On Monday, March 13, 2023, managed futures CTAs faced a 9-sigma event and their worst losses since 2000.

Edit on March 18, 2023, due to some comments in tweets:

“The standard deviation formula is never wrong; it is what it is. What could be wrong is the understanding people have and the inferences they try to make. You don’t know the population distribution; it may not exist at all, but it’s probably a power law, so these events are more frequent than normal.

In other words, in the article, no attempt is made to infer the frequency of these events or make any other inference based on them.”

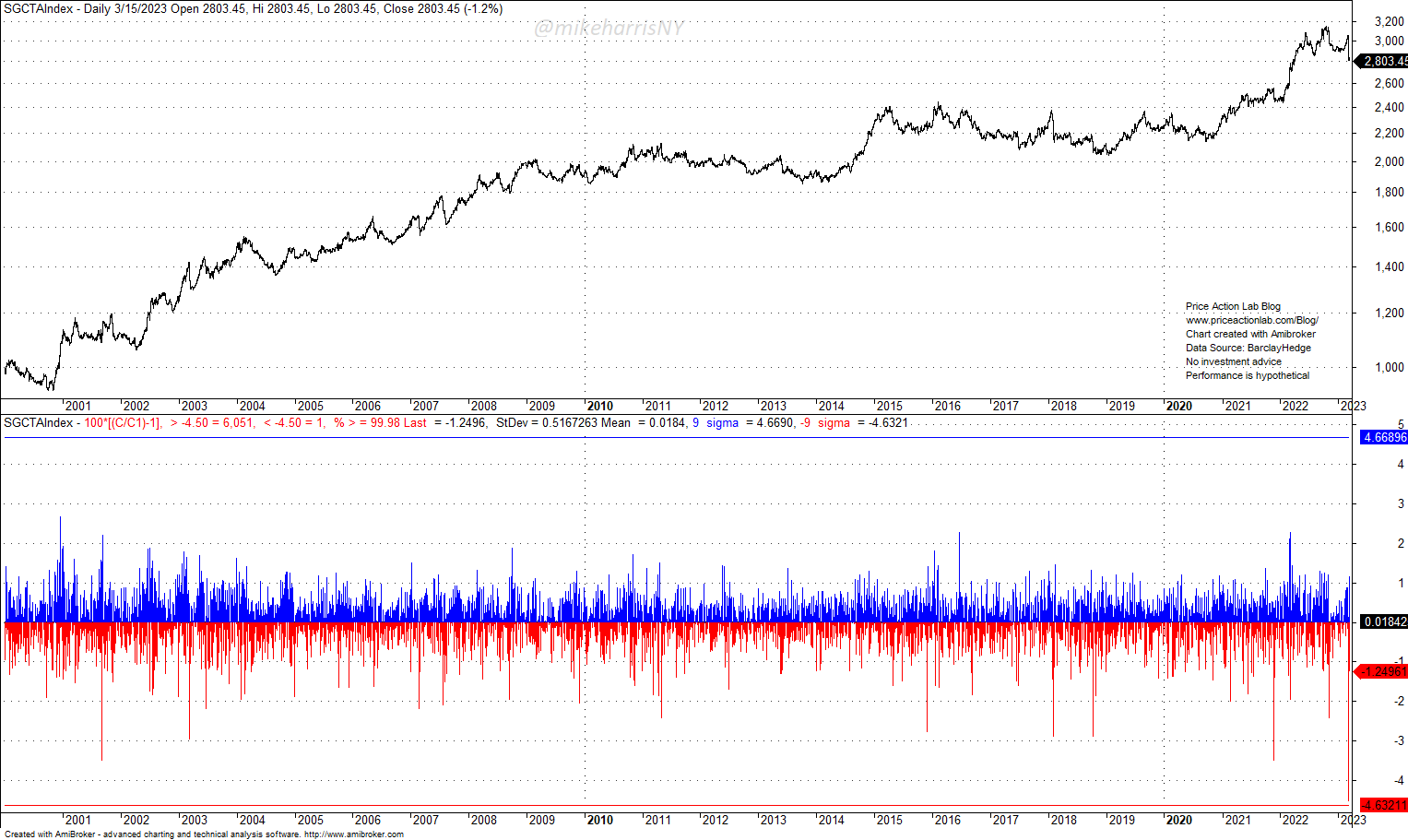

Below is a chart of the Société Générale SG CTA Index, which shows the histogram of daily returns since the index started in 2000.

A 4.5% drop on Monday, March 13, 2023, was a nearly 9-standard deviation move based on the available sample of daily returns since January 2000.

The loss was extreme, but it is probably due to a temporary low dispersion in CTAs, or, in other words, all the CTAs in the index had similar positions.

