Commodity Trading Advisors, who were short the equity and bond markets, were the main targets of a major short squeeze this week. Systematic traders who were out of the market missed potential gains.

Summary

- Rare weekly moves in the stock and bond markets

- CTAs and managed futures were short-squeezed

- The uncertainty in macro and wishful thinking

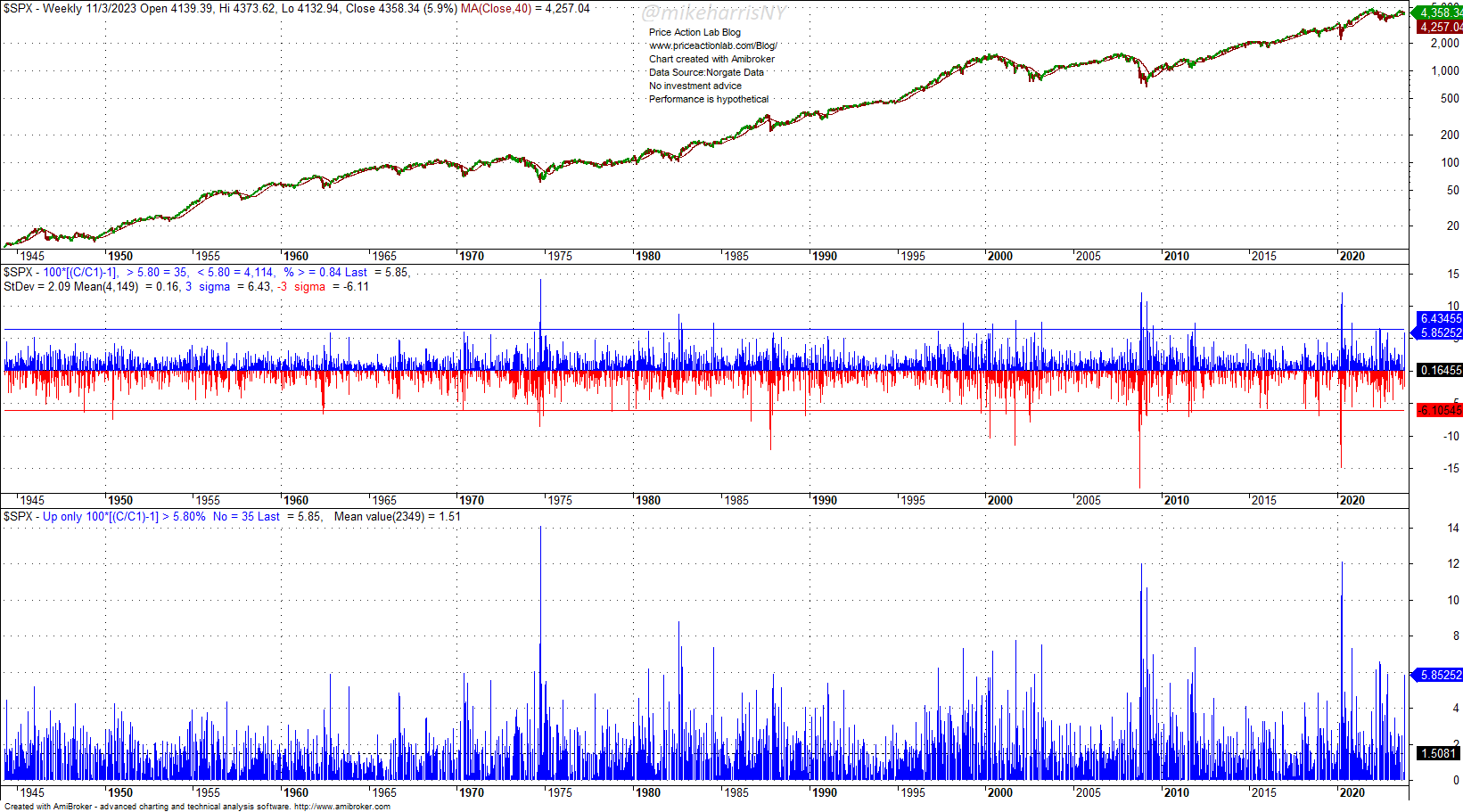

The short squeeze in the stock market this week was a rare event with a low frequency of occurrence since 1945, based on weekly data.

Specifically, based on the available sample of 4,149 weekly returns since 1945, a 5.85% weekly move has a frequency of occurrence of only 0.84%, while it is nearly 3 standard deviations away from the mean. For up moves only, the mean weekly return has been 1.5%, and a 5.83% move was larger by a factor of 4; this was a significant up move in the stock market.

Note that while the S&P 500 index total return is +15% year-to-date, the S&P 500 equal weight index total return is only +1.7%. The stock market has been driven this year by a few mega caps, while the broader market internals are weak.

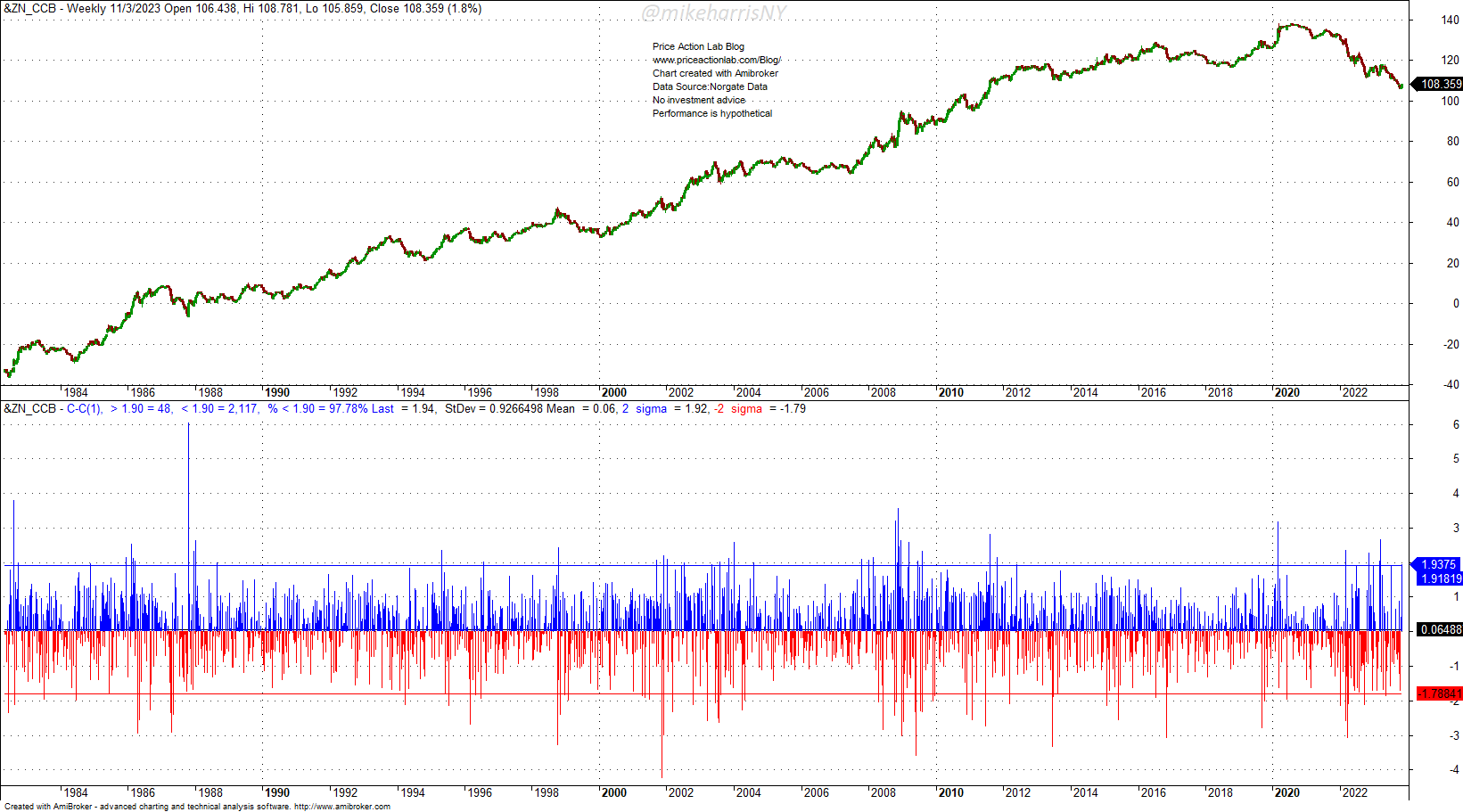

Along with the rally in stocks, there was a 2-standard deviation move of nearly two full points in the 10-Year Note futures based on weekly backadjusted data since 1982.

The frequency of a two-point up move is only 2.2% based on the available sample of weekly data.

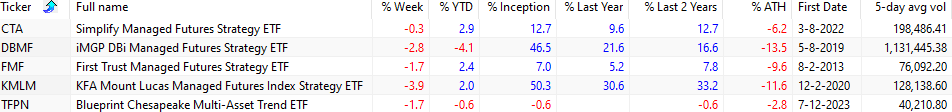

The rare moves in the stock and bond markets this week caused a short squeeze, mainly in the CTA space. Most CTAs were short equity index futures and bonds. Below is a performance table of five popular managed futures and CTA ETFs.

The DBMF ETF fell 2.8% for the week on a 5-day average volume of more than 1.1 million shares. The KMLM ETF plunged 3.9%. The newly launched TFPN lost 1.7%.

The short squeeze occurred because equity investors and probably some CTAs focused on the bullish dimensions of this week’s employment report and ignored the hawkish bias of the Fed Chairman. The market was heavily short stocks and bonds, and a short squeeze was bound to occur. The rush to exit short positions by noise traders, discretionary traders, and CTAs using dynamic stops exacerbated panic buying.

Some systematic traders were out of the stock and bond markets at the start of the week due to signals from key indicators, such as the 200-day moving average. This was also the case with our ensemble of six trading strategies. There were no significant losses due to the short squeeze, but no profits were realized. However, the objective of most diversified systematic traders is to avoid setups with a high risk/reward ratio, and that was the case at the end of the previous week, i.e., the strategies worked as they were expected.

The CTA short squeeze may continue into next week if there is more panic buying and reversal signals. It is hard to forecast what will happen due to the vast optimization space of CTAs and especially trend-following, which results in a multitude of strategies for the same markets with different entry and exit points.

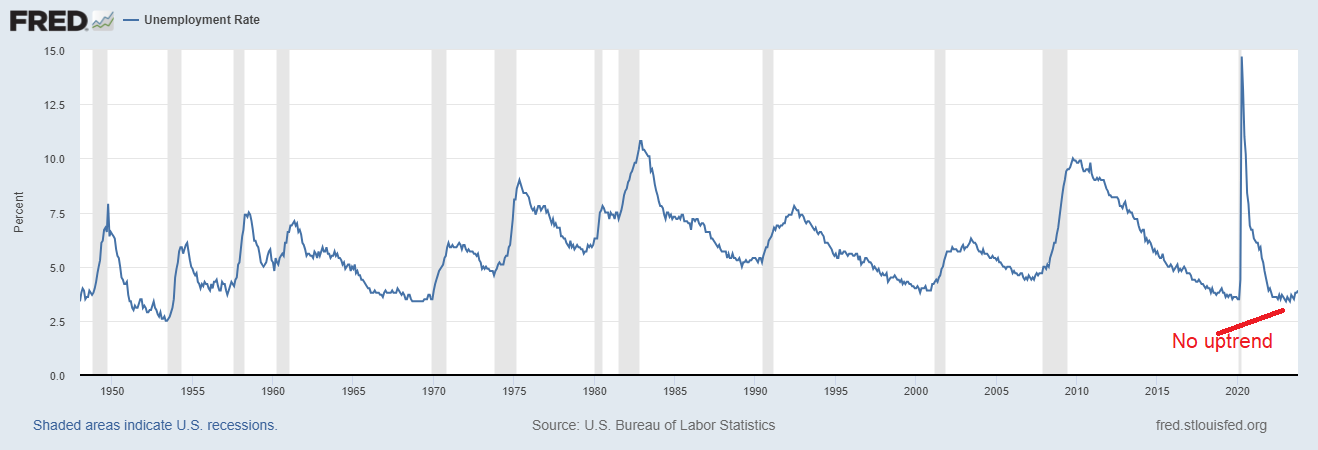

From a macro perspective, we do not see any justification yet for excessive optimism. The inflation fight may take longer than many analysts think, and the terrain is highly uncertain. Even if a recession starts, inflation could stay above the target, forcing the Fed to remain vigilant. Despite some analysts’ wishful thinking, the recent increase in unemployment does not yet indicate a strong trend.

In addition, we may not have seen the end of upward wage increases yet. Inflation in food, shelter, and energy remains high, and prices are on the rise, although at a lower rate. Workers will demand higher compensation to survive, given the decimated purchasing power.

All in all, there is higher uncertainty than usual, but short squeezes will occur, and they are more frequent in bear markets. Occasionally, large short squeezes signify reversals in the trend, but this is known only in hindsight, and no technical or fundamental analysis can forecast them.

Price Action Lab Blog Premium Content

Subscribe for immediate access to hundreds of articles. Premium Articles subscribers have immediate access to more than two hundred articles, and All in One subscribers have access to all premium articles, books, premium insights, and market signal content.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter.