The US dollar is more than a reserve currency. It is also a tool that helps politicians and central banks boost asset prices and avoid making unpopular decisions.

The debasement of the US dollar may accelerate as central bankers and politicians are faced with tough choices about the rising debt. There are four ways to reduce debt, as I wrote in a recent article: cut spending, raise taxes, default, or inflate away the debt.

Cutting spending and increasing taxes are unpopular choices, especially before an election year. Default is out of the question for the USA because it will lead to global chaos and collapse. What is left is inflating the debt away via currency debasement. This could be accomplished by debasing the currency while instituting policies that keep nominal GDP growth above inflation. This is the only viable choice for the USA at the moment, given that all three other choices are unpalatable.

The Fed Chairman’s conference yesterday after the rate decision gave me the impression that political pressures have increased for the quick solution to boost asset prices: debase the dollar. Promises of rate cuts for the following year were able to accomplish this because they cannot cut rates when core inflation is at 4%. Probably politicians got that right, but it is only a guess.

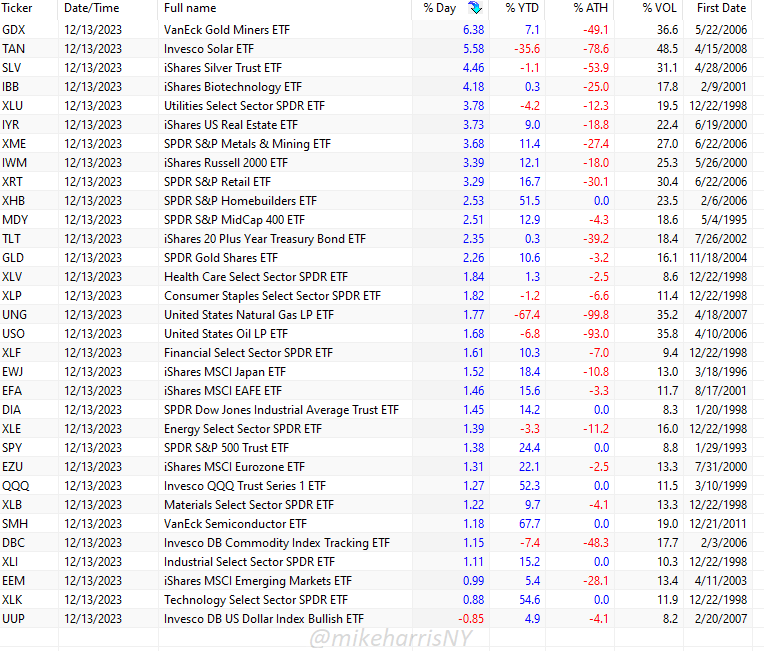

Based on promises of three 25 basis-points cuts for next year, stocks and bonds exploded higher, along with commodities, including crude oil. There is no free lunch. The table of 32 ETFs covering multiple sectors of the economy is telling.

Gold miners (GLD) surged 6.4% on dollar debasement, metals and mining (XME) jumped 3.7%, materials (XLB) gained 1.2%, and, of course, the real targets, stocks (SPY) added 1.4%, and long-duration bonds (TLT) rose 2.4%. But here is the point: only the US dollar fell, with the UUP ETF down 0.85%.