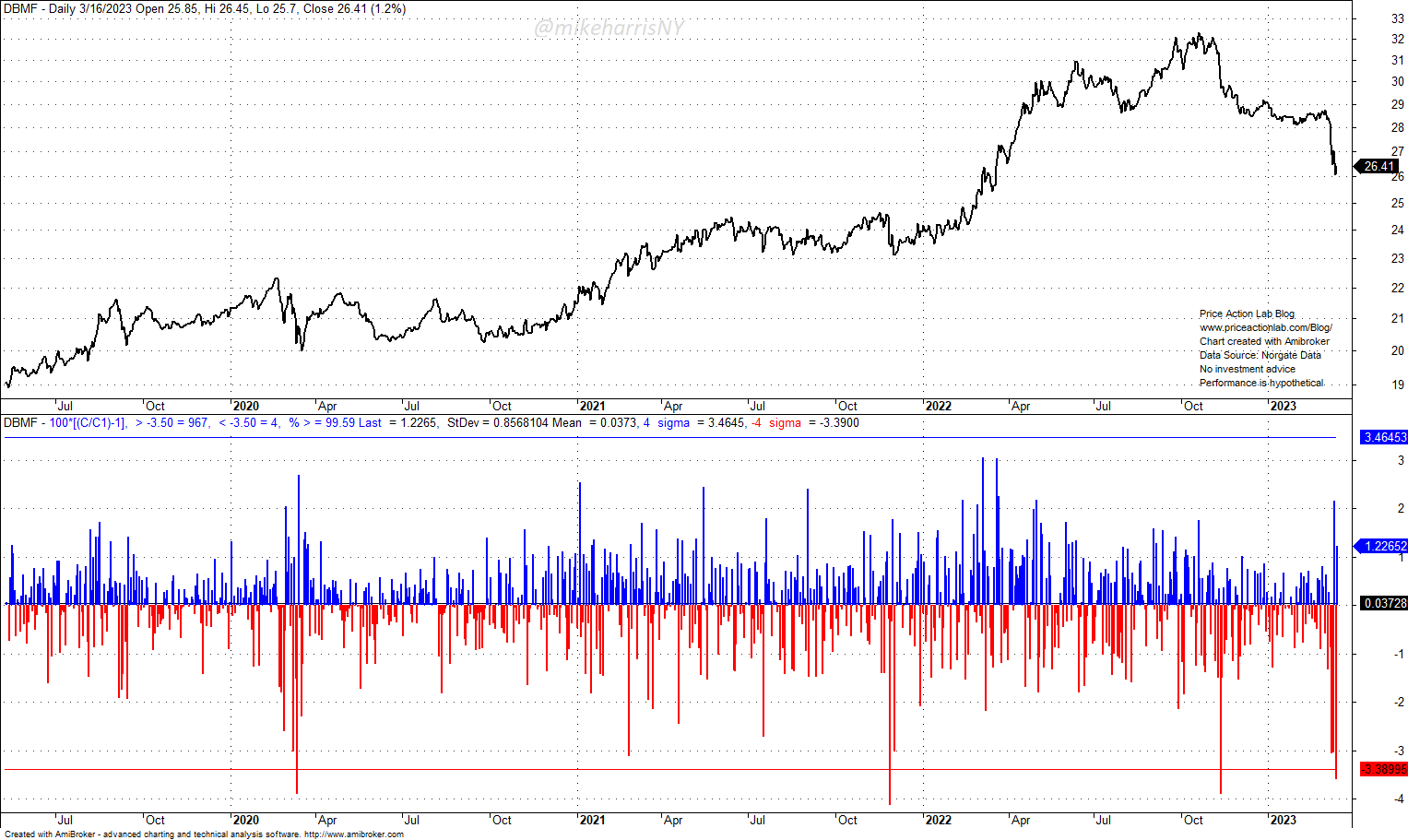

In addition, due to similar positioning and an extreme left-tail event, managed futures ETFs that track CTAs were also hit hard. The DBMF ETF fell 3.6% on Monday, March 13, 2023, which was a 4-sigma event.

The DBMF ETF has faced a total of four 4-sigma events since its inception. When the dispersion of CTAs is low and they are down, the losses in replication ETFs can multiply.

Managed futures CTAs are under stress after a good performance in 2022, but the reversal in commodities and rates has had a negative impact this year. In the long term, these losses are immaterial, but in the short term, they can impact investors, especially those who allocate to managed futures near peak performance.

Premium Content

Online Books

Premium Articles

Systematic Market Signals

By subscribing you have immediate access to hundreds of articles. Premium Articles subscribers have immediate access to more than two hundred articles and All in One subscribers have access to all premium articles, books, premium insights, and market signals content.

Free Book

Subscribe for free notifications of new posts and updates from the Price Action Lab Blog and receive a PDF of the book “Profitability and Systematic Trading” (Wiley, 2008) free of charge.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter.