Most retail traders are after lottery tickets instead of following strategies and having a disciplined approach to markets. This is the disadvantage of retail and provides an edge to institutional systematic trading.

Despite many good books on the subject of trading by experienced authors with skin in the game that have emphasized the importance of a systematic, disciplined approach to trading, it is evident that the overwhelming majority of retail traders are chasing lottery tickets. Thousands of posts on financial social media daily are proof that retail is after discretionary lottery tickets. The actions are justified based on either technical or fundamental analysis, but they are far from systematic. A systematic approach is appalling to the majority of retail traders; they are after the “big one” and the excitement that comes with that.

I can understand the feelings and motives of the majority of the retail crowd. A tiny fraction is successful, but determining whether it was skill or luck is impossible. Surely, some very experienced discretionary retail traders appear to be consistently successful. However, they are the wrong people to follow because experience and luck in trading are not transferable and quantifiable. There are also those “bluffers” who take the opposite positions of those they claim to have because they either enjoy this game or that is part of some strategy.

More importantly, discretionary retail traders who chase lottery tickets provide a good fraction of the alpha of systematic traders. For someone to profit from trading, someone else or some group of traders must lose. The sell side is always eager to create more trading products that retail can use to chase lottery tickets because this is how their institutional clients can profit and make them large commissions.

In my experience, retail traders on average give up following a systematic strategy if the performance stays flat for more than three to six months. In many cases, the performance improves after a retail trader abandons a strategy. It is similar to closing a trade after a small profit, only to see it increase tenfold afterward.

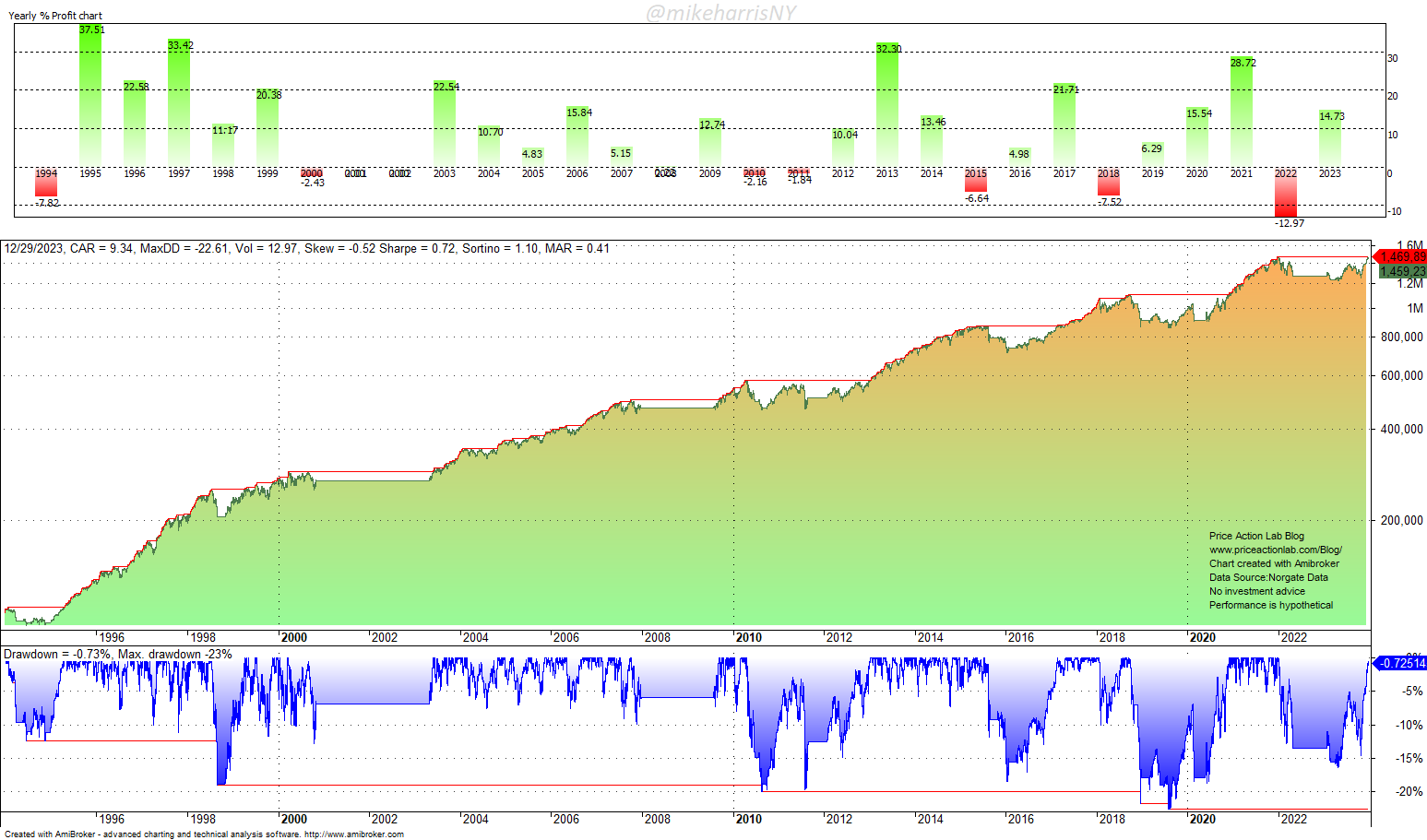

The first example I will show is the well-known 12-month moving average price series momentum in SPY ETF.

I suspect no retail trader is following this simple but well-documented strategy with a 9.3% annualized return and a maximum drawdown of less than 23%. Following this strategy is frustrating for the majority of retail traders who are after lottery tickets, usually options or leveraged ETFs. This particular strategy was slightly down for two years in a row, 2010 and 2011. But then, in 2012 and 2013, those who had the discipline to follow it nearly doubled their investment.

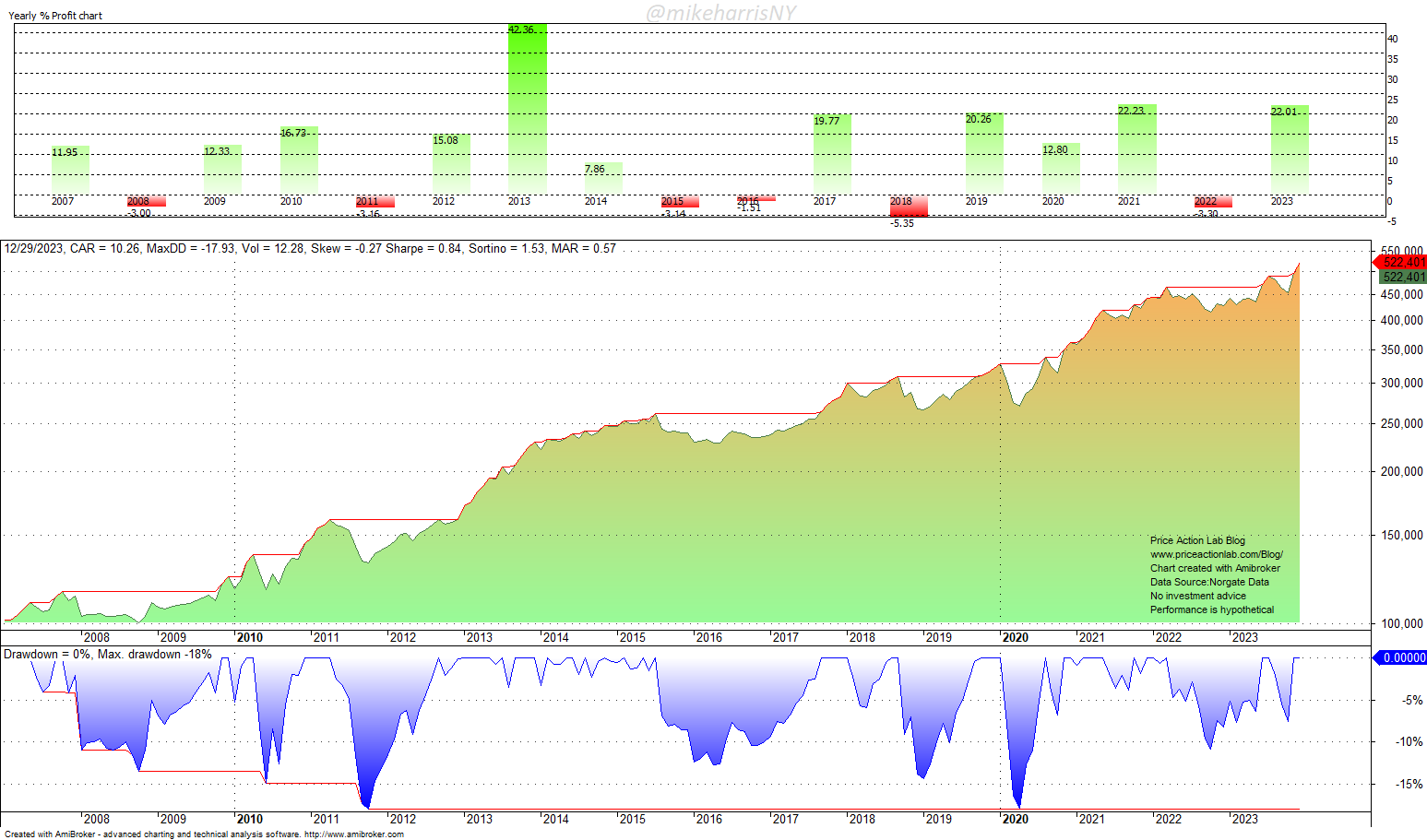

Below is a sector rotation strategy (DMSRM) we included in our ensemble this year.

This strategy can have long periods of nearly flat performance, but the annualized return since 2007 is more than 10% and Sharpe is 0.84. This strategy is not recommended for those who are after lottery tickets because following monthly rotation signals can get frustrating and is not all that exciting. But this is the type of strategy that could offer long-term potential.

Strategies are not panaceas

Strategies can fail. Most strategies will fail in the long term due to market regime changes. This is why systematic traders are constantly looking for new strategies that have economic value to replace those with diminishing potential. It is a constant fight with non-stationarity, but possibly the only way to stay ahead. This is the reason investment banks and hedge funds employ many scientists who are looking for new edges. Retail has no chance to profit from those professionals, but on the contrary, they are the source of their performance. The only way to compete in the markets as a retail trader is to employ a systematic approach with prudent risk and money management. But that does not offer the excitement of winning lottery tickets. It gets boring and frustrating, but these are what the markets seem to reward in the long term.

Price Action Lab Blog Premium Content

Subscribe for immediate access to hundreds of articles. Premium Articles subscribers have access to more than two hundred articles, and All in One subscribers have access to all premium articles, books, premium insights, and market signal content. NEW! Hybrid Asset Allocation Signals

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter.