A 6.6% gain in S&P 500 this week is not a signal of market direction. The market is smarter and more powerful than any market participants who make forecasts.

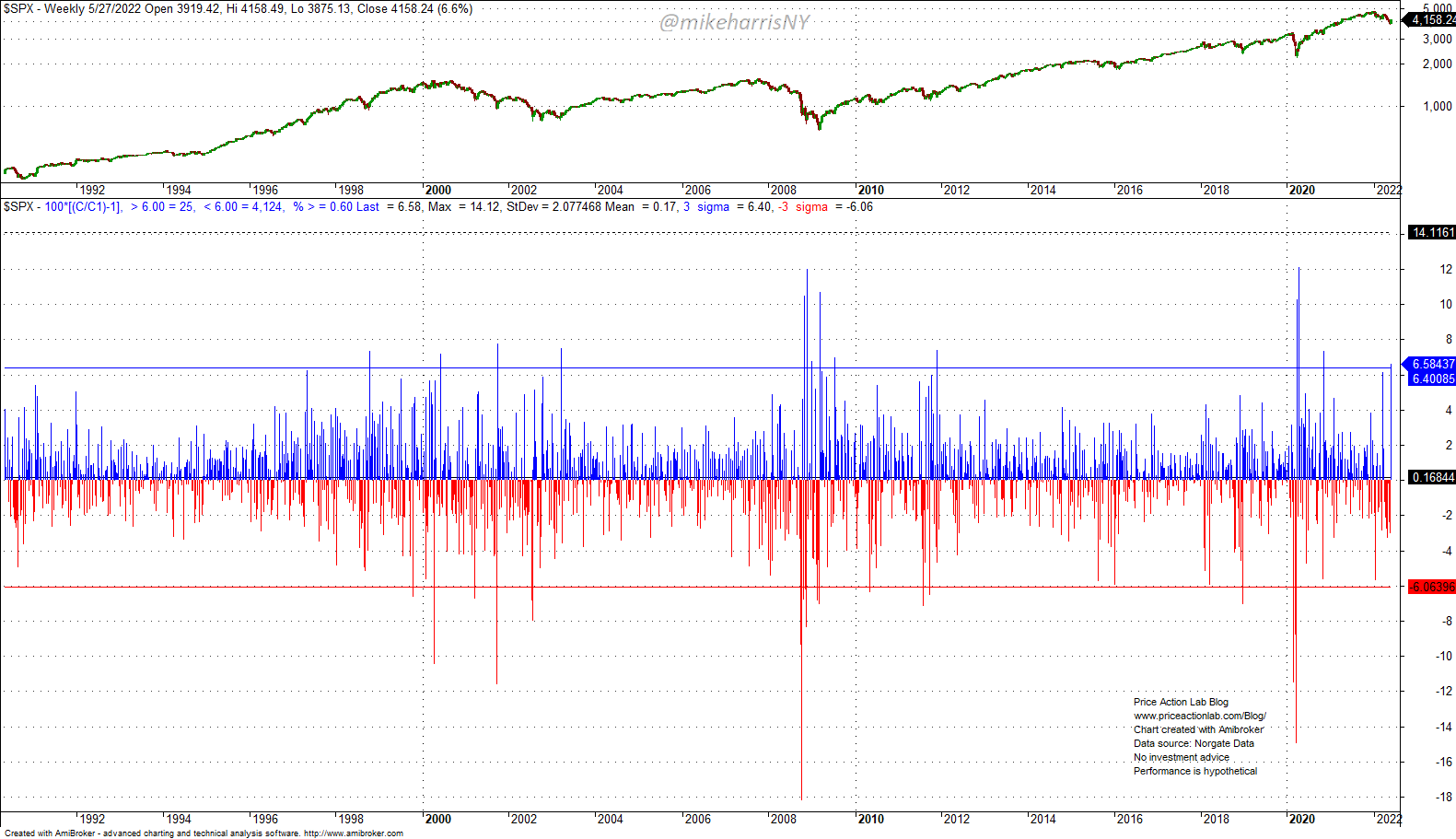

This week the S&P 500 gained 6.6%. Based on the sample of weekly returns of the index since 1942, this was a three-standard deviations move.

The last time the S&P 500 index gained more than 6% in a week was for the week ending November 6, 2020, when it surged 7.3%. There have been 25 weekly returns larger than 6% in the index since 1942, or 0.6% of the available sample.

Do these large rebounds in the index signal a bottom? Let us look at a table with all weekly returns larger than 6%.

I have highlighted some cases when after a weekly return of more than 6%, a bear market continued. Those were during the dot com and financial crisis periods.

Even if we had a large sample of say 1000 weekly returns larger than 6%, any forecast about medium-term direction would be still probabilistic.; in the markets, there is no certainty.

Those who try to forecast market direction, or whether the market has formed a bottom, based on this large weekly return are in essence making a bold call. These large weekly changes can occur at bottoms or before large corrections and bear markets are over.

The market is smarter than the smarter forecaster and more powerful than the most powerful market participants. Some participants may be able to impact short-term direction but no one can do that for long-term direction. Furthermore, forecasting the market bottom is an exercise in futility. The forecasts reflect the biases, and often mi8sconception, of those who make them.

Premium Content 10% off for blog readers and Twitter followers with coupon NOW10

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data