Nearly every day there are articles in the financial blogosphere and media, as well as on social media, that show a positive 1-year forward stock market return on the average for certain macro and technical analysis setups. Their conclusions are wrong.

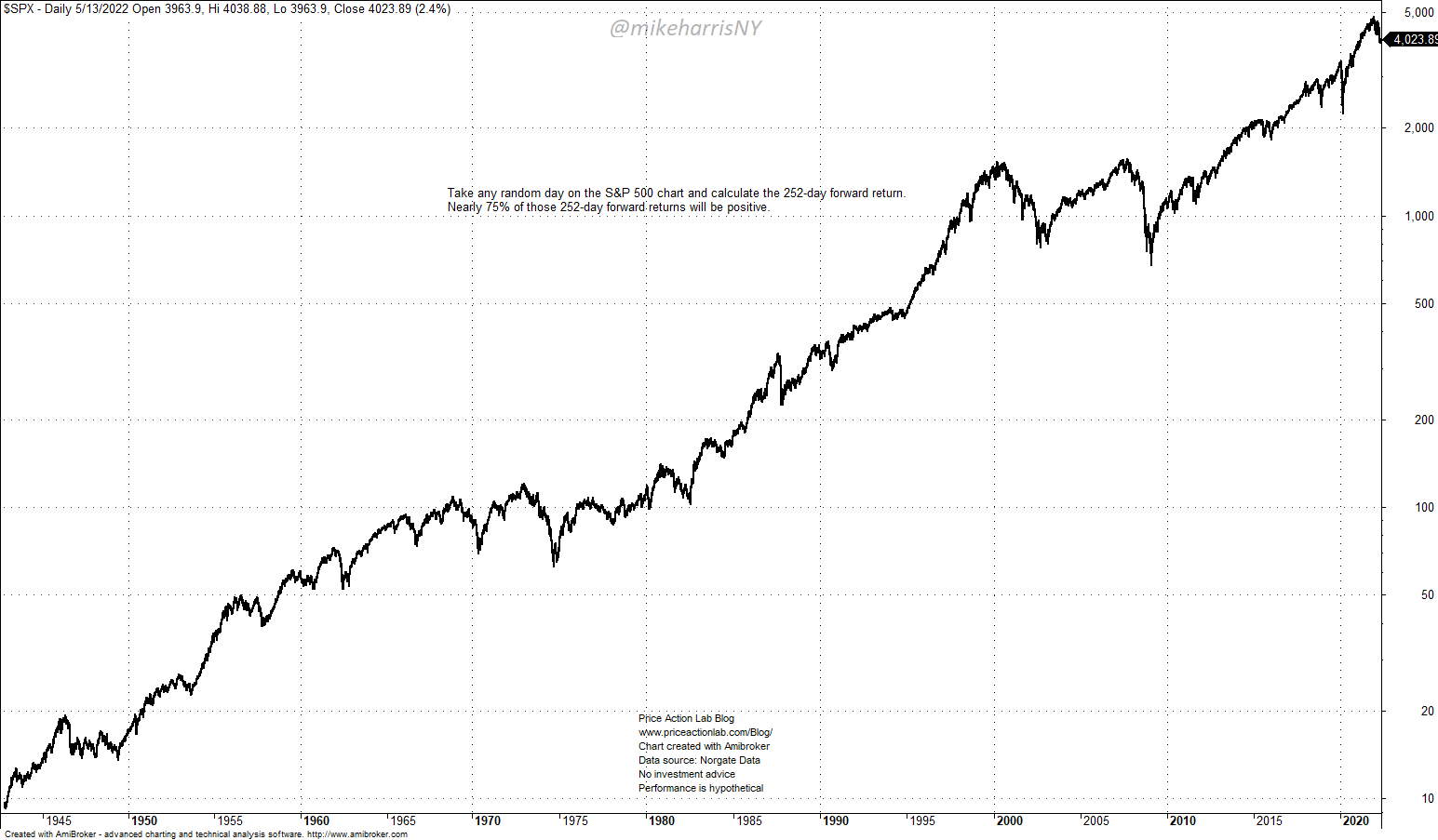

All these articles have something in common: they attribute the higher average 1-year returns to some setups although they are due to the long-term upward bias of the market and those setups are irrelevant. This is shown in the chart below.

