Trading strategies evolve towards chaotic performance if no improvements are made that are compatible with changes in the market regime and microstructure.

The financial markets are highly non-linear, dynamic, and stochastic processes. These types of random processes usually have many hidden modes, and some are even chaotic. Strategies attempt to profit from market moves by oversimplifying price dynamics with the use of rules and heuristics. The objective is to maintain a high enough positive Sharpe ratio for as long as the strategy is used. Unfortunately, due to the non-stationary nature of financial price series, most strategies fail to maintain a positive performance, or what many mistakenly call “positive expectation.” The reason for the mistake is that the expectation is only known in the limit of sufficient samples, and in finance, the required sample size is so large and beyond the generation capability of most low-frequency strategies.

In addition, many use the concept of ergodicity in wrong or confusing ways. Ergodic processes are a small subset of stationary processes and a tiny subject of stochastic processes. An ergodic process is stationary but the reverse is not true. Due to hitting an absorbing barrier put in place by capitalization constraints, ruin can happen even in an ergodic process. One problem is that a sufficient sample of trades is required for an average to converge to the mean of the distribution, or what is known as the expectation. Even worse is the fact, as reflected in some articles and books, that some traders think non-stationarity is the cause of trading system failures, and if the process were ergodic or made to be one, the problems would go away. However, non-stationarity is the source of profits and in an ergodic world, no one will have an edge over any other player in a zero-sum game, i.e., profits in the long term are impossible to make.

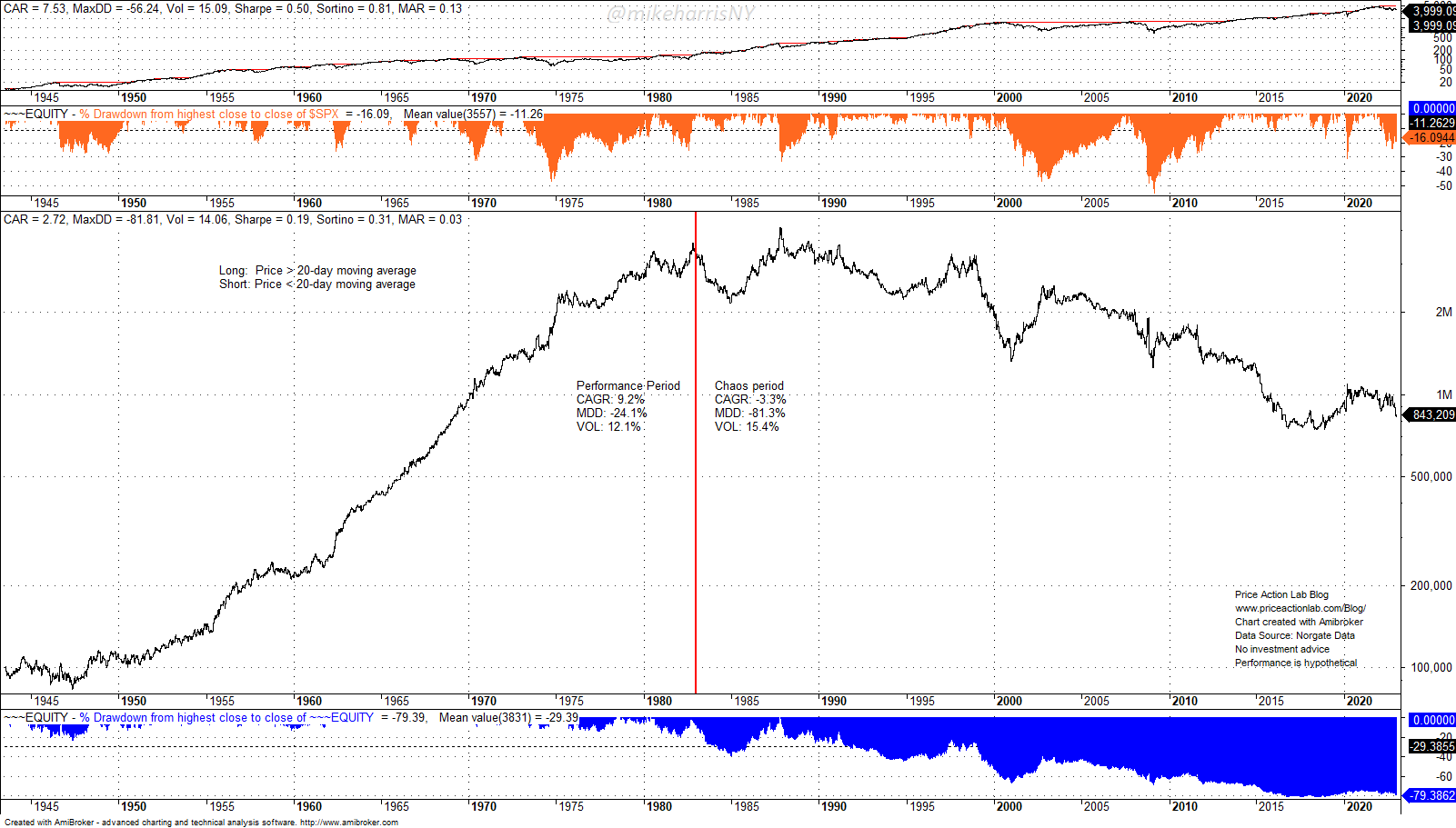

Regime changes due to changes in fundamentals, market microstructure, or even market participant behavior can cause trading strategies to become chaotic even after many years of profitable performance. One example is how a simple moving average cross with 20 days for taking long and short positions in the S&P 500 (hypothetically) performed for 40 years starting in 1942 but then became erratic afterward for the next 40 years, as shown below.

From 1942 to 1982, this simple long-short moving average crossover strategy had a 9.2% annualized return at a maximum drawdown of 24.1%. But after 1982, the strategy became chaotic, the annualized return fell negative to -3.3%, and the maximum drawdown increased to 81.3%, which is close to ruin. What happened?

The primary reason for the failure of trend-following strategies based on fast-moving averages after the 1980s was autocorrelation regime changes, as has been described in other articles in this blog in the last 12 years.

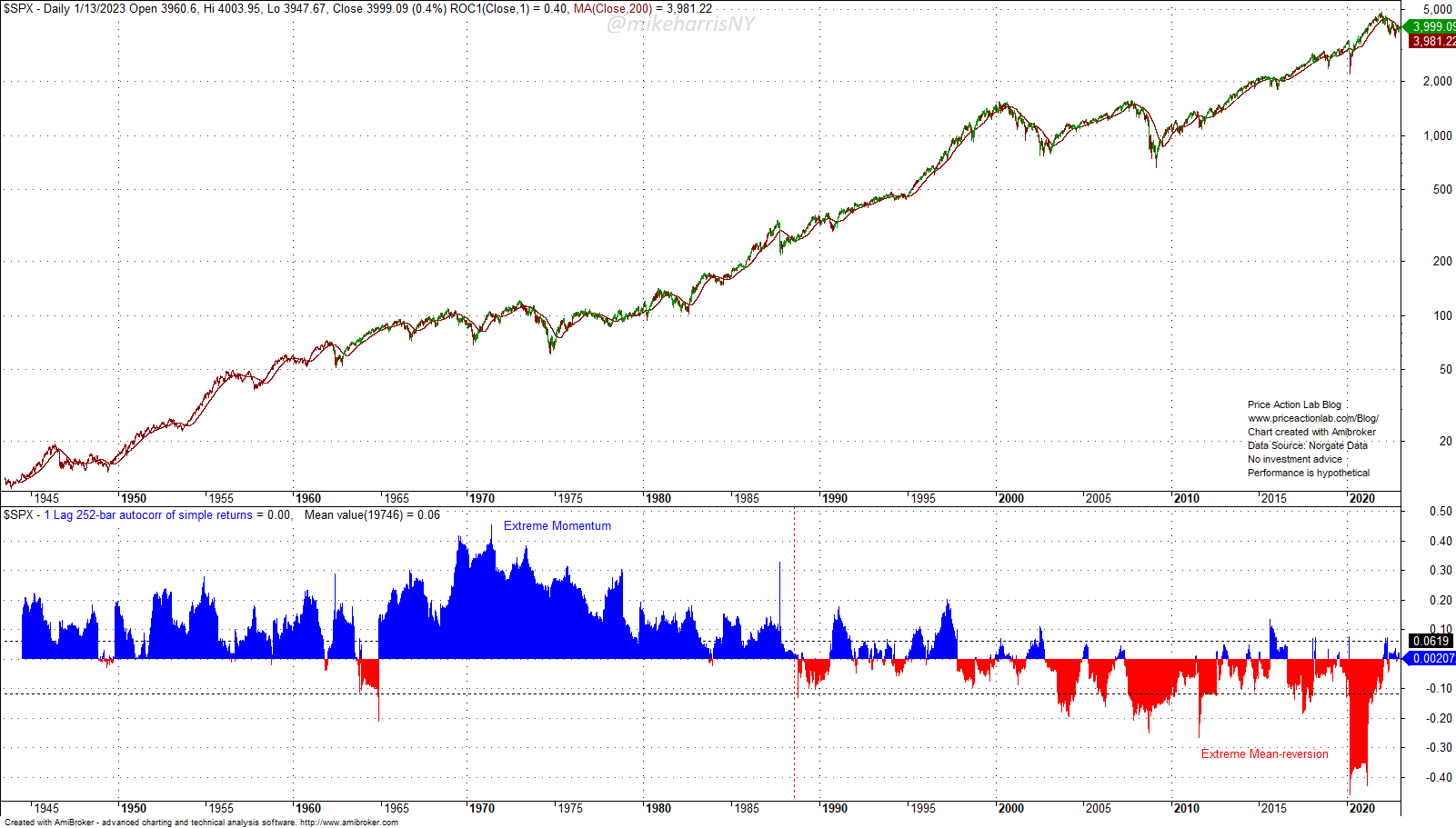

The 1-lag, 252-day autocorrelation of S&P 500 daily returns fell gradually from highly positive to highly negative and recently even to extremely negative levels. This was a significant regime change that affected many strategies, caused chaotic behavior, and even ruined traders that used them.

For example, many have heard of turtles and the turtle trading strategy. However, not many know that the original rules have been revised a few times. Originally, the turtles used entries based on 20-day or 55-day breakouts. Nowadays, there is not much profit potential in fast breakouts, and the turtles that have survived use 100-day or longer breakouts. The original strategy turned chaotic and the turtles had to adjust. Some did this successfully and are still in business, generating alpha for their investors.

In general, it is not a good idea to try to adjust a strategy after a random drawdown. However, adjusting, updating, or even canceling a strategy may be necessary if a regime change has occurred that will cause a chaotic performance, as in the example of the moving average cross above. This is where experience plays a role and artificial intelligence and machine learning have limitations. Some experienced traders can smell a regime change from miles away. I have argued in an article in SSRN that knowing when regime changes occur is much more important than any quantitative analysis.

Many edges of the past disappeared in the new millennium due to crowded trades, regimes, and market microstructure changes. The result was a turn to strategic and tactical allocation with diversification. Neither of these strategies will escape entering chaotic modes in the future. We got a taste of this with risk parity and the simpler 60/40 allocation in 2022.

Managed futures is probably the most responsive space to regime changes. Experienced futures traders and especially systematic trend followers know how to adjust to changing market conditions. A new challenge is the financialization of the space with replication ETFs. The trade may get too crowded if this trend continues and some strategies may trigger chaotic modes. This third decade of the new millennium is becoming more challenging for strategies. Chaos may become the norm, rather than the exception.

Subscribe for free notifications of new posts and updates from the Price Action Lab Blog and get the PDF book “Profitability and Systematic Trading” (Wiley, 2008) free of charge.

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data