The volume of the iMGP DBi Managed Futures Strategy ETF has surged this year along with the gains of Commodity Trading Advisors.

The BarclayHedge CTA Index is up 8.5% year-to-date, while the index of the largest 20 CTAs is up 18.7%

Due to significant losses in stock indexes and the traditional 60/40 portfolio, investing in alternatives has gained traction even among some conservative investors.

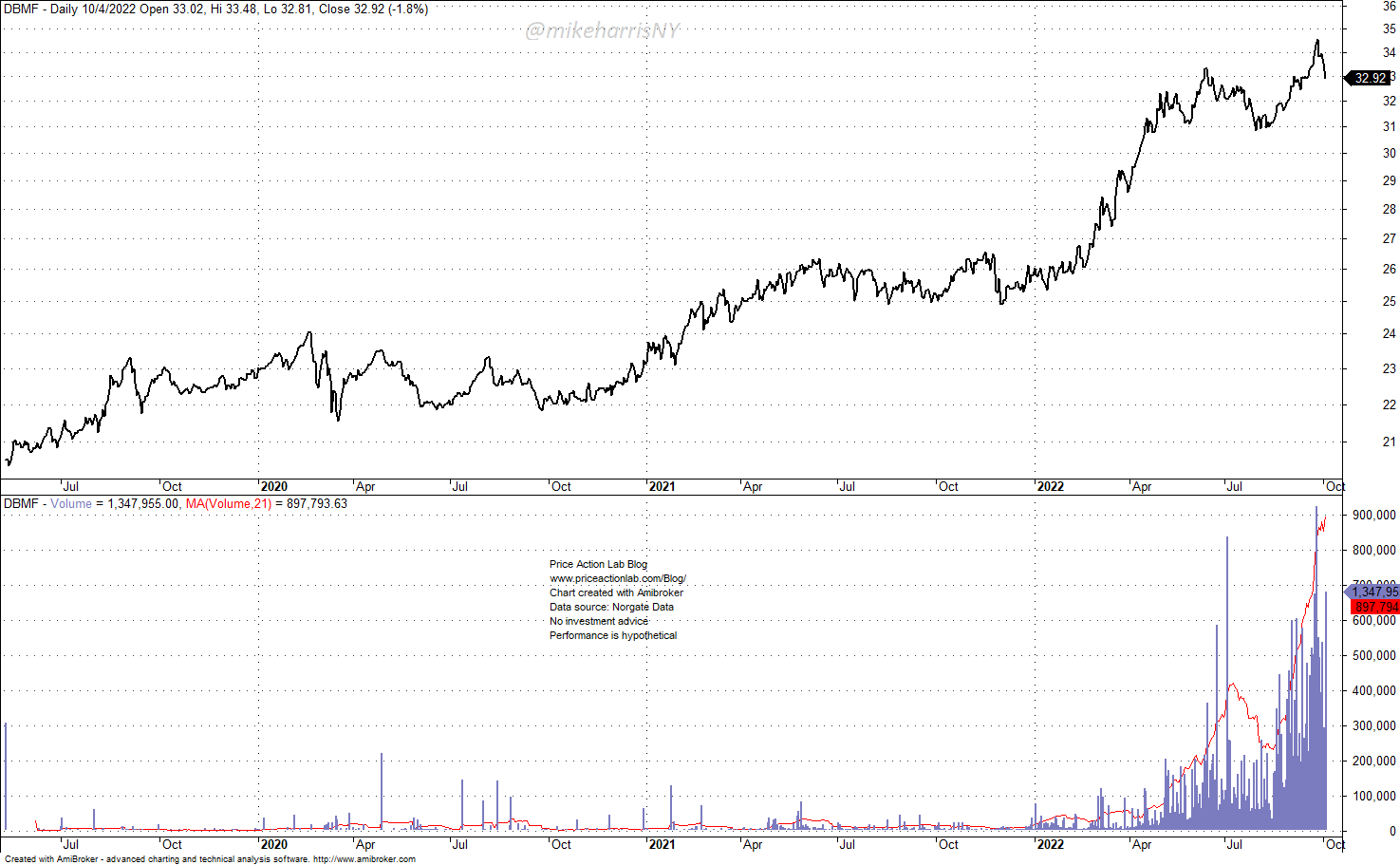

As a result, the volume of the iMGP DBi Managed Futures Strategy ETF (DBMF) has increased exponentially this year.

The average 21-day volume has surged from 20,120 at the start of the year to nearly 900K on Tuesday, October 4, 2022.

The ETF is up 27.2% year-to-date. Note that in the last two days and due to a rebound in equities and fixed-income, the ETF has lost 3%. The drawdown from all time highs of September 27 of this year is 4.7%.

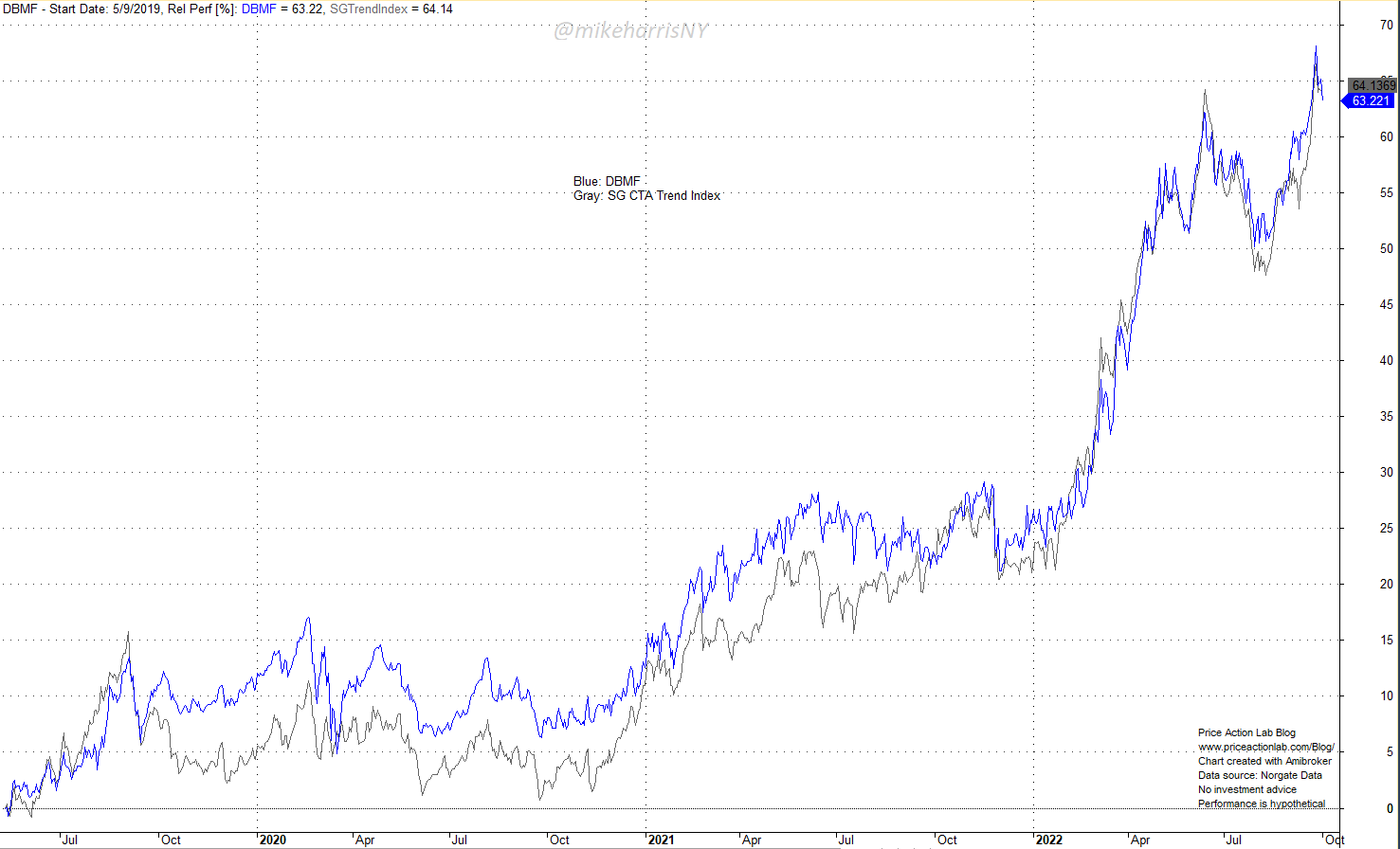

The DBMF ETF has been tracking closely the SG CTA Trend Index (as of October 3, 2022)

If this ETF will continue tracking the index closely, it will offer access to CTAs and diversification benefits to retail investors.

For Limited-Time Only Premium Content Is 10% off for blog readers with the coupon NOW10

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data