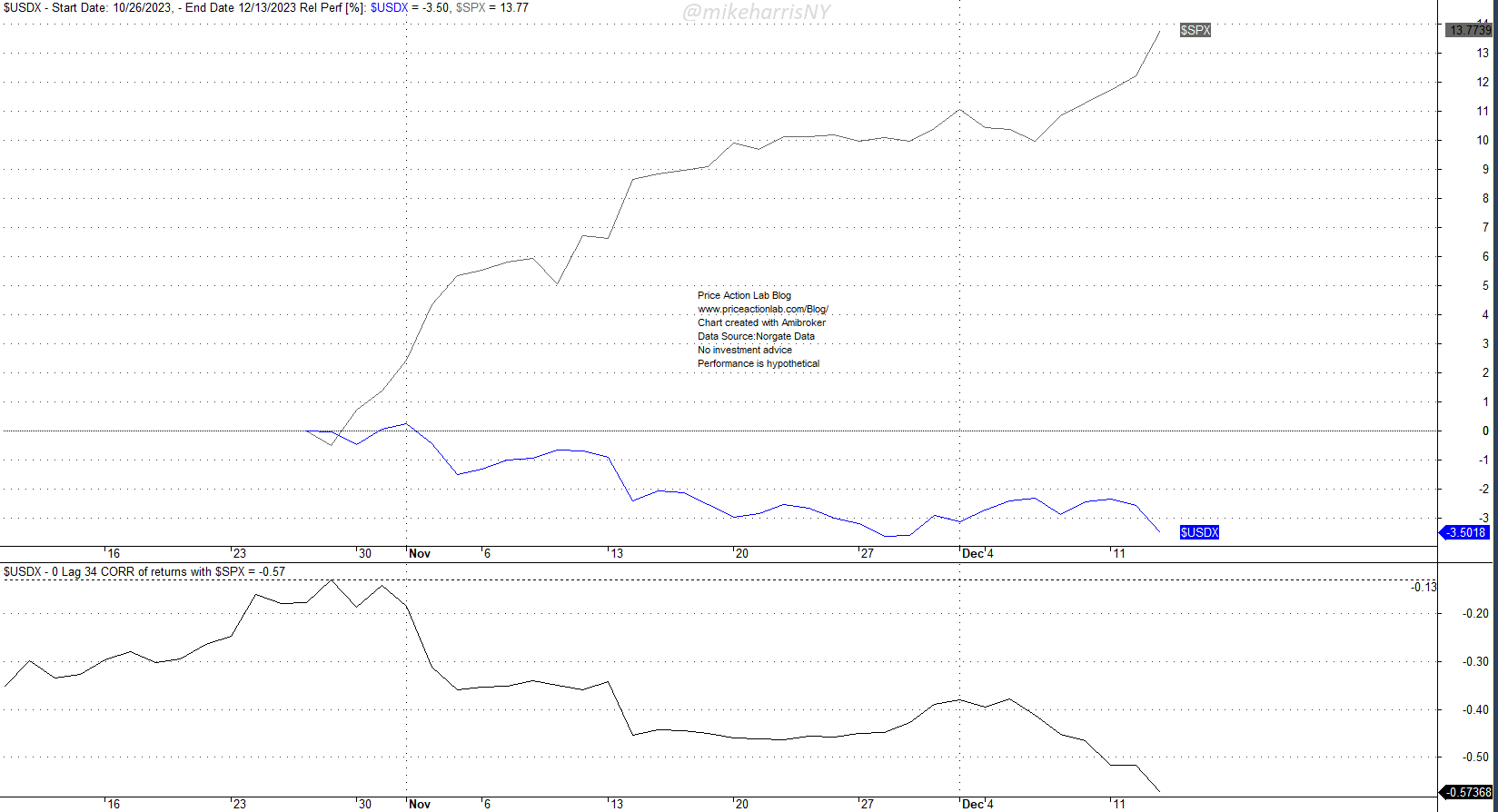

Since October 26 of this year, the S&P 500 has gained 13.8%, while the US Dollar index has fallen 3.5%. The 0-lag, 34-day correlation of daily returns has dropped from -0.13 to -0.57. Someone could claim that this is a natural path for the US dollar because of a normalizing economy. However, currency rates are relative and depend on the performance of other major economies in the world. With Europe, Japan, and China in worse shape, why is the US dollar dropping while asset prices are surging? We can start looking for reasons and counterarguments until we regress to the reason for the existence of the universe, the Big Bang. The above table is telling here: everything gained while the US dollar fell.

The US dollar debasement policy has worked well in the past but it is a short-term solution that, in the long term, creates more problems. Imported inflation is one of the problems but the most serious is the moral hazard: politicians and central bankers do not deal with the actual structural problems of the economy but resort to the easy solution available because the US dollar is a reserve currency.

What will happen in the remote case that the US dollar loses some of its reserve currency appeal? Borrowing from a common expression found mainly in books on mathematical subjects, “This is left as an exercise to the next generation”.

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter.