DLPAL DQ software can be used to identify potential outliers in daily and weekly price data. No programming is required.

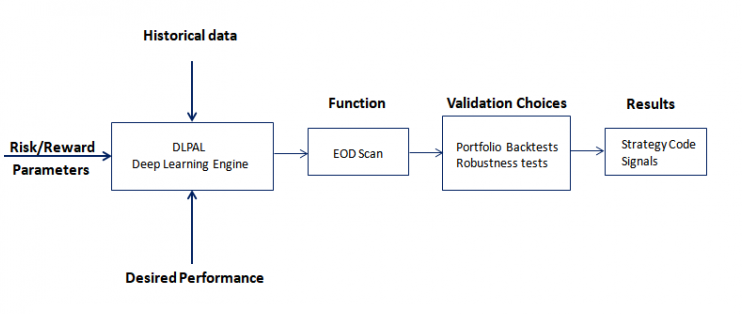

Below is a summary of how the DLPAL DQ software is normally used:

Tasks performed once

Step 1. Generate initial OHLC data for any number of securities. Preferably, five years or longer of price history is required.

Step 2. Create Scan Workspaces for each group of securities with your preferred risk/reward parameters.

Tasks performed daily or weekly

1. Update the data files and open the desired workspace.

2. Run the program.

3. Use portfolio backtests and/or robustness checks to validate the results.

4. Select potential outliers that fulfill your criteria.

No programming is required except in the case of data downloading and updating.

For more details about anomaly detection and specific examples, see the article below:

The article provides examples of criteria to use for validating anomalies in price action. The user could look for high portfolio profit factor, win rate, and/or expectation, or multiple signals, or a combination of criteria.

DLPAL DQ Software. © 2011 – 2022 Tradingpatterns.com. All Rights Reserved.

DLPAL DQ generates code for popular platforms and has a signal tracking module for signal generation going forward, as well as, several other useful tools.

We offer 3-month fully functional trials at a fee and unlimited lifetime licenses. Click here for more details about the demo.

DLPAL DQ can be used to scan hundreds, or even thousands of securities for price action anomalies, using multiple instances of the program.

For more information about DLPAL DQ click here.