Stock market predictions for gains in the coming year are not very useful because the odds of the stock market gaining in a given year are already high.

Summary: Most stock market analysts forecast gains for the next year, especially after a profitable year. However, these forecasts are not useful, as the odds of a stock market gain in a given year are already high. Bullish forecasts are not useful for passive equity investing, which makes up more than half of the invested capital. Bearish forecasts are more useful in adjusting the weight of stocks in strategic and tactical asset allocations.

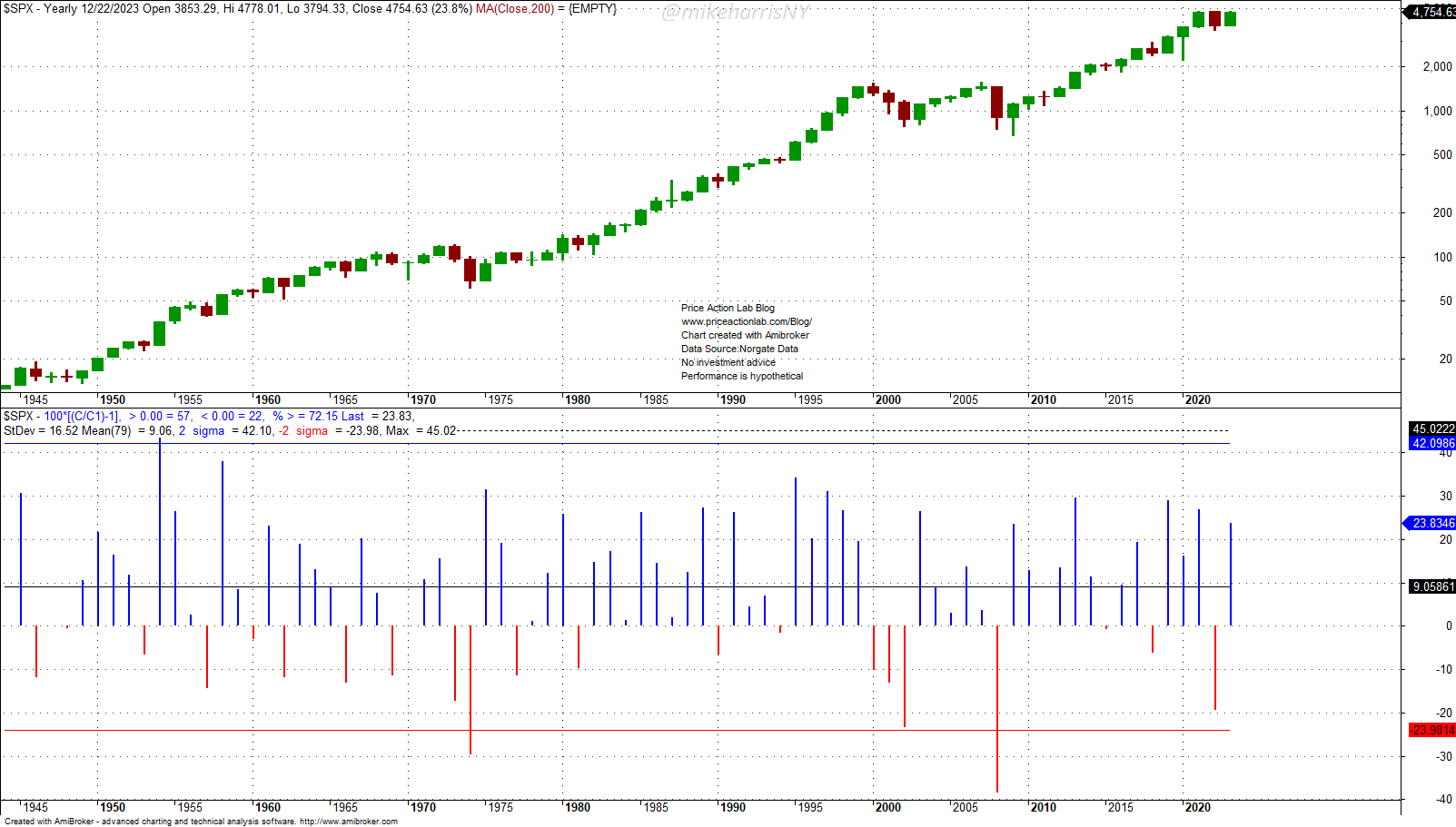

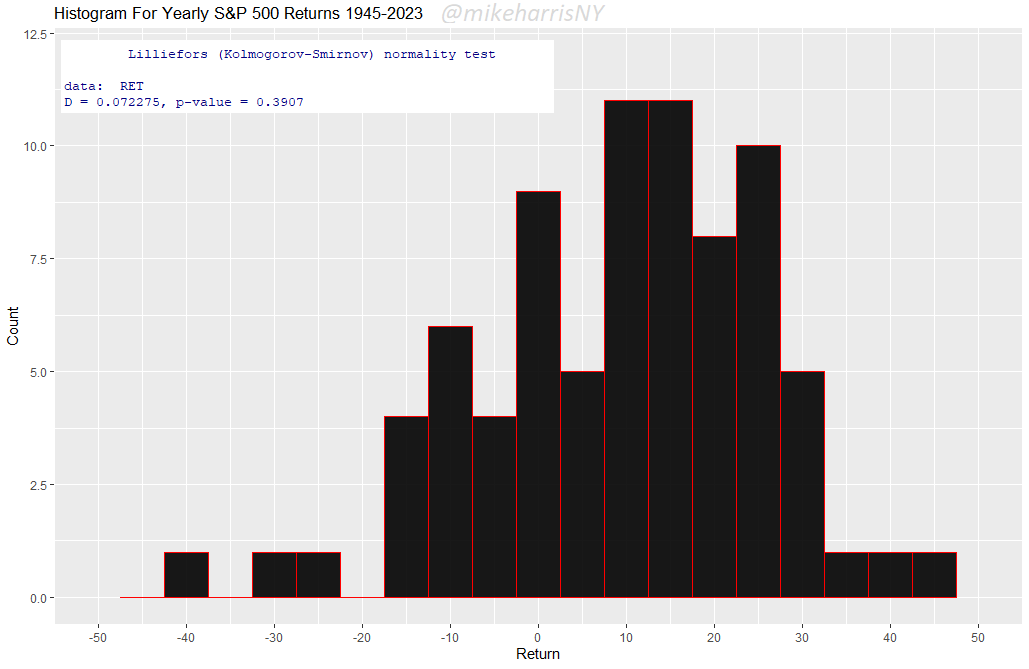

The histogram of the S&P 500 annual returns in the last 79 years reveals a hit rate of 72.15% or 57 up versus 22 down years.

Annual S&P 500 returns are approximately normal. Note that all annual returns are within +/- 3 standard deviations, and there are no outliers.

The K-S test yields a p-value of 0.3907, and normality cannot be rejected. If we assume that the probability of a winning year is about 72%, then the odds of an up year are about 2.6:1, which means that a forecast of an up year is not required. What is more interesting but difficult is a forecast of a down year, but the odds are low.

Bullish forecasts are not useful, especially for passive equity investing, which makes up more than half of the invested capital in the markets. These investors will hold stocks no matter what the forecasters claim because they rely on the high odds of rising prices. Even in the case of tactical allocations, the bullish forecasts are not useful. On the other hand, a bearish forecast is more useful in adjusting the weight of stocks. For example, if investors expect stocks to go down, they can reduce the allocation from 60% to 30% and increase the allocation to other assets, such as bonds, gold, managed futures, etc.

I find it curious that some market professionals make bullish forecasts for the next year. As shown in the histogram above, the odds of a stock market rise in a year are already high, and these forecasts do not provide any useful information. It is also pointless to take credit for predictions that have inherently high odds.

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter.