The chicken or egg causality dilemma raises a few intriguing questions about the impact of forecasts on market performance. Below are some thoughts.

Near the end of every year, we always hear about forecasts for the next year, mainly for the stock market but also for the other capital markets: bonds, commodities, and futures. Forecasts about the stock market are the most popular because they impact most retail investors who invest in passive index funds.

According to Wikipedia, chicken or egg is a paradox about the problem of origin and first cause. Aristotle concluded the paradox leads to an infinite sequence. Certain fields, like evolutionary biology, resolve the paradox by arguing that both chickens and eggs had other ancestors. Quantum mechanics challenges the notion of causality and the existence of a paradox of this kind. We should also mention that certain religions provide a resolution based on creationism.

Despite the philosophical and scientific challenges, this paradox appears to hold significant importance in the markets, primarily due to causality rather than the existence of a first cause. How do forecasts affect market returns, and in turn, how do market returns affect forecasts?

I attempted to offer an account of the impact of the chicken or egg paradox on markets in a presentation I gave during the M4 conference in 2018. I argued that the paradox is the main driver of reflexivity.

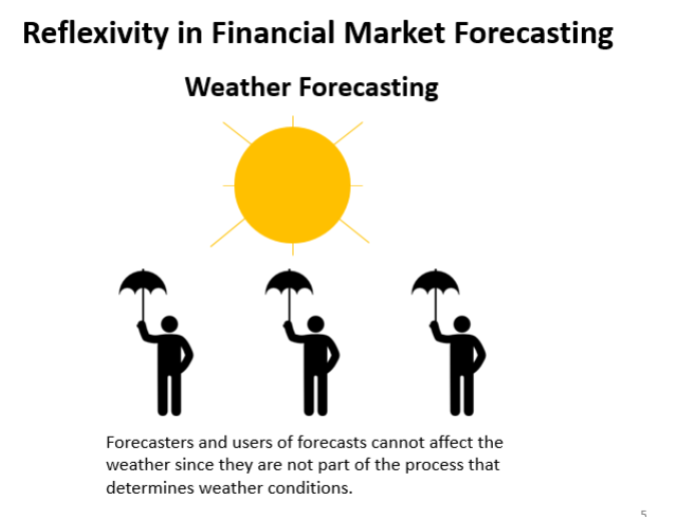

In summary, the weather remains unaffected by forecasts, as the forecasters and users of their analysis do not play a role in determining it (at least locally in time and space). Therefore, no matter what their actions are, they cannot influence the weather.

Slide 5 of M4 presentation by Michael Harris, NYC, 2018: https://shorturl.at/RSbq0

In contrast, forecasting in financial markets results in a highly complex environment.

Slide 6 of M4 presentation by Michael Harris, NYC, 2018: https://shorturl.at/RSbq0

Both active traders and investors and forecasters feed the market with information, which drives prices and returns. In this particular model, forecasts affect market prices and returns. But which is the main driver? Alternatively, how can we address the chicken or egg paradox in the markets?

Simply put, forecasts from “credible” market participants and economists, particularly those from the sell-side and their consultants, significantly influence market performance. The markets do not care about the forecast of a social media account with a thousand followers but assign high credibility to one from a major bank. This is one reason for insignificant market players to refrain from making forecasts other than enjoying a victory lap at some point in time with some probability—something that no one really cares about, at any rate.

However, overwhelmingly, the sell-side and their consultants are always bullish on the stock market. This creates a positive feedback loop via reflexivity. As a result, the market interprets both positive and negative economic news as bullish drivers. Both passive index investors and the prevailing political economy system benefit from this arrangement. However, the reflexivity may create an economy with a pro-capital bias instead of a pro-labor bias, but this is another important subject that is beyond the scope of this brief article.

To conclude, bullish forecasts and reflexivity are the major drivers of stock market returns even under harsh economic conditions. Large corrections and bear markets can and will occur, but their drivers are unexpected events beyond what the reflexivity can absorb. Lately, there is an attempt to absorb these too via the use of powerful narratives. Artificial intelligence has been the dominant narrative in the last two years, amid significant geopolitical turmoil. As this narrative’s power is fading, a new one about quantum computing has emerged, but it does not appear to be as powerful. Yet, most large banks and investment firms predict higher prices for 2025 because they bet on reflexivity: forecasts of higher prices drive the stock market higher, and in turn, higher prices result in forecasts for even higher prices.

As long as passive investing is the dominant style in the US market due to the link between pensions and stock market performance (which was Wall Street’s greatest achievement), this dominant reflexivity cycle will remain intact. However, this dynamic may face an absorbing barrier in case an alternative dynamic asset class emerges that can serve as a store of value. If this ever happens, as there is currently an effort with cryptocurrencies, the stock market, or at least many of its sectors, may face serious challenges.

Subscribe below for notifications of new posts and updates from the Price Action Lab Blog and get the free PDF book “Profitability and Systematic Trading” (Wiley, 2008).

Premium Content

By subscribing, you have immediate access to hundreds of articles. Premium Articles subscribers have immediate access to more than two hundred articles, and All in One subscribers have access to all premium articles, books, premium insights, and market signal content.

Disclaimer: We only provide the articles for informational purposes, not as investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the articles. You should never treat the articles as financial advice. The author of this website is not a registered financial adviser. Before subscribing, please read our Disclaimer and Terms and Conditions.

If you found this article interesting, you may follow this blog via RSS, email, or Twitter.