When inflation and rates rise, equities and bonds fall. If commodities are also volatile, there is capital destruction because there is no safe asset. Unrealized gains and losses become transitory. The right strategies are known only in hindsight.

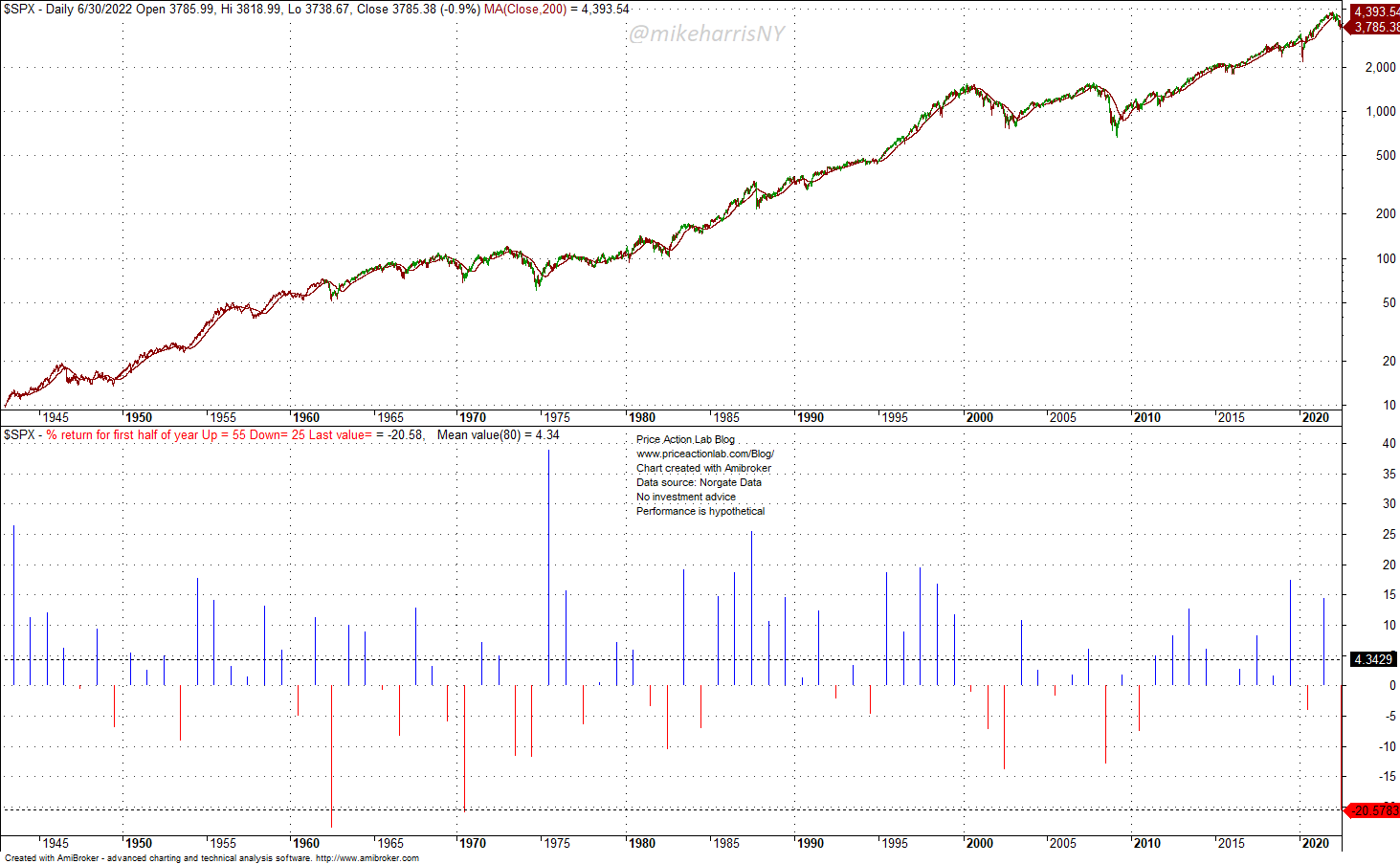

Descriptive statistics reflect the state of the market but always in hindsight. The most recent impressive descriptive statistic is the third worst drop in the first half of the year for the S&P 500.

The index fell 20.6% in the first half of this year, nearly matching a 21% drop in 1970 for the first six months. The worst drop in the first half of a year was in 1962 and was equal to 23.5%. The large drop tells us the first half of this year was rare by historical standards but that is not a consolation to investors who have been impacted by losses.

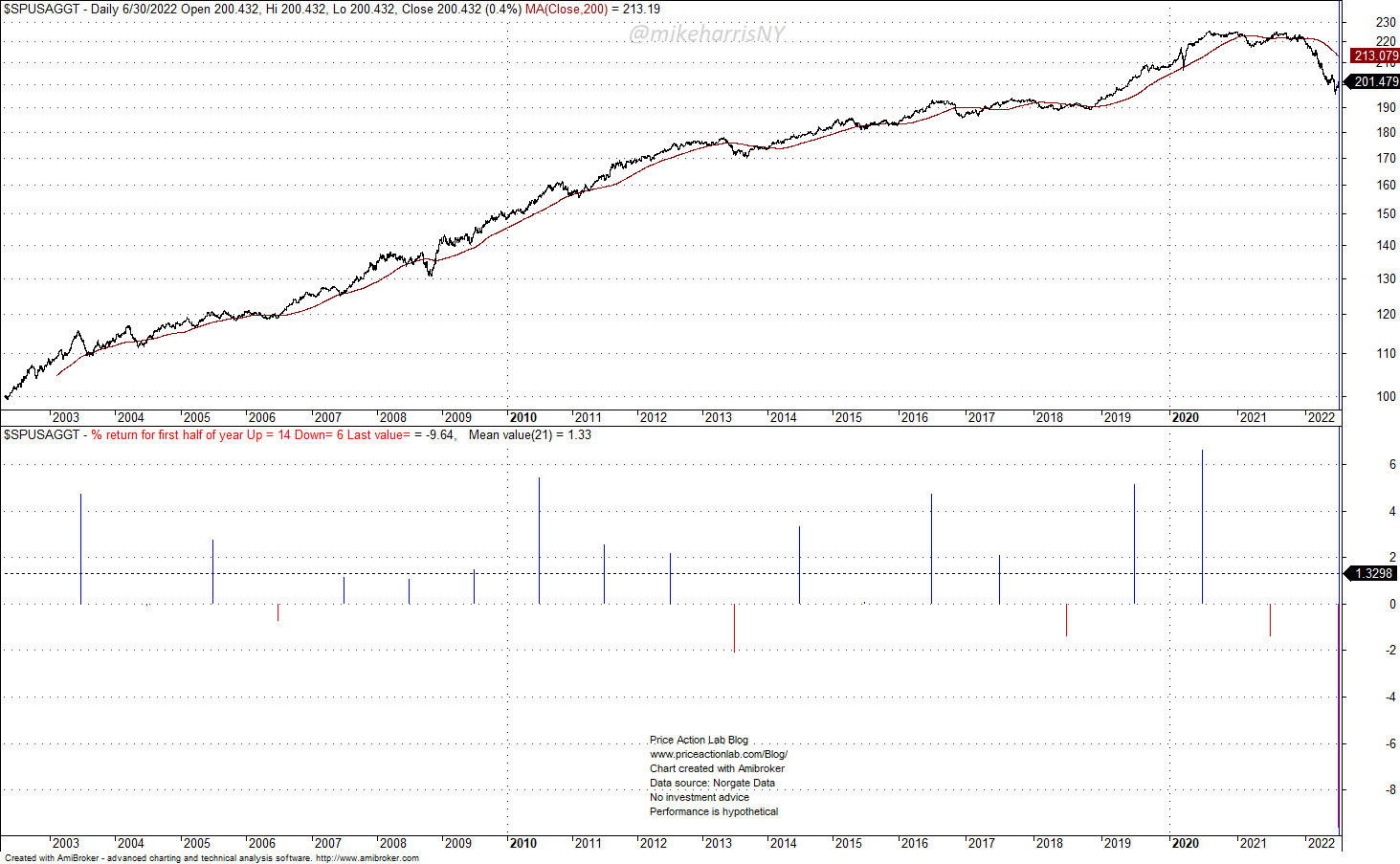

The investment landscape is even more challenging due to rising inflation and rates. As a result, bond prices have taken a hit.

The US Aggregate Bond Total Return Index plunged 9.6% in the first half of this year. Since 2002, the largest drop was 2.1%.

The combination of plunging equity and bond prices has impacted 60/40 strategic portfolio returns significantly this year. A portfolio with 60% in SPY and 40% in AGG is down 15.2% year-to-date. The largest loss was -19% in 2008. Memories from 2008 are not the best development for the investment industry and the customers.

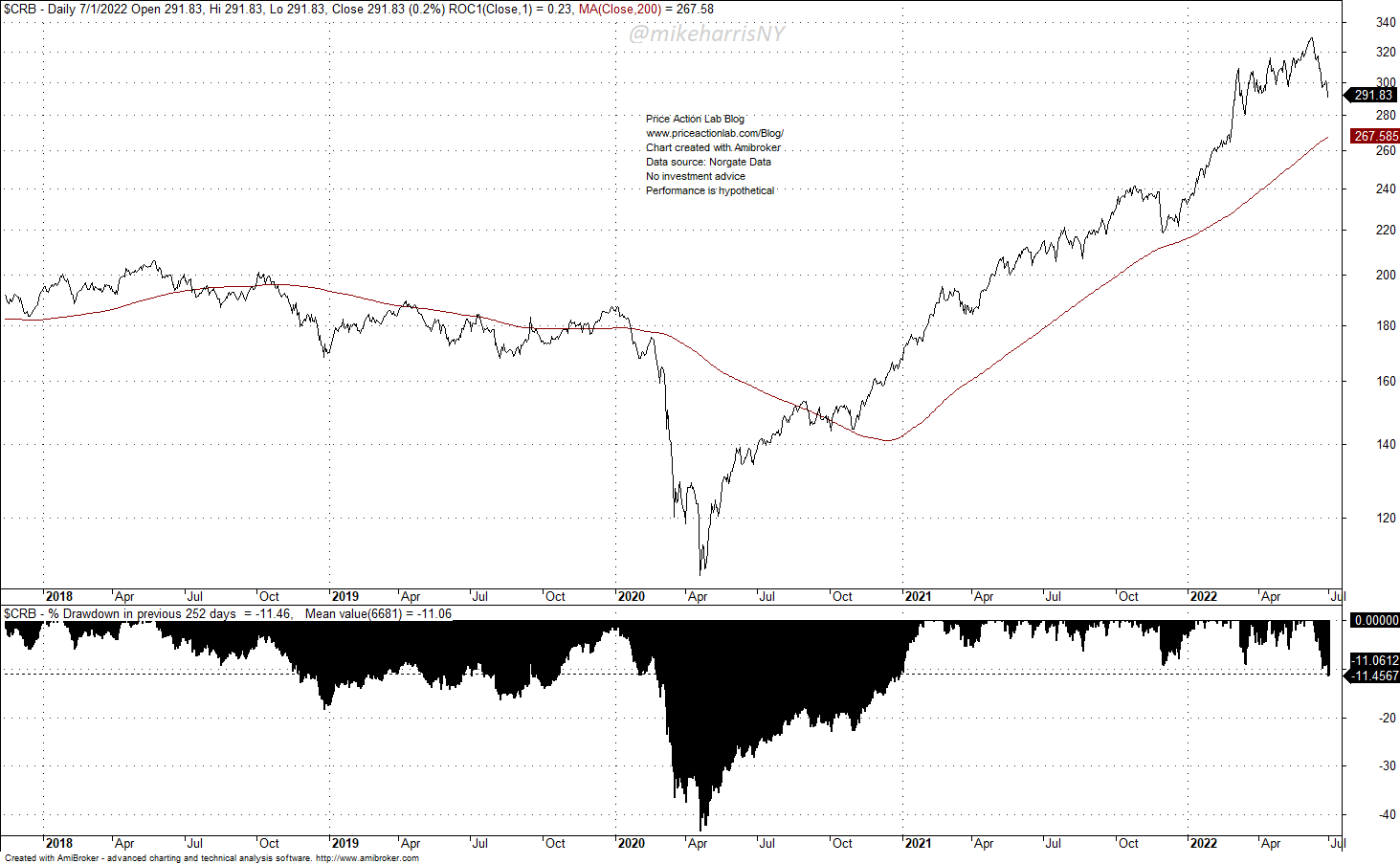

High volatility in commodities is adding fuel to a high uncertainty investment landscape.

The $CRB index is down 11.5% from its June highs. Volatility is rising in commodities and CTAs could see some of their unrealized gains evaporating. According to BarclayHedge, the top 20 CTAs are up 15% on the average year-to-date. However, these are mostly unrealized gains. Traders know how fast unrealized gains can disappear or even turn into realized losses.

CTAs will probably manage to finish the year with profits but the future will be more uncertain than in the past.

Capital destruction

An explosive mix of plunging stocks and bonds, and highly volatile commodities, is driving capital destruction. Wealth due to unrealized gains of the previous decade is evaporating. The rich 0.1% have seen their wealth plummeting due to lower equity valuations. This is a bust cycle after a boom.

Hindsight is not your friend

In hindsight, it is easy to find a strategy that worked well in the first half of this year. Optimization and selection bias make that possible. Those few who have made profits this year, in my opinion, succeeded due to their discipline and risk management. I can start my backtesting software right now and find 10 strategies that made high returns year-to-date but only in hindsight.

Our weekly signal service based on an ensemble of six strategies is down 3.5% year-to-date. Allocation to equities is 0% and the strategies are 86% in cash. The S&P 500 index is down 19.7% year-to-date.

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data