Traders often bet against some important technical patterns because, by the time of their formation, the price move is already exhausted. Below are statistics about an important technical pattern in the stock market that was formed last week. Access to the full article requires a Premium Articles subscription or an All in One subscription.

Last week the S&P 500 and SPY ETF closed below their 12-month moving average. As already reported in an article on this blog on April 30, 2022, this is an important technical signal.

The 10-month and 12-month moving averages are widely used momentum indicators. On the last day of April, both the S&P 500 and the SPY ETF closed below those two key moving averages. This might have accelerated the sell-off, as many momentum traders might have elected to rebalance their portfolios before the market closed and also before the open of the next month.

We will look at a backtest of the price series long-only momentum strategy that goes long at the next monthly open when the price drops below the 12-month moving average and exits at the close after 5 days.

Entry signal: Buy at the open of the next day if the price crosses below the 12-month moving average.

Exit signal: Sell at the open of the next day after five trading days.

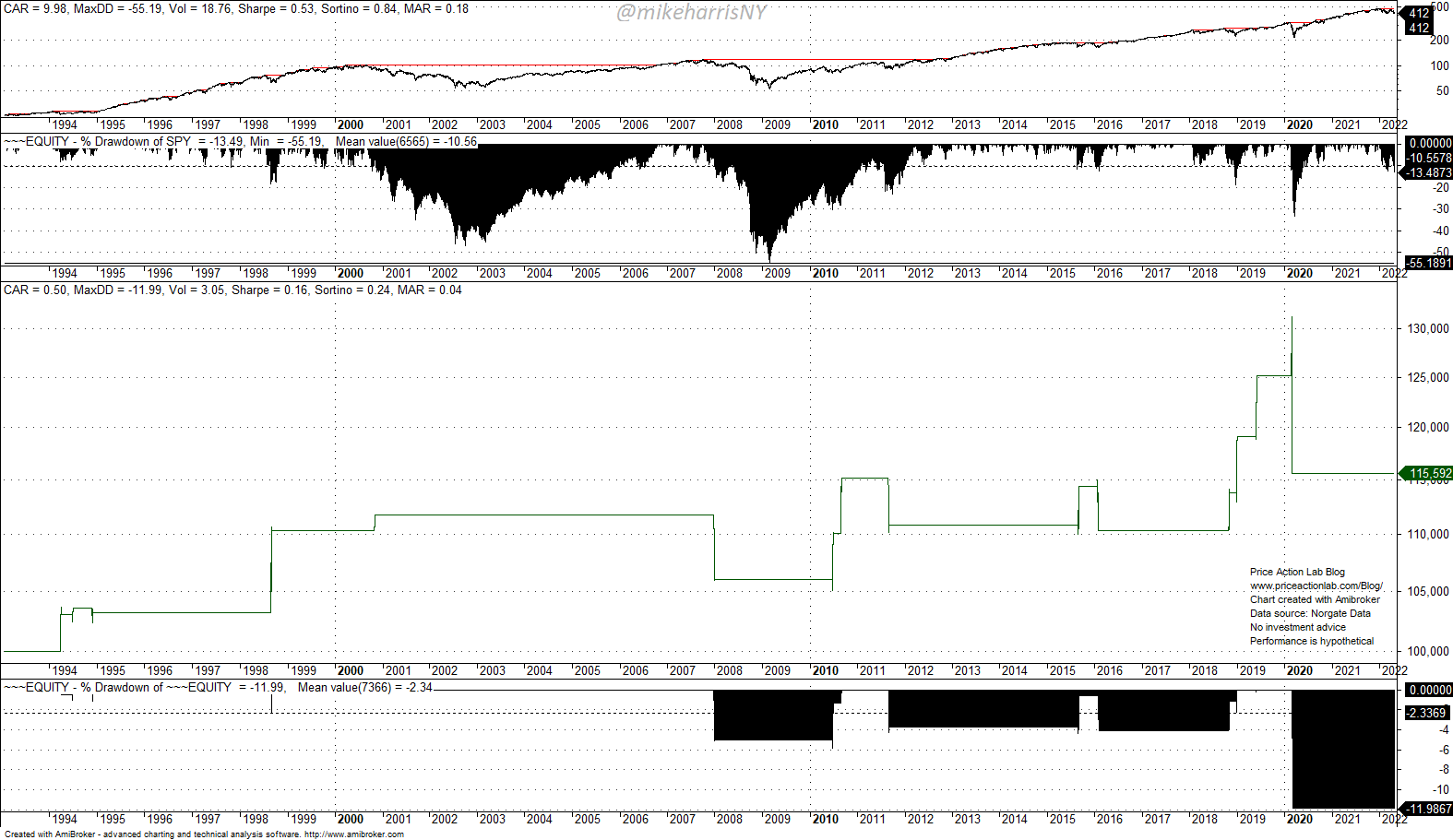

This is a short-term contrarian trading strategy of the monthly price series momentum bearish cross. Below are the results in the case of SPY ATF since inception. Equity is fully invested and we use $0.01/share for commission and slippage.

There are 15 trades and 10 are winners for a win rate of 66.67%. The largest yearly loss is 7.7% in 2020 when this contrarian strategy didn’t work. Overall, this has been a profitable strategy, but the sample is small.

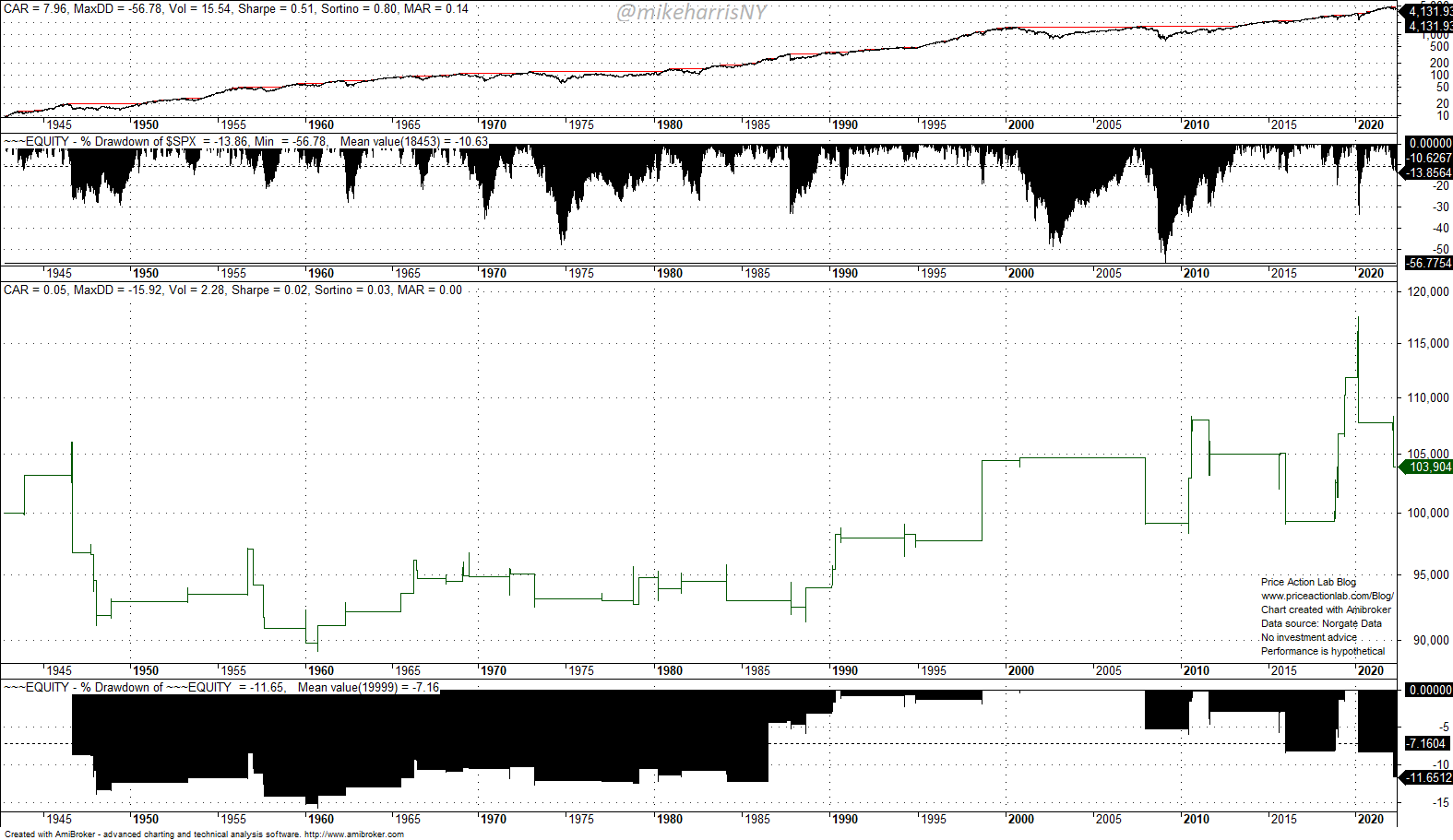

We can increase the sample if we use the S&P 500 index in the place of the SPY ETF. The index is not tradable but this could indicate the performance of this contrarian strategy since 1942. Below are the results.

In the S&P 500 case, there are 47 trades and 24 are winners for a win rate of 51.06%. The largest yearly loss is 6.4% in 1957.

The conclusion is that the win rate of this contrarian strategy has been slightly better than a fair coin toss. Although the win rate appears small, it is relatively high when betting against this momentum strategy and this is probably due to the long-term upward bias of the market. The results also provide some hints about the performance of the short side, i.e., instead of just closing positions when the price crosses below the 12-month moving average, going short in addition.

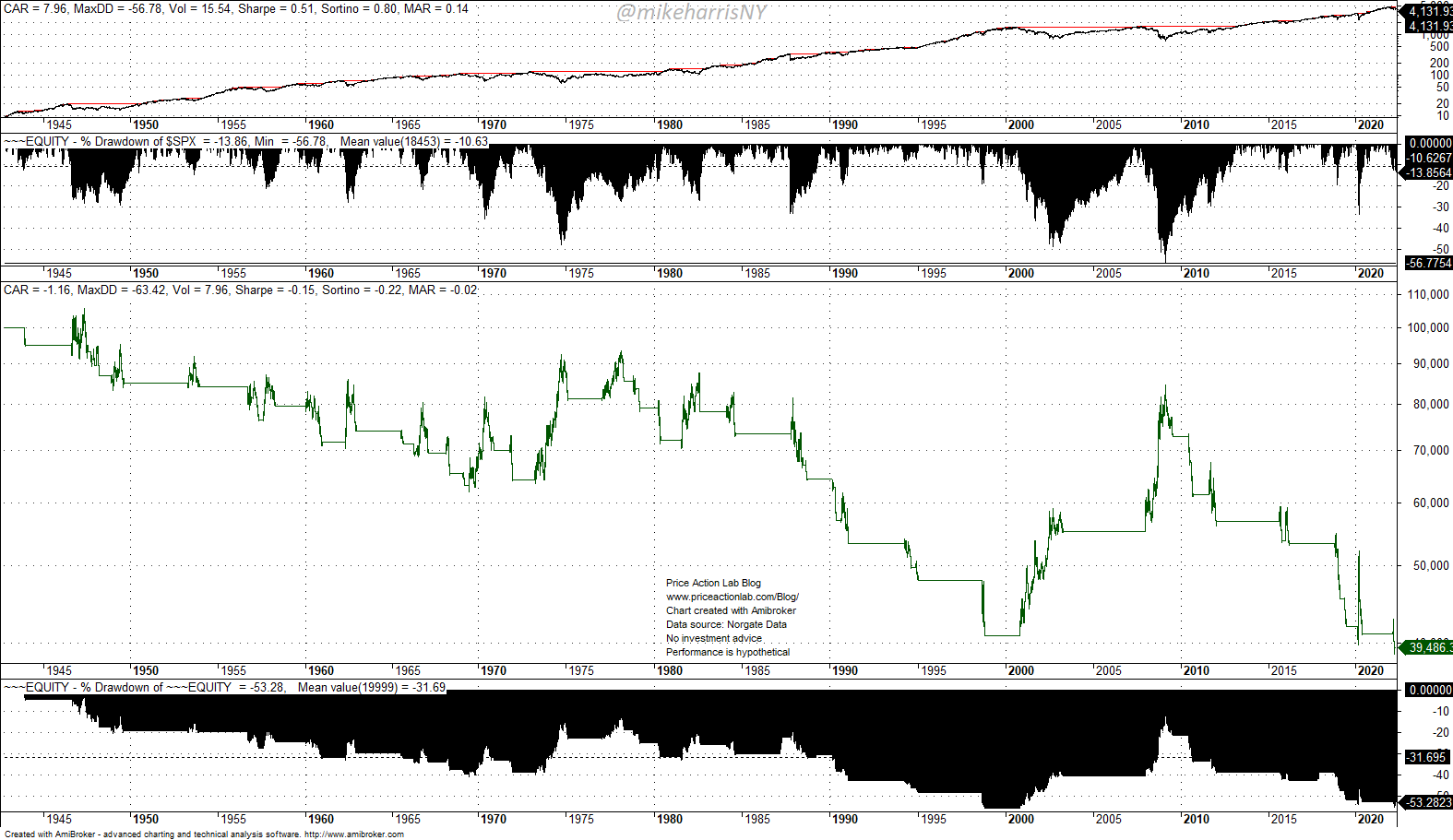

Entry signal: Short at the open of the next day if the price crosses below the 12-month moving average.

Exit signal: Cover at the open of the next day if the price crosses above the 12-month moving average.

Below are the results for S&P 500 (theoretical) since 1942.

The CAGR is -1.16% and this has been a highly losing strategy. There was a period between 2000 and 2009 when this strategy worked well, but afterward, the strong upward bias due to quantitative easing destroyed any profitability.

Conclusion

Betting against the bearish price action momentum signal based on the 12-month average for a short-term gain is probably a coin toss but this is still a relatively high win rate.

Historically, using the bearish signal to short the market has been a highly unprofitable strategy on average, but it has worked well during specific periods.

Specific disclaimer: This report includes charts that may reference price target levels determined by technical and/or quantitative analysis. No updates to the charts will be provided if market conditions change that affect the levels on the charts and/or any analysis based on them. All the charts in this report are for informational purposes only. See the disclaimer for more information.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data