Take any random day on the S&P 500 chart and calculate the 252-day forward return. Nearly 75% of those 252-day forward returns will be positive.

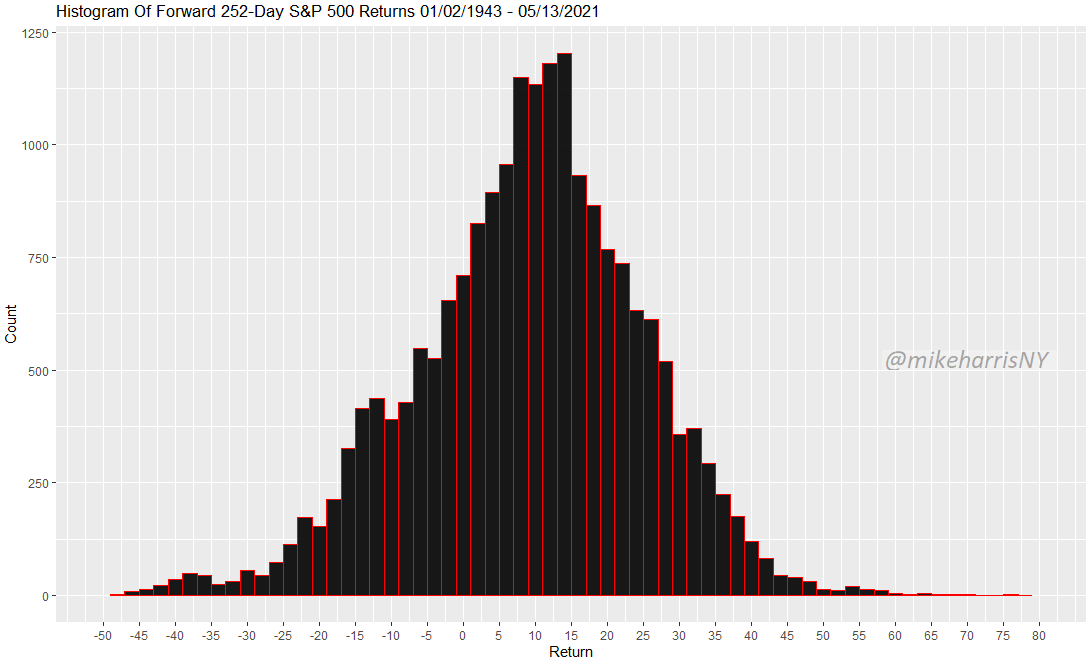

The distribution of 252-day forward returns after the close of every day on the chart above is shown below.

The mean 252-day return is about 9% and the standard deviation is about 15.7%. This distribution shows a strong upward bias. Kurtosis is 0.32 but it’s not clear if the distribution is close to normal.

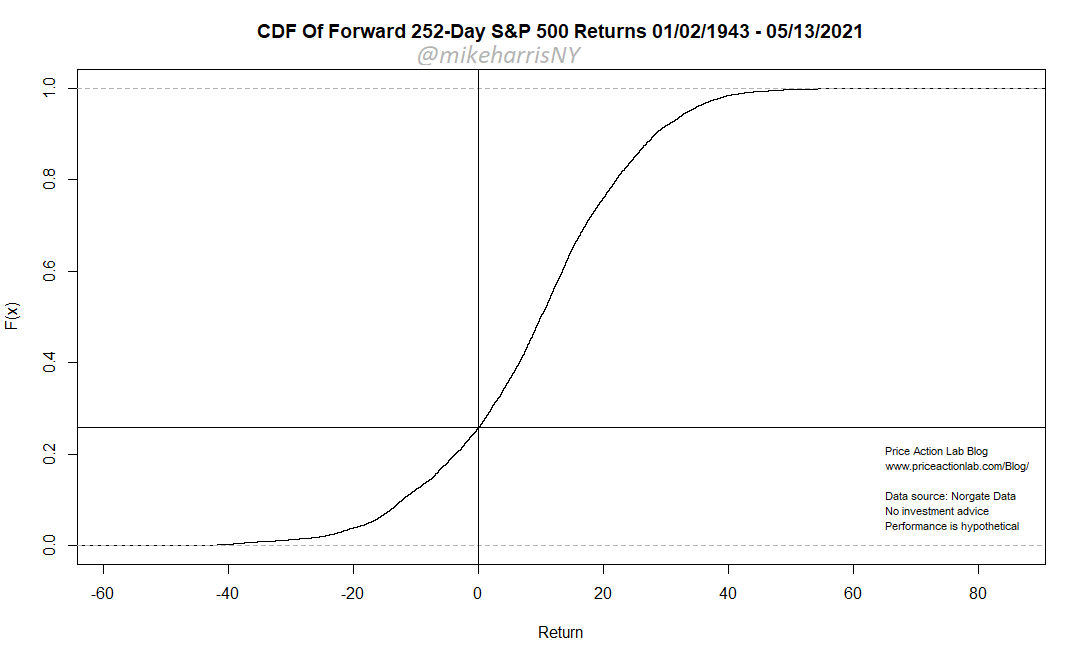

Below is the cumulative distribution function (CDF).

it may be seen from the CDF, that about 25% of the returns are negative and 75% are positive.

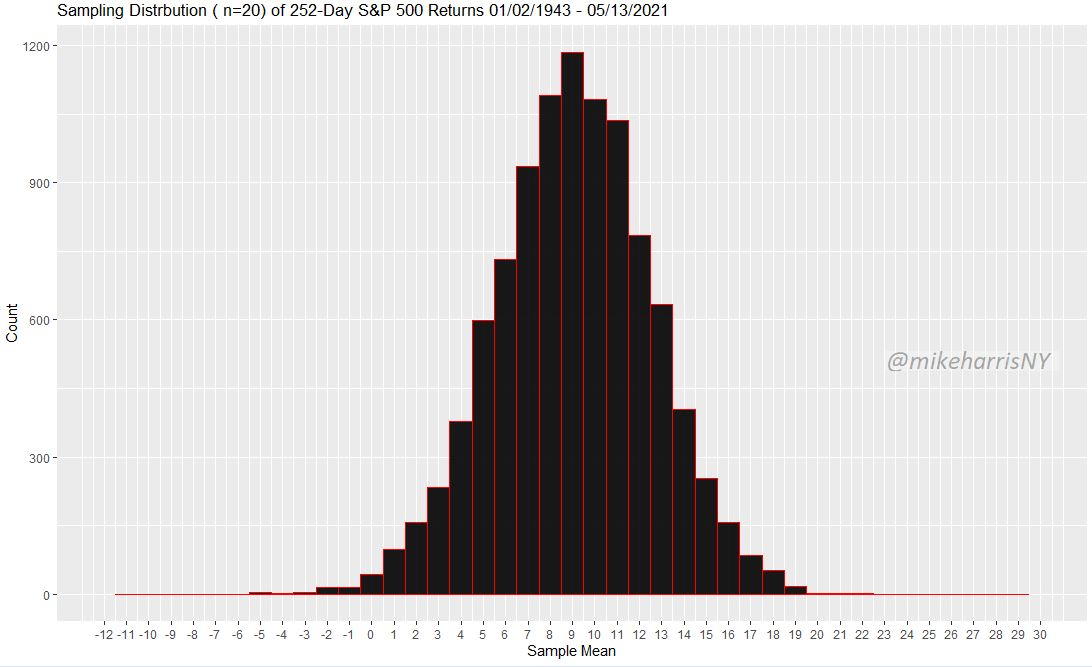

Next, consider sampling to correspond to some random macro or technical analysis patterns with 20 past occurrences. Below is the distribution of 10000 sampled means.

As expected by Central Limit Theorem, the distribution is approximately normal with the same mean and standard deviation equal to 15.7% divided by the square root of 20, or about 3.51%. The overwhelming majority of those sampled means are positive, about 99% of them. For the average return of 20 randomly sampled occurrences to score higher than 95% of the sampled means in the distribution (p-value < 0.05), it must be higher than 14.5%. This is hardly the case with those random macro and technical analysis patterns found in articles and social media posts because, even if the average return is higher, they are not random samples but selected from a large set (data-mining bias.) When selection is made, the p-value must be adjusted to the downside to correct for the bias and as a result, there is a demand for a higher average return.

The above described in a nutshell the statistical significance issues in many of the studies based on macro and technical analysis setups with small samples. In most cases, the predicted 1-year forward return has nothing to do with the pattern discussed but with the long-term upward bias of the market. In other words, the patterns have a spurious correlation with the returns.

Premium Content 10% off for blog readers and Twitter followers with coupon NOW10

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data