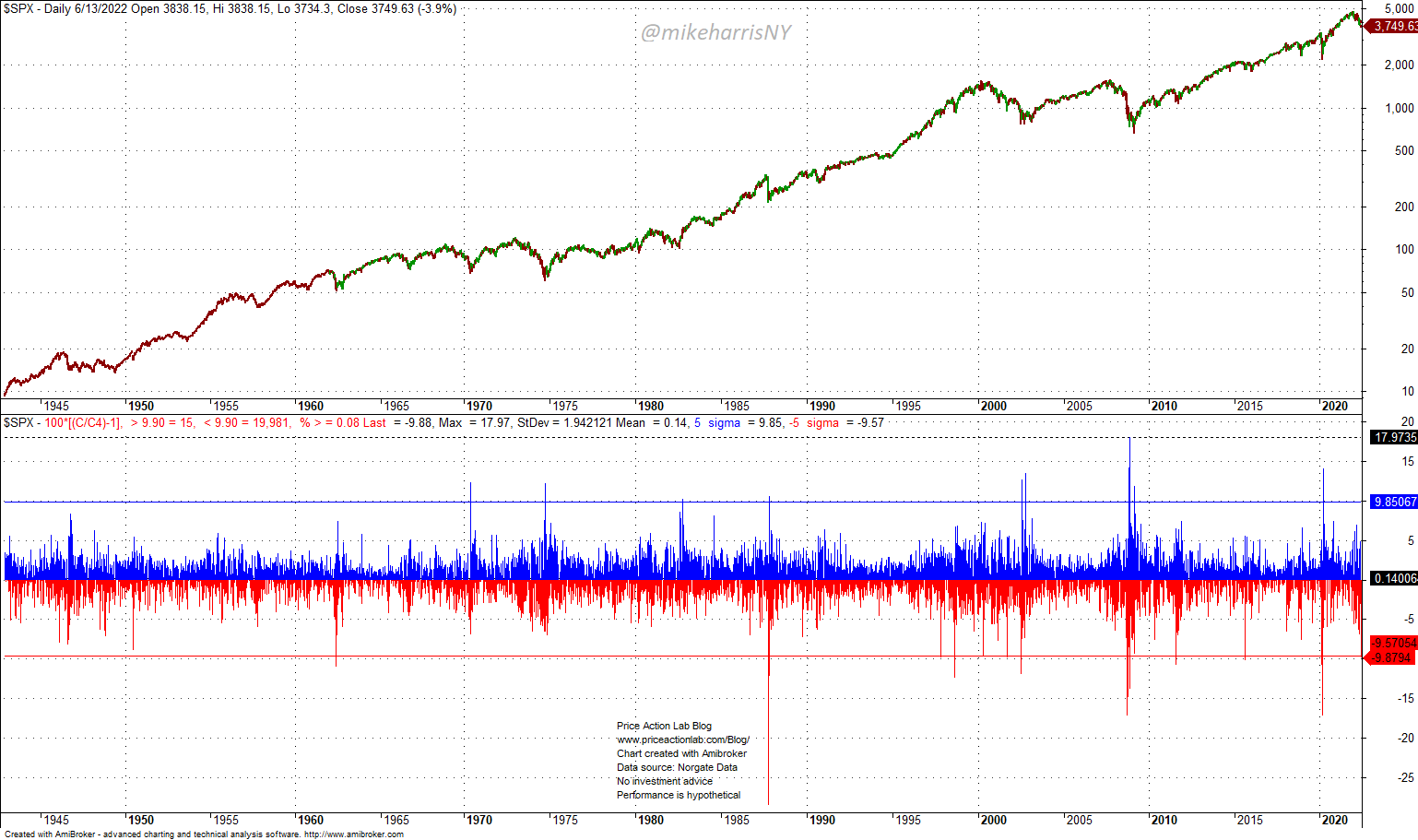

Risk accumulates slowly but also happens fast. The S&P 500 dropped nearly 10% in the last four trading days. This is a 5-sigma event based on an available sample of daily returns since 1942.

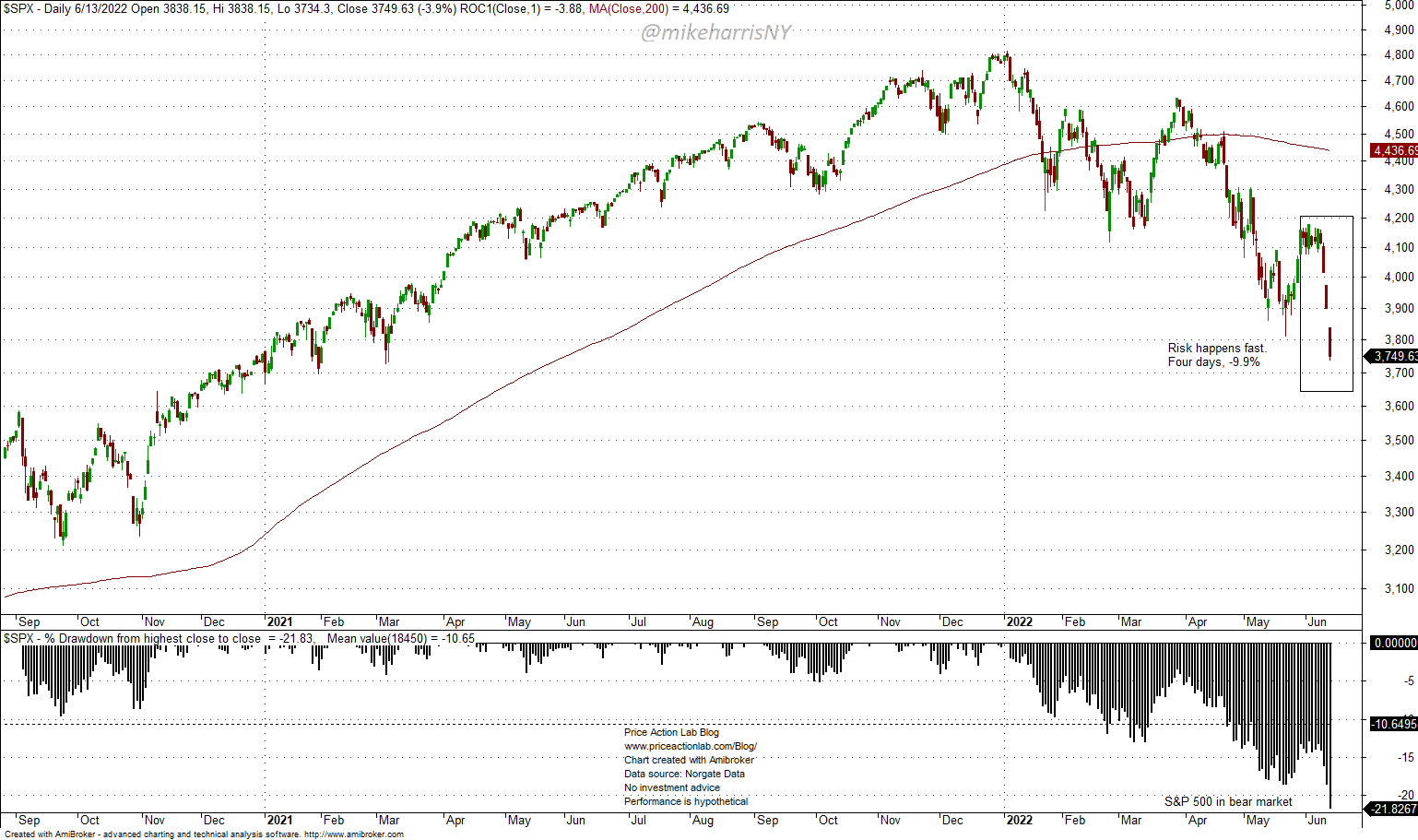

The S&P 500 fell into a bear market territory on Monday, June 13, 2022, after a 4-day losing streak of -9.9%.

Based on an available sample of 4-day returns, this 4-day losing streak of -9.9% was a minus 5-sigma event, as shown below.

The minus 5-sigma is at -9.6% and the S&P 500 4-day return was -9.9%. This was an extreme event that has occurred only 15 times since 1942. In most cases, these losing streaks occur near bottoms but can also occur along downtrends. The sample is small to make any statistical inferences.

Risk happens fats and left tail events in the markets have a higher probability than predicted by a normal distribution.

Premium Content 10% off for blog readers and Twitter followers with coupon NOW10

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data