Market recap, open positions, new signals, and performance of six trading strategies. Tactical asset allocation, mean-reversion, cross-sectional momentum, and equity long-short. Access the full report with a Market Signals or All-in-One subscription.

- U.S. securities exchanges will be closed on Monday, February 19, for Presidents Day.

- The monthly updates of the hybrid asset allocation and dynamic momentum signals are free for Market Signals subscribers. The next update will be on March 1, 2024. Click here for more details.

Contents

1. Market Recap and Comments

2. Ensemble Performance

3. Positions and Performance of Strategies

4. Signal Summary for Next Week

1. Market Recap and Comments (February 12–February 16, 2024)

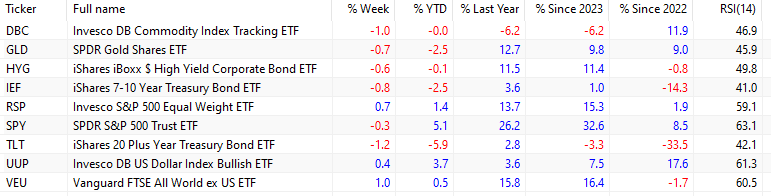

Large-cap stocks (SPY) fell 1.4% on Tuesday after an unexpected increase in the CPI but recovered in the following two days and made new all-time highs. On Friday, stocks fell 0.5% due to a higher-than-expected PPI to finish the week down 0.3%. Implied volatility, as measured by the VIX index, spiked to a high of 18% on Tuesday, only to fall again near 14% by the end of the week. Realized volatility (21-day) rose to 0.73% from 0.66% at the end of the previous week.

Investors attempted to shrug off the unexpected rise in inflation and were partly successful, especially in the case of international stocks (VEU), which ended the week with a gain of 1%, and the equal-weight S&P 500 ETF (RSP), which ended the week with a gain of 0.7%. However, tech stocks (QQQ) were hit harder and finished the week down 1.5%. Nevertheless, market breadth improved slightly.

The bond market came under renewed pressure due to the rise in inflation. The TLT ETF dropped 1.2%. The DBC ETF fell 1% despite a 3% gain in the spot price of crude oil for the week due to large losses in soft commodities and natural gas. Gold (GLD) fell 0.7% for the week, and the US dollar (UUP) was up 0.4%.

Since January 2022, the SPY ETF has been up 8.5%, but with a maximum drawdown of 24.5%. Gold has outperformed stocks in the same period, with gains of 9%. Note that TLT is down 33.5% in the same period.

A nearly half-point drop in 2-year note futures surprised many analysts, who expected the 2-year yield to resume its downtrends after recent gains. There was a three-sigma event in 2-year yields that confirmed again how ineffective macroeconomic analysis is in forecasting short-term market moves in times of uncertainty. See this article for more details.

Uncertainty is increasing due to fears of a trough in inflation and another rise. What does the future hold? We leave these answers to those with special abilities to predict the future. All we can do is try to minimize losses in the case of a bear market and maximize long-term risk-adjusted returns. For some investors, these should be the objectives. For others, their objective is maximizing wealth. Due to the risk-reward relationship, maximizing wealth implies higher risks and a higher probability of uncle point. The objective of the ensemble of strategies we use for these reports is not wealth maximization but maximizing risk-adjusted returns and achieving this at a reasonable volatility level. Although it may appear painful to do that at times, reaching the uncle point is always much more painful.

2. Ensemble Performance

|

This post is for paid subscribers

Already a subscriber? Sign in |

Access the full report with a Market Signals or All-in-One subscription. By subscribing, you have immediate access to hundreds of articles. Market Signals subscribers have immediate access to hybrid asset allocation and dynamic momentum monthly signals and more than two hundred articles in the Premium Education section, and All in One subscribers have access to all premium content (except daily mean-reversion signals.)

Charting and backtesting program: Amibroker. Data provider: Norgate Data

Disclaimer: The Premium and Weekly Signals are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the Premium and Weekly Signals. Under no circumstances should the premium or weekly signals be treated as financial advice. The author of this website is not a registered financial adviser. Before subscribing, please read our Disclaimer and Terms and Conditions.

Copyright notice: Any unauthorized copy, reproduction, distribution, publication, display, modification, or transmission of any part of this report is strictly prohibited without prior written permission.