inflation”. Obviously, we have to admit the war that followed was an unexpected event. However, the Fed was already behind the curve.

Here we are now: UK Natural Gas has gone parabolic.

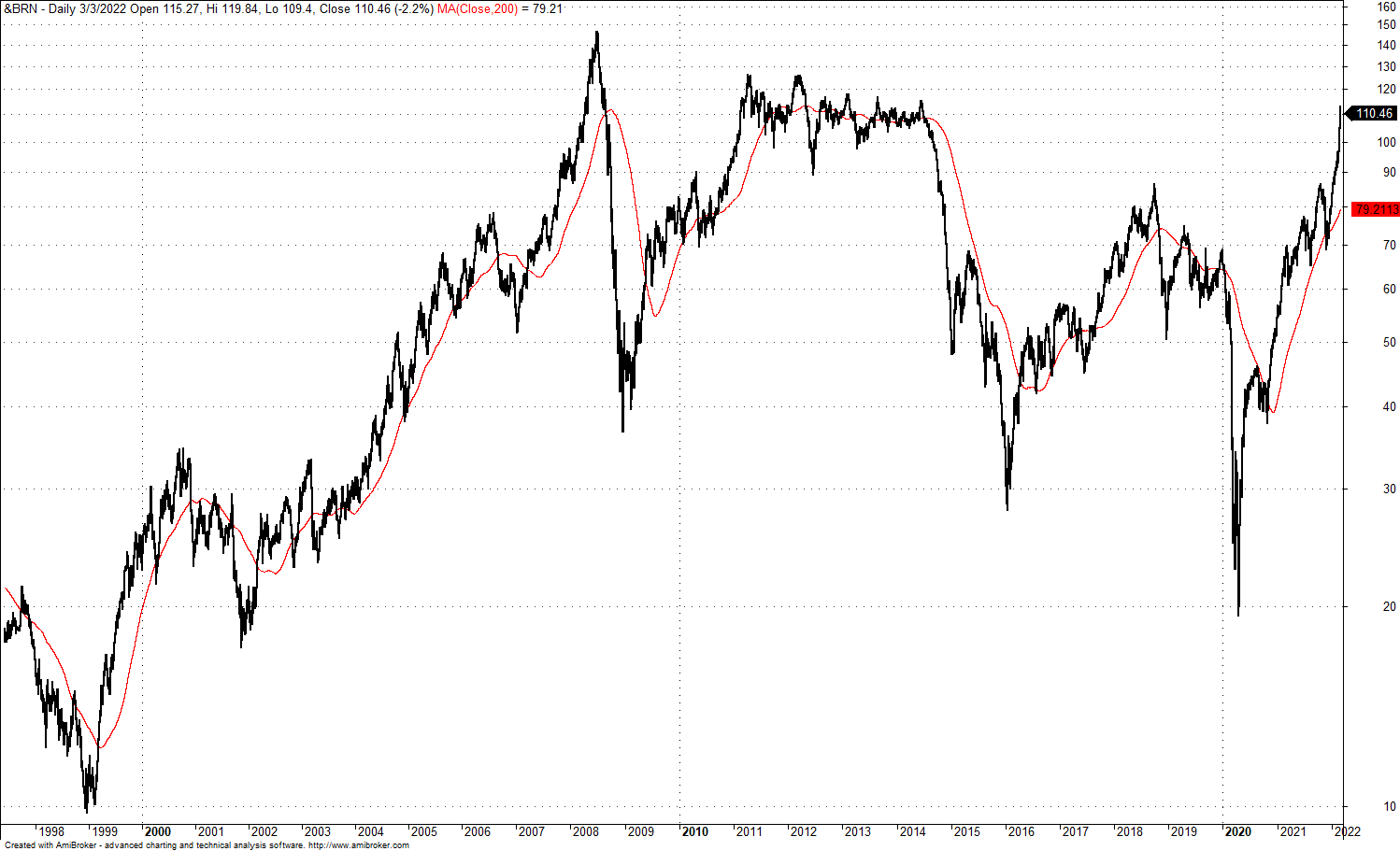

Brent has gone parabolic and approaching 2008 highs.

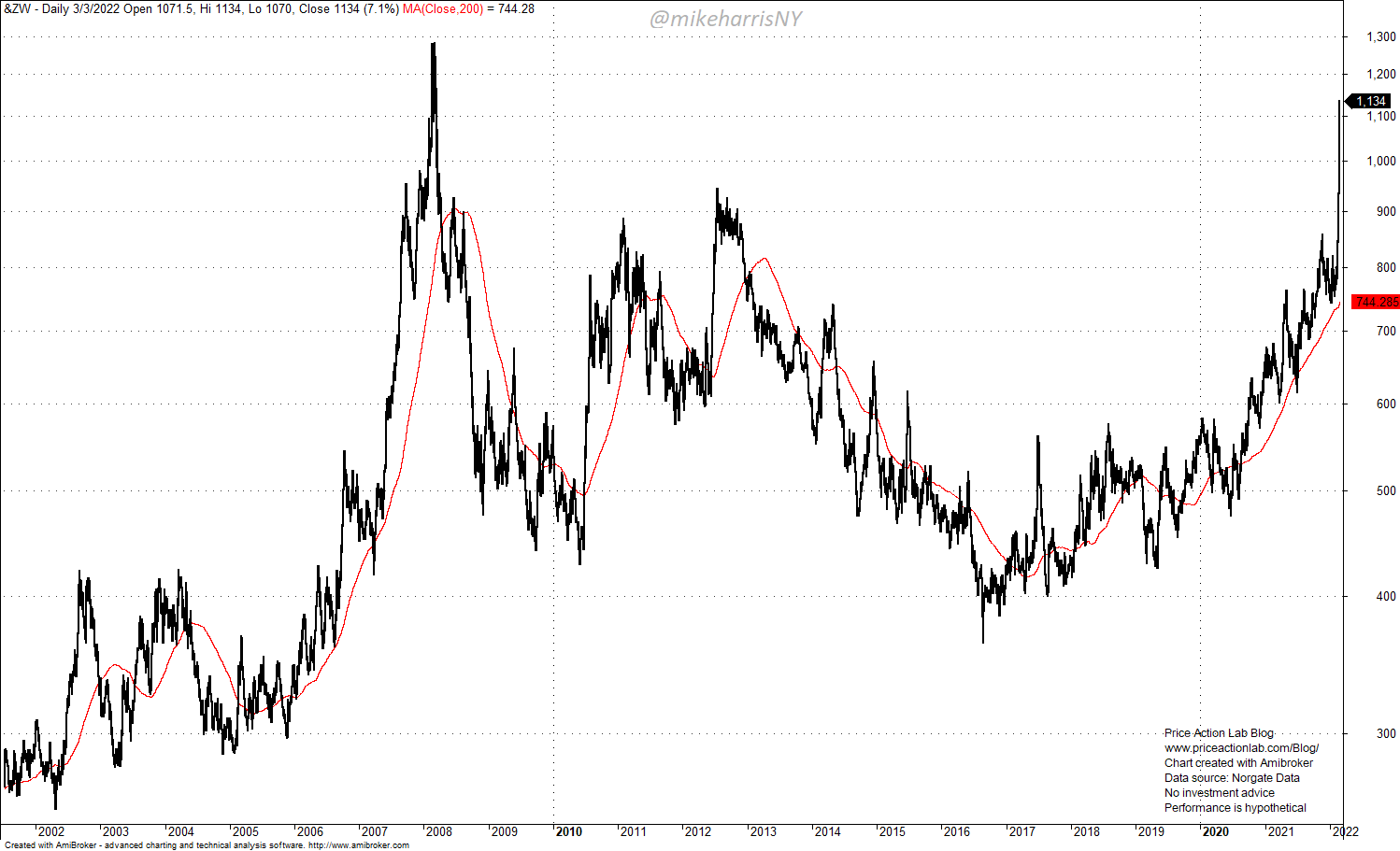

Chicago Wheat has gone parabolic and also approaching 2008 highs.

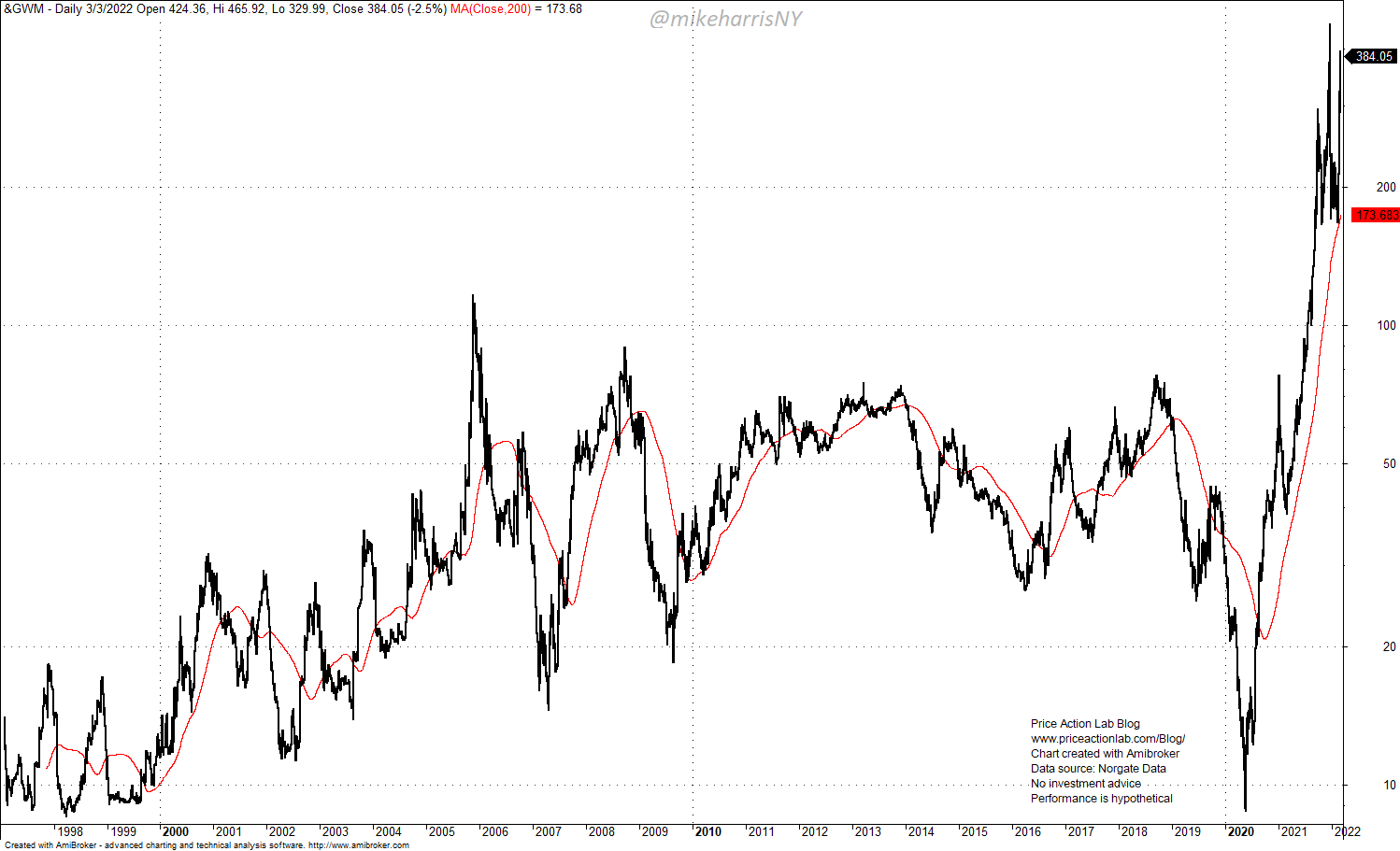

This is one of most ominous charts in my opinion: LMEX index, which is weighted index of Aluminum, Zinc, Nickel, Lead, Copper and Tin. Index is at new all-time highs.

Central banks will probably cause equity markets to crash in an attempt to contain inflation and avoid the worst scenario: stagflation.

We came to this point because central banks have lost their independence and have become tools of politicians and markets.

Many middle income families may cross the poverty line due to failure to act early.

