The bulk of the gains in AAPL in the last six years have been realized by holding the stock on Mondays. This is a remarkable market anomaly that should not be present in the highest capitalization stock of the U.S. market and raises questions about the games played by Wall Street firms at the expense of investors.

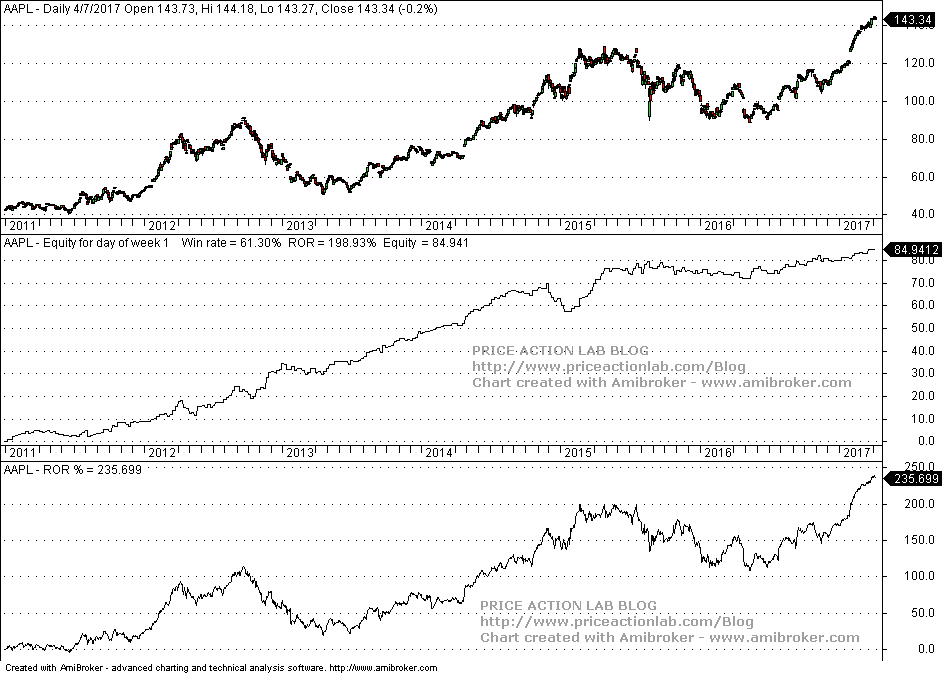

Since 01/2011, AAPL has gained about 236%. The bulk of the profits, or about 199%, have been realized by holding the stock only on Monday, i.e., buying at the previous close, usually a Friday, unless a holiday, and selling at the close of Monday. Below is a chart that shows the equity growth for one share and the Buy and hold ROR.

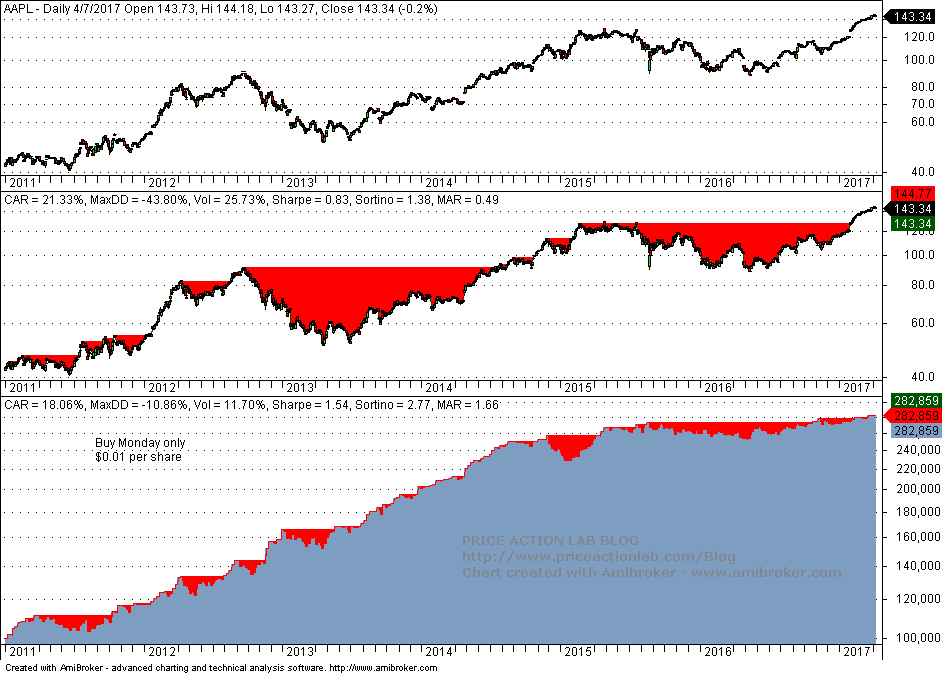

But what about commissions, someone would ask? Below is a backtest of the Monday price action anomaly with $0.01 per share commission for fully invested equity.

CAGR for the Monday trade is 18.06% net of commissions. Buy and hold CAGR is 21.33%. More importantly, Sharpe for the anomaly is 1.54 versus 0.83 for buy and hold. Even more interesting is the fact that MAR (CAGR/Max. DD) is 1.66 for the anomaly versus 0.49 for buy and hold.

Amazing! Who are those that buy the stock on Mondays and then sell for the rest of the week just to repeat the pattern week after week in the last six years plus? Is this stock manipulation? I am not an expert in this area and I will let others with the expertise to investigate that. This is the highest capitalization stock in the U.S. market. Trading in this stock should be nearly efficient.

Note that the equity curve in the last chart is in log scale. In the last two years this particular anomaly shows signs of subsiding but it is still present. Specifically, since 01/2014, the total return for the anomaly is about 41% net of commissions versus 92% for buy and hold. MAR is 1.02 versus 0.73 for buy and hold. Therefore, the Monday trade still generates about half of the gains at much lower risk.

I hope after this article efficiency will start returning to AAPL stock trading. Uninformed investors were impacted by this anomaly and incurred higher cost. Actually one of the purposes this anomaly existed was probably to make investing in the stock more expensive, indirectly.

If you found this article interesting, I invite you follow this blog via any of the methods below.

Subscribe via RSS or Email, or follow us on Twitter

If you have any questions or comments, happy to connect on Twitter: @mikeharrisNY

Charting and backtesting program: Amibroker

Technical and quantitative analysis of Dow-30 stocks and 30 popular ETFs is included in our Weekly Premium Report. Market signals for longer-term traders are offered by our premium Market Signals service. Mean-reversion signals for short-term SPY traders are provided in our Mean Reversion report.