Many analysts in financial media, blogs, and social media will tell you when they think it’s a good time to place a trade but won’t tell you when to exit it. Exiting a position is much harder than entering one.

Long trades realize a profit when the exit price is higher than the entry price, and short trades realize a profit when the entry price is higher than the exit price. However, it is known that the difficulty in establishing entry and exit levels in the markets is not symmetric: exits are harder than entries because uptrends correct faster than they develop, and downtrends usually end up with a short squeeze.

Most financial analysts are good at determining entries, but few come back after a while and say, “Hey, do you remember when I told you to buy XYZ? Now it’s time to get out. ”

In relation to current market conditions, it doesn’t take more than a moving average to realize that some commodities and the US dollar are rising, while stocks and bonds are falling. In some podcasts, forums, Twitter Spaces, etc., you can find analysts telling traders about being long in commodities and the US dollar and flat or short in equities and bonds. Well, that’s the easy part.

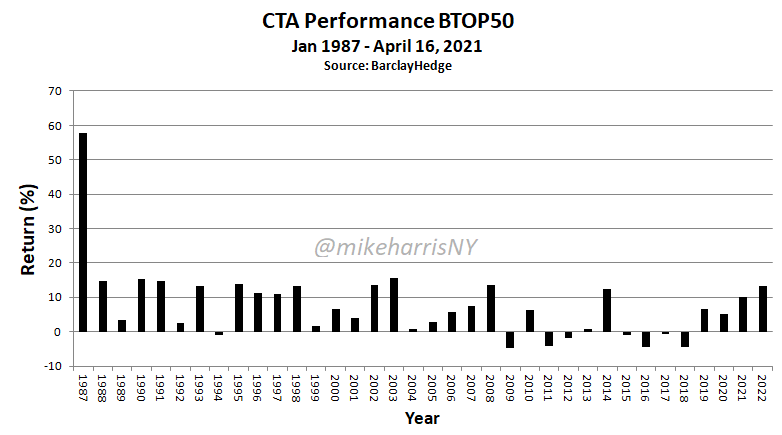

The hard part is the timing of the exits. Profits can easily evaporate in commodities and currencies, for example. Many strategies are good at establishing entry points but have a large delay in getting out of the market. For example, the top 20 CTAs are up an estimated 13.2% year-to-date due to trends in commodities and other markets.

Yet, despite a rebound in performance in the last two years, the annualized return is about 3.1% in the last 19 years. One problem with trend-following is that there are many good indicators to signal entries, but there is a real shortage of indicators that signal an exit so that open profits are realized before a sizeable trend reversal. I won’t be surprised if year-to-date CTA profits mostly evaporate by the end of the year.

In the past, trends were smoother due to higher serial correlation in market returns, but with negative serial correlation now dominant, the exit process has become more complicated. For more details, see this Twitter thread.

In my opinion, this is where the value of strategies comes from, as opposed to discretionary market analysis about the state of the market: they provide both entry and exit points. Still, the exit part is hard. It’s easier for anyone with a moving average to determine that the current trend of commodities is up. It’s hard to decide to get out. Equities are in the same boat: it’s easy to see that they’re in a downtrend, but predicting a bottom is difficult. Market Analysts typically present only one side of the story

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.