Lately, retail traders are being targeted by another round of hype involving high annualized returns from trading strategies that are unrealistic but relatively simple to understand and backtest.

I first provide the general structure of the bogus trading strategies that are lately being used to hype extraordinary returns, and then present results from a specific example. Finally, I discuss the reasons why these strategies underperform in reality.

Hype in the retail trading space is nothing new. In the 80s, retail traders were promised a fast way to riches if they applied technical analysis. In reality, technical analysis acted as a wealth redistribution from retail to professionals and market makers. Some outlier winners, real or hypothetical, are still being used to hype technical analysis, but most retail traders are nowadays aware that its use offers limited potential.

In the 90s, neural networks and more advanced technical analysis methods were presented as ways to outperform the markets, but soon traders found out that the former was a curve-fitting tool, and the latter methods suffered from subjective interpretations.

Nowadays, there is an attempt to present AI as the method for realizing large returns, but the outcome will not be any different: there is no way for retail to beat professionals and market makers.

Lately, a class of intraday trading systems has been hyped to retail as the way to make extraordinary returns. The motives are not exactly clear for this hype; they may be due to incompetence, scams, or both.

The general structure of the trading strategies that promise extraordinary returns

The market is usually the stocks in an index, such as the Russell 1000. If certain conditions are met at the close of a trading day, then buy next day at a limit price. The limit price is calculated based on certain technical indicators. Exit the position at the close of the day.

An example of an intraday strategy that buys stocks at a limit price

If at the close of the day, the price of the stock is lower than the difference of the 10-day moving average of the close minus the 10-day ATR, and the stock price is above the 200-day moving average, then buy next day at a limit price equal to the closing price minus the 10-day ATR. Exit at the close.

The strategy is applied to the Russell 1000 stocks from 01/03/1995 to 04/16/2023. A maximum of 5 positions are held open, and the ranking function to decide which stocks to select is the 3-day rate-of-change.

The strategy is simple and backtesting it with EOD data is easy, provided delisted series are used. Here we use Russell 1000 current and past constituents from Norgate Data (see link at the end). The starting capital is $100K.

No commissions, no slippage, and no liquidity constraints

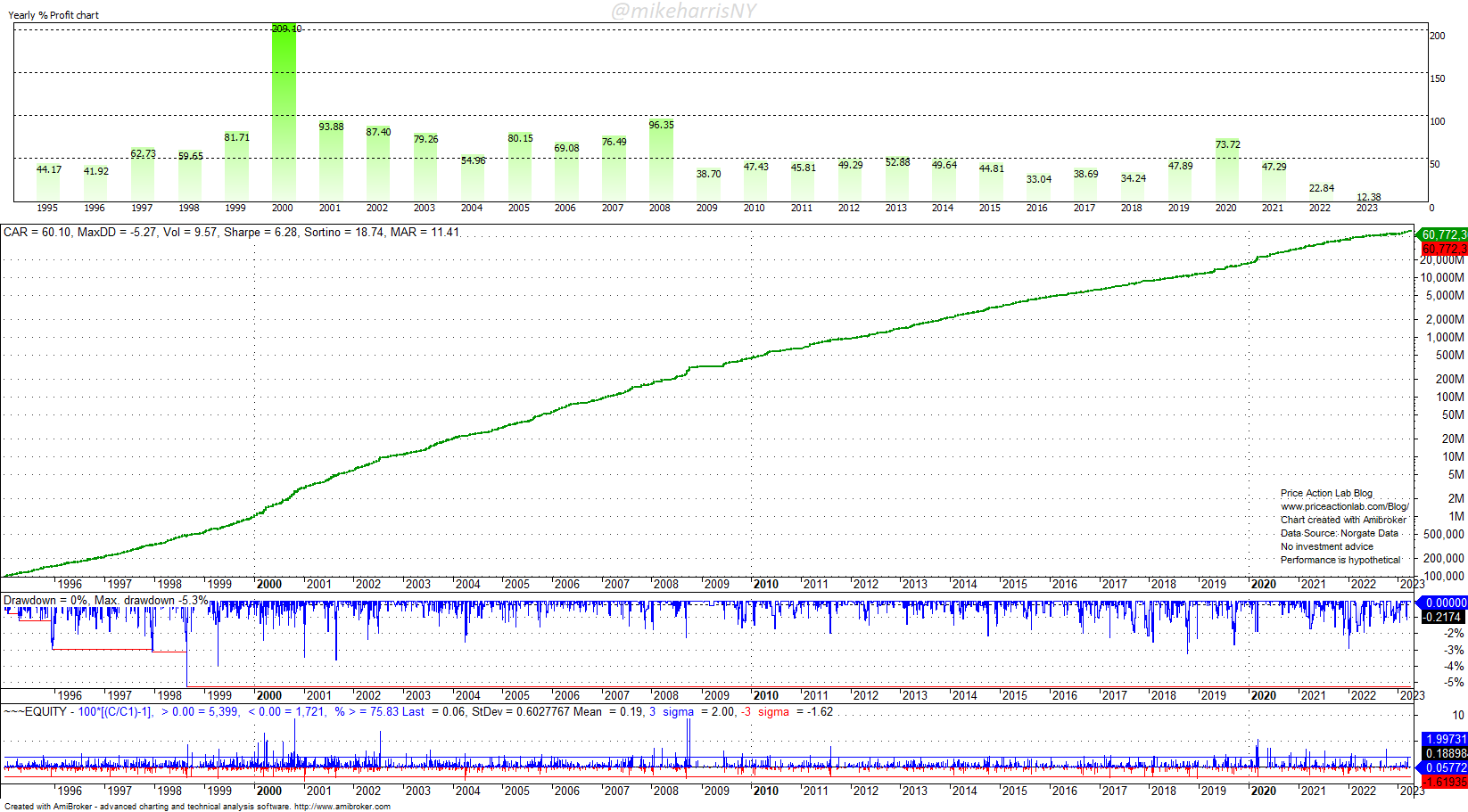

This is a backtest with a 60% annualized return, 5.3% maximum drawdown, and Sharpe of 6.3! This is better than the Holy Grail! There is no look-ahead, the numbers are “real” in the backtesting sense.

The newbie thinks they have found the way to riches. The experienced professional suspects a bogus backtest. But what are the problems with it?

The first problem an experienced trader suspects is liquidity constraints, and the position size may be unrealistic, as the results below show. Many trades have positions of millions or even billions of shares. There is no way these orders were executed in real life. This is an example of a page from the many from the backtest results.

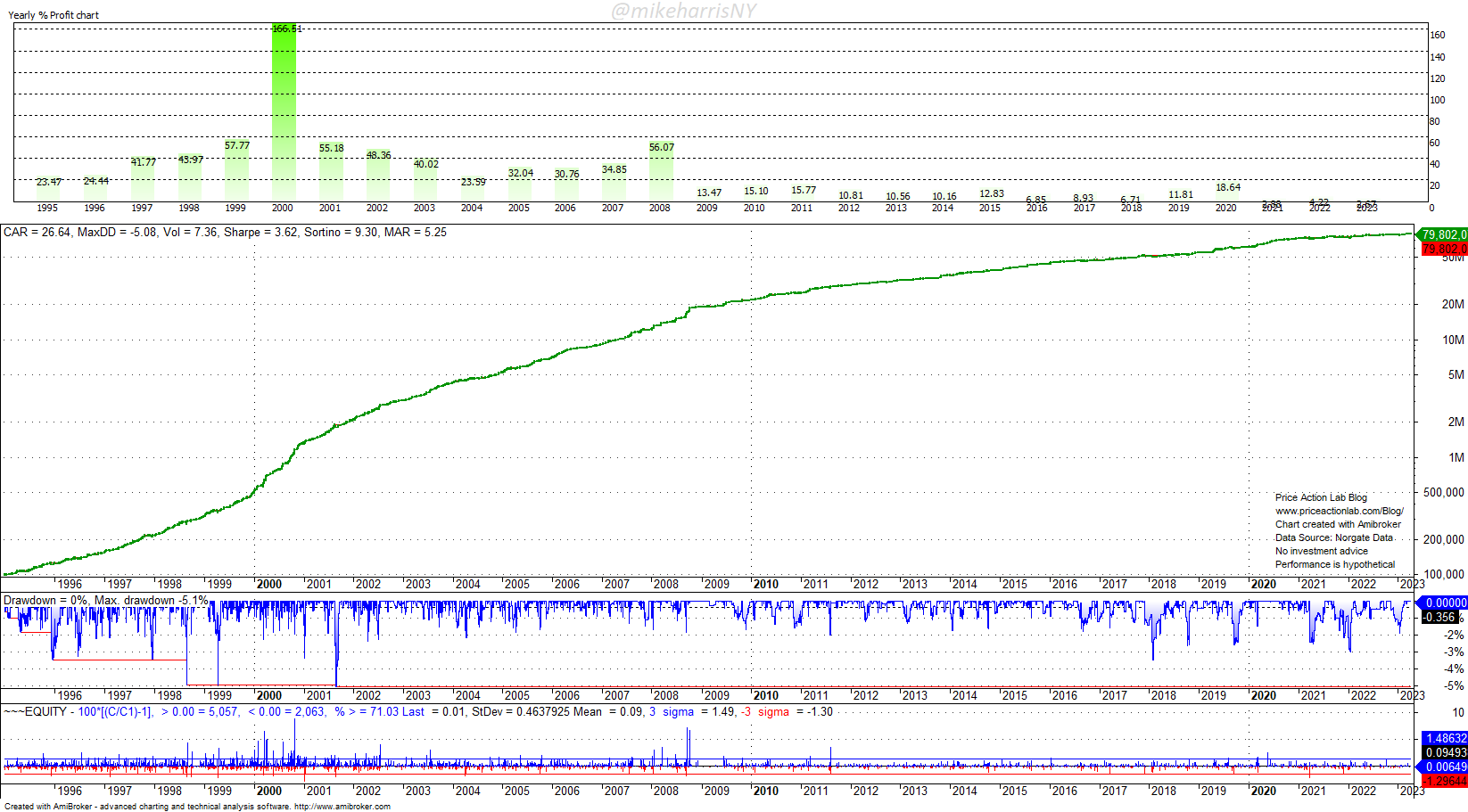

As a first step, to deal with liquidity constraints in a limited but more realistic way, we will limit the position size for all entry orders to a maximum of 1% of the daily volume. We will also add 0.05% commission and slippage to each order. Below are the results.

The annualized return dropped from 60% to nearly 26%, and Sharpe fell from 6.3 to 3.6%. We are starting to realize what the problems with this intraday strategy are.

In real life, these types of strategies can have a significant impact on prices because when the limit price is triggered, the price starts to move, and depending on the available liquidity, the effect can be large. There will be partial fills and the price may never touch the limit gain. Reducing the account size to avoid these effects, diminishes the potential, and there are also intraday trading capitalization limits.

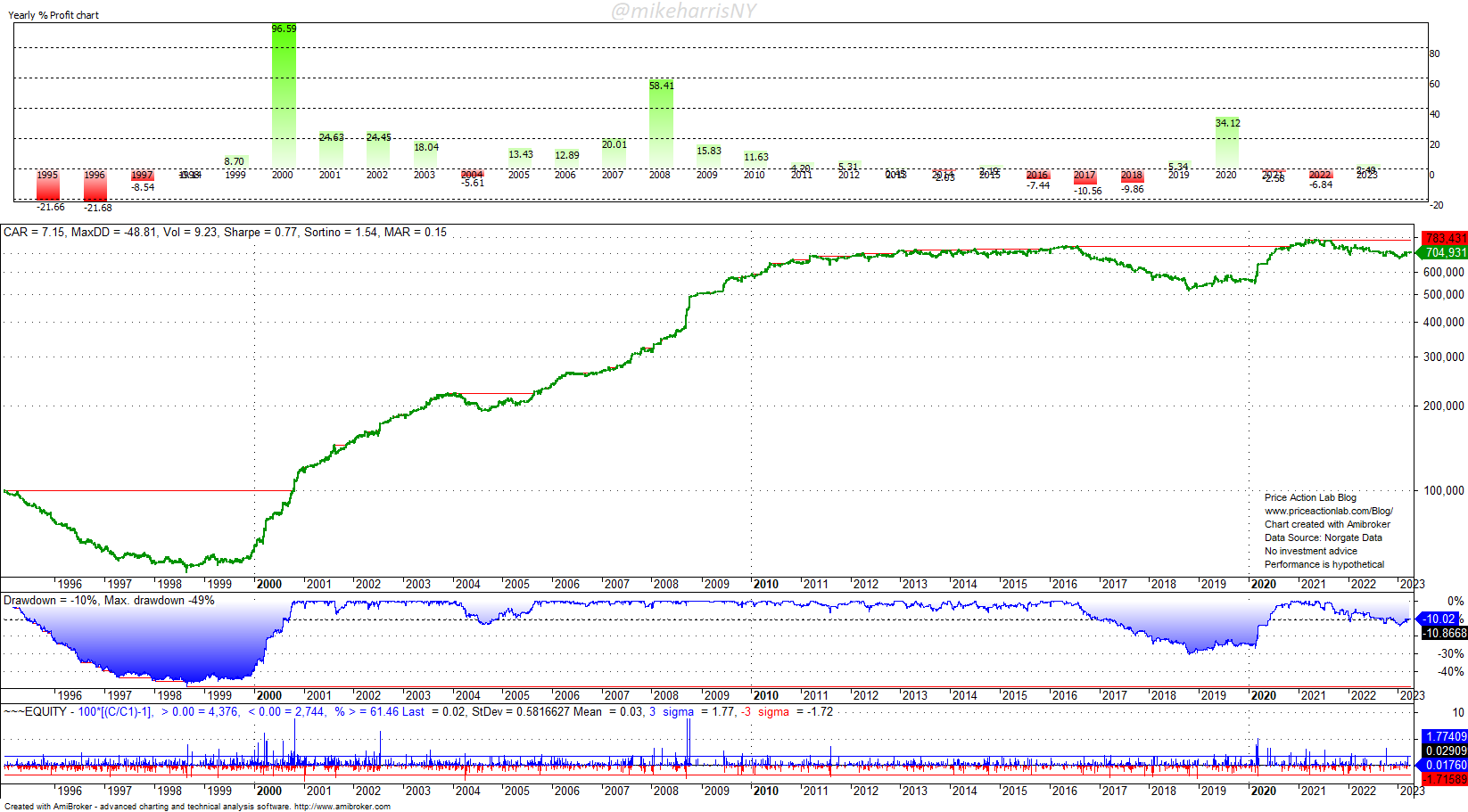

Backtesting the effect due to liquidity requires an enormous database of tick data and powerful computers. In this particular case, a supercomputer may be required to test the effects on a universe of 1000 stocks in the last 37 years. For this article, we will increase the slippage to 0.2%, to account for some of these effects. This is a crude method, but we are interested in the results.

The initial 60% annualized return plunged to 7.2%, the maximum drawdown increased to nearly 49%, while the Sharpe dropped from 6.3 is about 0.8! This is what real life can do to unrealistic strategies. The actual results can even get worse.

If markets were that easy for retail, and simple strategies with limit orders in mean reverting bull markets (close above the 200-moving average) could generate extraordinary returns, then this would equate to money printing. But the reality is harsh, and making large returns is not easy.

There are several variations of the strategy discussed in this article, but all have this in common: they can be unrealistic and bogus. Those who propose these strategies may be naïve, have no skin in the game, lack an understanding of market limitations, or have an agenda. Those who may benefit from these strategies are mainly the market makers and some professionals, who may use advanced risk management methods and liquidity search algos, acting as counterparties mainly.

Premium Content

Online Books

Premium Articles

Systematic Market Signals

By subscribing you have immediate access to hundreds of articles. Premium Articles subscribers have immediate access to more than two hundred articles and All in One subscribers have access to all premium articles, books, premium insights, and market signals content.

Free Book

Subscribe for free notifications of new posts and updates from the Price Action Lab Blog and receive a PDF of the book “Profitability and Systematic Trading” (Wiley, 2008) free of charge.

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data