After a rare period of falling stock and bond prices, questions about the efficacy but also the viability of the traditional 60/40 portfolio have been raised. We discuss some of these issues and potential alternatives. Access to the article requires a Premium Articles subscription or an All in One subscription.

As far back as June 2017, we warned about the risks of the traditional 60/40 portfolio and discussed an alternative tactical allocation with 70% invested in the portfolio and 30% in a forex trend-following program.

Tactical asset allocation is not for everyone and many investors prefer strategic allocations with rebalancing frequencies that minimize turnover and tax implications. There are trade-offs and no free lunch.

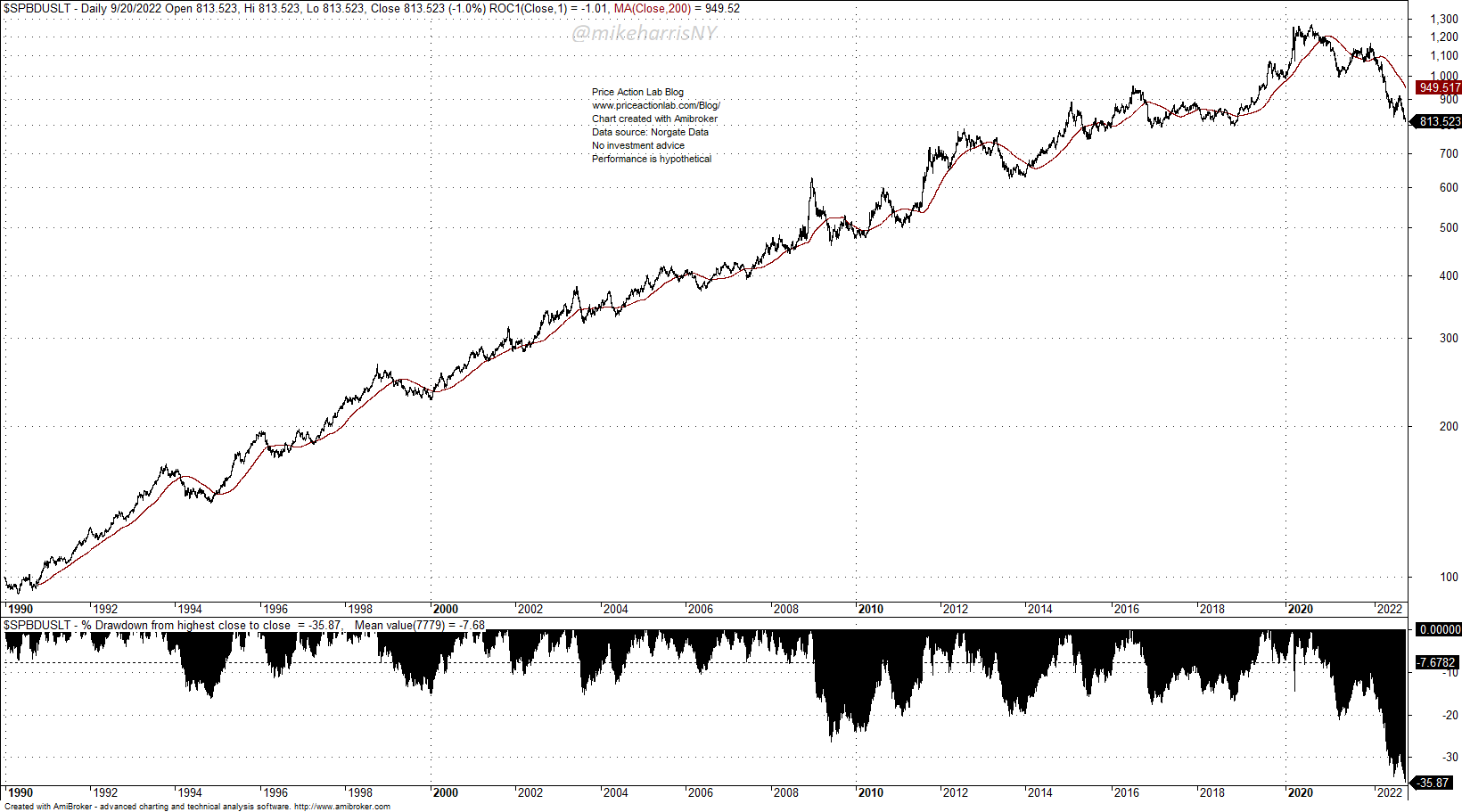

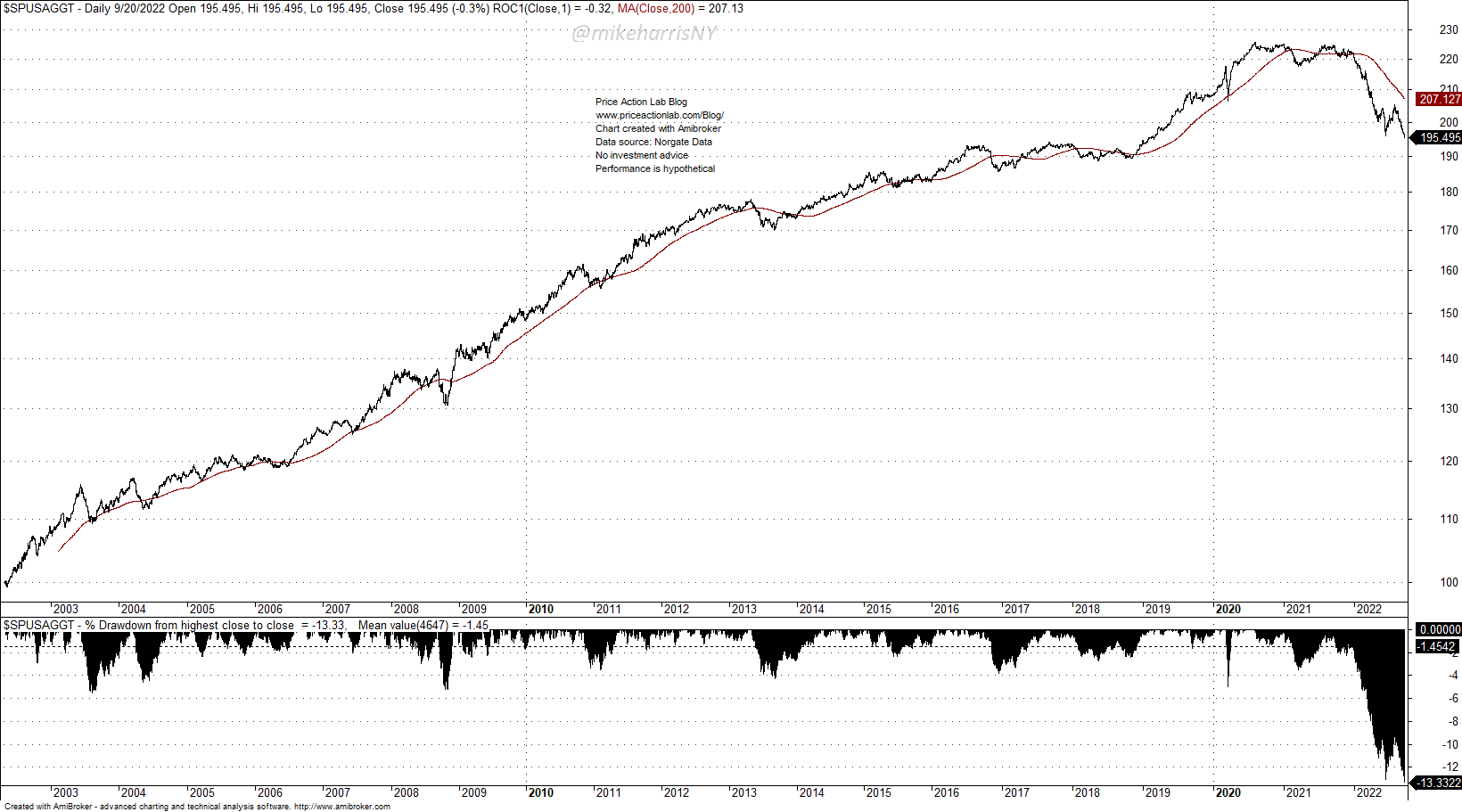

The 60/40 portfolio in SPY and AGG ETFs is down 16% year-to-date, but the drawdown is still within historical extreme levels. However, investors anticipate a long period of higher yields and a recession, which may cause portfolio losses to accumulate. This has prompted a search for alternative solutions to traditional 60/40 allocation.

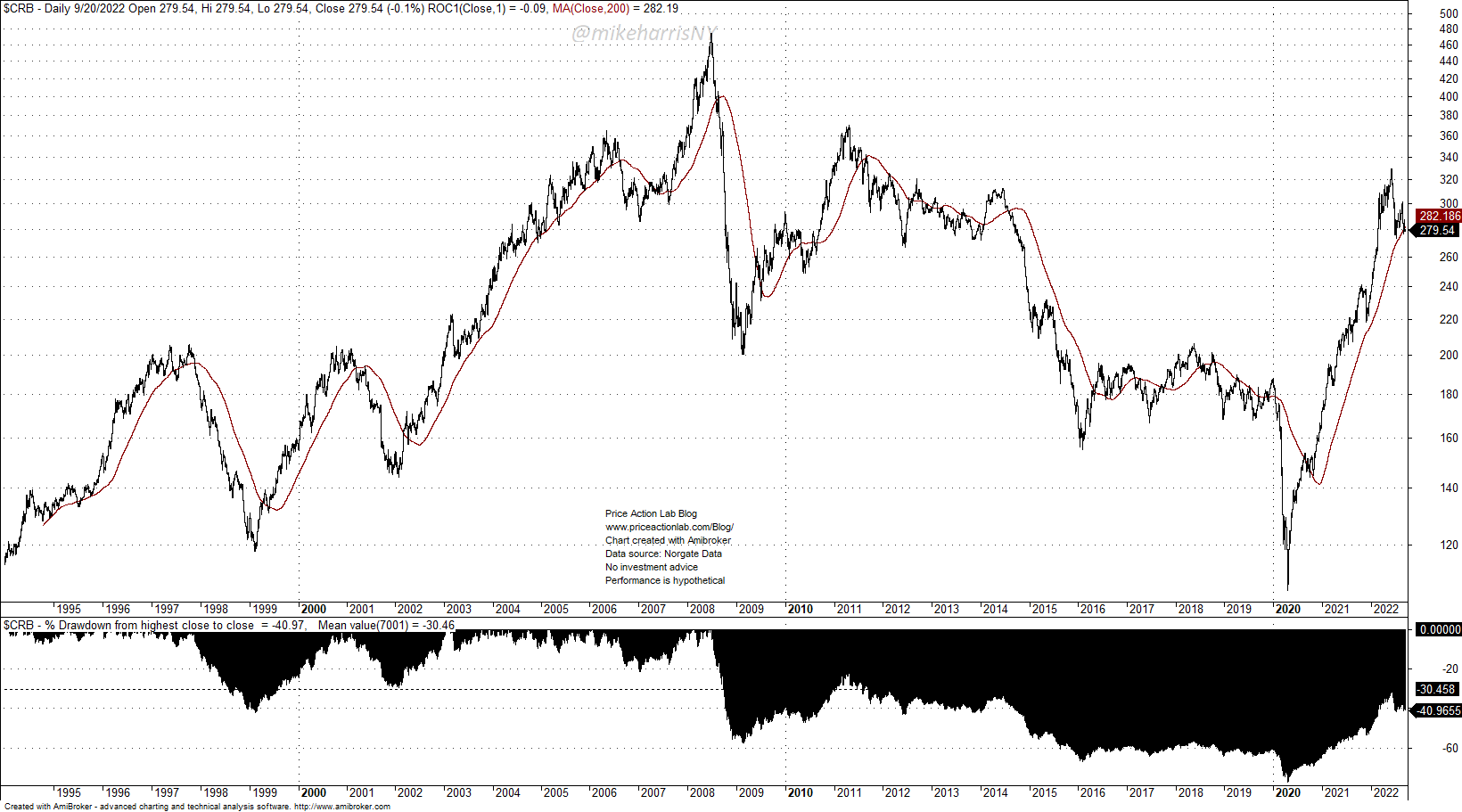

There is bad news for those looking at major markets as potential substitutes for the bond market in the 60/40 allocation. For example, commodities markets have had wild swings historically, making them unsuitable substitutes.

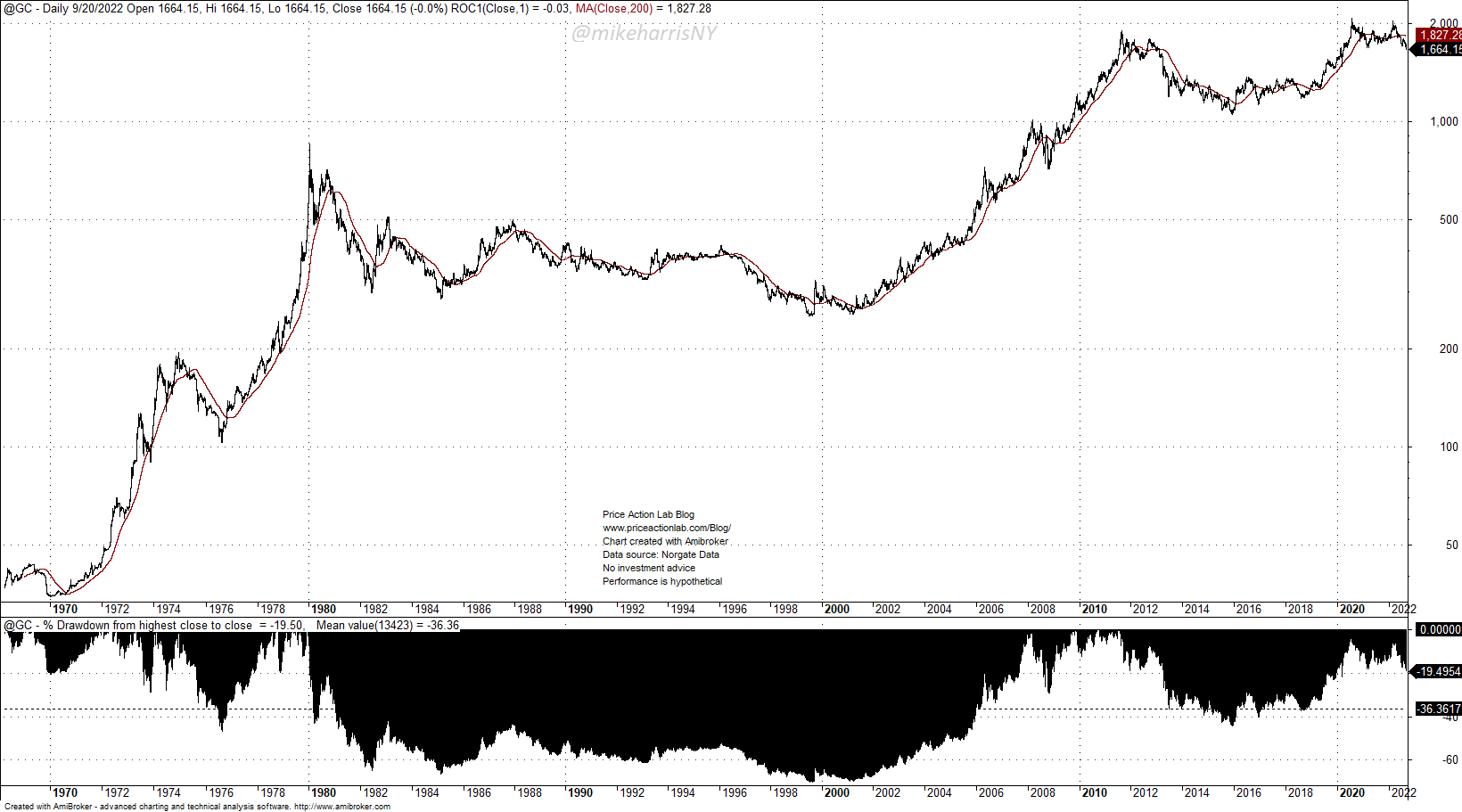

Gold has also been erratic with large drawdown and long periods of stagnation, while also subject to wild swings.

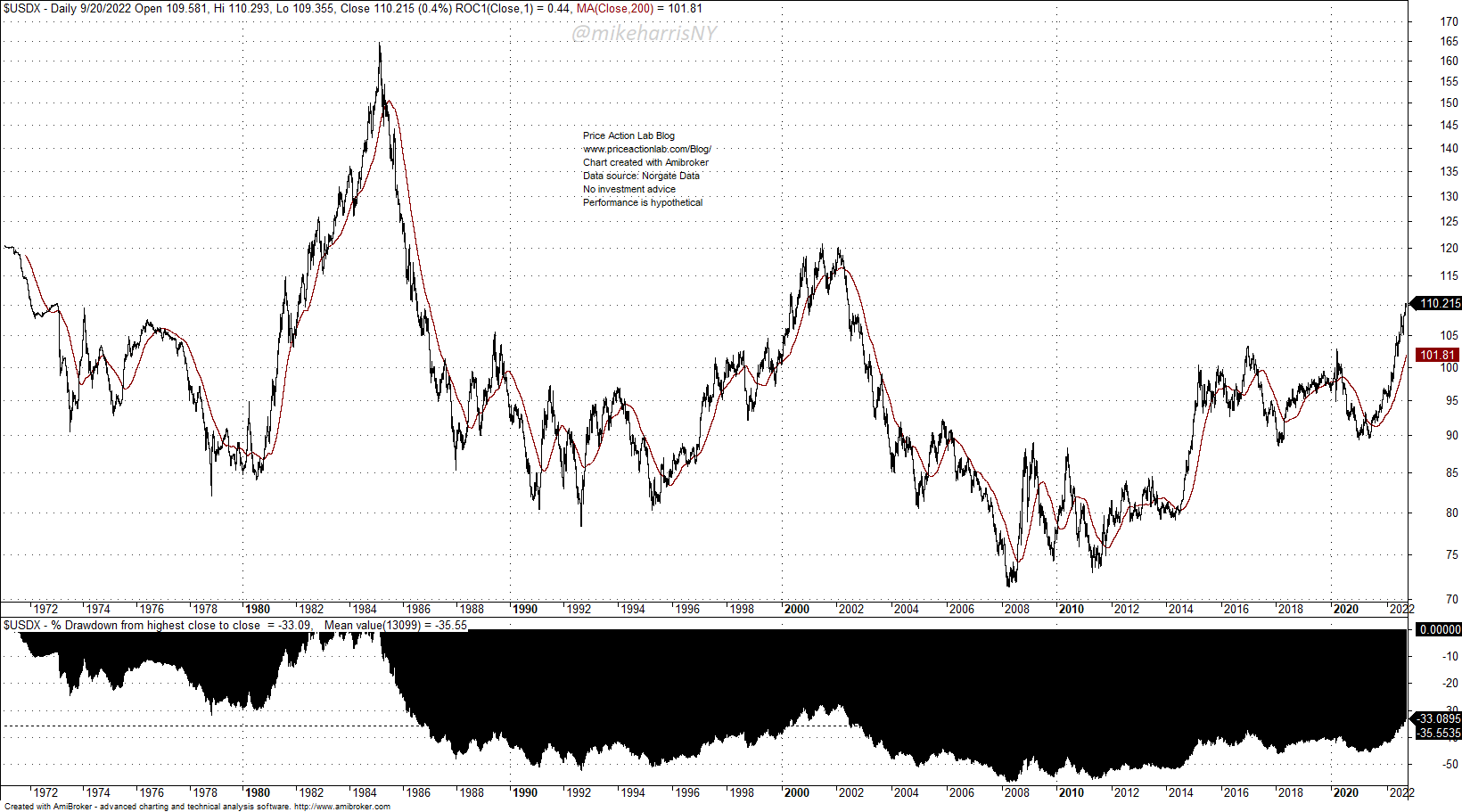

Turning to the US Dollar, the chart does not offer any hope that this can serve as an alternative to bonds. This is a very erratic market subject to wild swings.

There is no major market that can offer an alternative to bonds, which recently have experienced the largest drop in the last several decades. Long-term bonds are down more than 35% and short-term are down more than 13%.

An Alternative 60/40 Allocation

|

This post is for paid subscribers

Already a subscriber? Sign in |

If you have any questions, you may contact support.

Specific disclaimer: This report includes charts that may reference price target levels determined by technical and/or quantitative analysis. No updates to charts will be provided if market condition changes occur that affect the levels on the charts and/or any analysis based on them. All charts in this report are for informational purposes only. See the disclaimer for more information.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter.

Price Action Lab premium Content: By subscribing you have immediate access to hundreds of articles. Premium Insights subscribers have immediate access to more than a hundred articles, Premium Articles and Market Signals subscribers have immediate access to hundreds of articles that include the trader education section and All in One subscribers have access to all past premium content. Click here for more details.