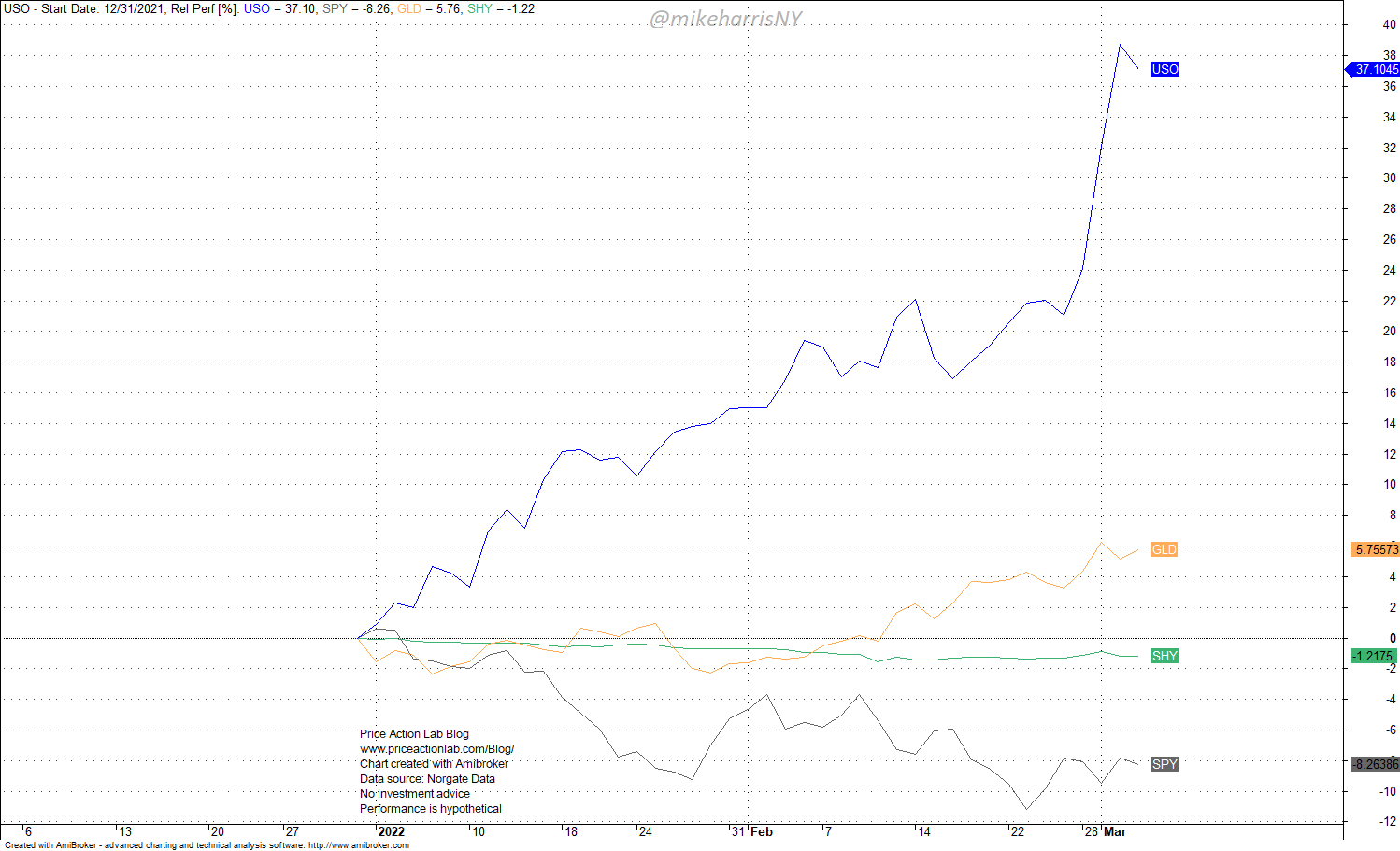

Year-to-date, crude oil (USO) is up 37.1%, gold (GLD) is up 5.8% while even cash (SHY) is down less than large caps (SPY) that are losing 8.3%.

Many fund managers haven’t lived through a prolonged market crash and high inflation period, or worse a stagflation period. There could be a huge consolidation in the financial sector. Many investors may lose a large fraction of their savings in case both stocks and bonds crash. In a stagflation period 60/40 allocations and similar schemes may not be immune from large losses. Probably CTAs will do better but not all since many have transitioned to equities due to dismal gains in commodities in the past.

There are many ominous indicators piling up. In my opinion central banks may be able to deal with inflation after hiking rates above 4% but in the meantime equities and bonds may crash. Central banks were reminded that volatility comes in clusters and we may not have seen all of them yet.

Premium Content 10% off for blog readers and Twitter followers with coupon NOW10

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS or Email, or in Twitter.