Below is a brief account of what you can do with the two versions of DLPAL. The article was updated on August 10, 2023.

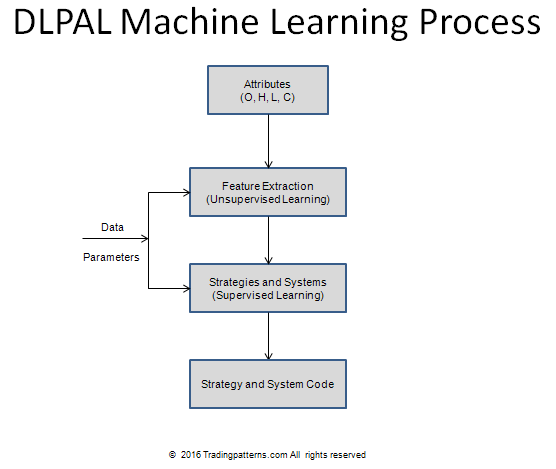

Deep Learning Price Action Lab™ (DLPAL) is based on a proprietary algorithm that produces the same output each time it encounters the same market conditions. This determinism and the absence of stochasticity comply with the standards of scientific testing and analysis1. DLPAL minimizes data-mining and data-snooping bias through the use of a proprietary unsupervised learning method for feature extraction and selection. Several functions are available for validation of the results, including a randomization tool for ranking the performance of any strategies identified or developed.

There are two versions of DLPAL: DLPAL DQ and DLPAL LS.

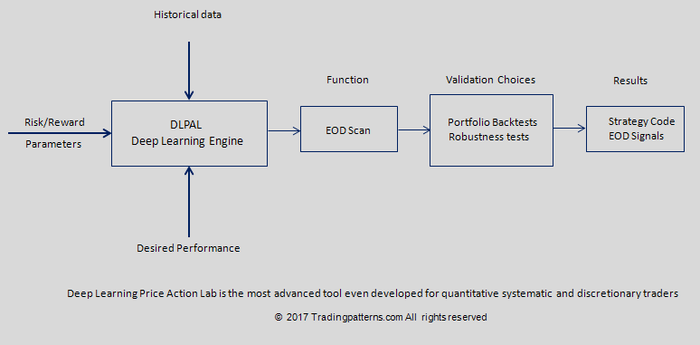

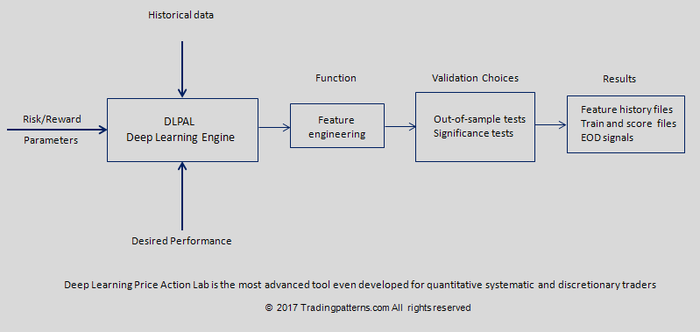

DLPAL DQ is a quantitative scanner for price action anomaly detection. The algorithm of the program identifies short-term anomalies formed in historical price data as of the last bar in the input data files that fulfill user-defined performance statistics and risk/reward parameters. Portfolio backtests and robustness test validation methods are available. This program also generates strategy code for Tradestation (EasyLanguage), Multicharts (EasyLanguage), NinjaTrader (7 and 8), and Amibroker AFL. This program can be of value to discretionary traders that like to scan many securities each day for price action anomalies and also like to make final decisions instead of following a system. Click here for more.

For examples of signals click here. For a demo trial trial click here.

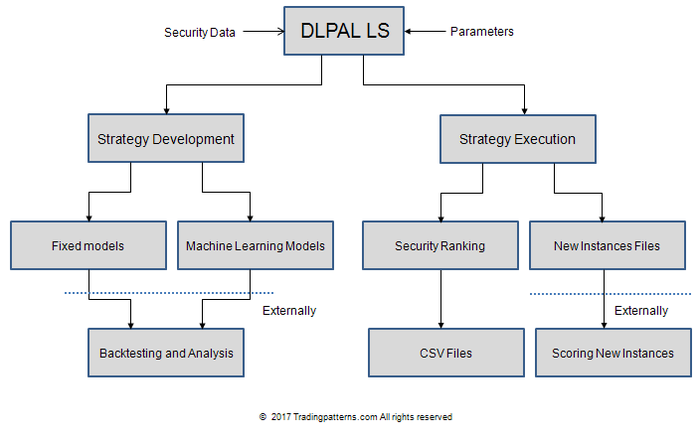

DLPAL LS calculates a set of features that measure the directional bias and the significance of a single or group of securities. This version can be used for both systematic and directional equity long/short traders, as well as directional traders in other markets. The calculated features allow for ranking securities according to specific criteria. Click here for more.

The users of the program can sort results based on different criteria and generate output for trading APIs. Historical files of features can be generated for backtesting the strategies and for machine learning.

Click here for an example. For a demo trial trial click here.

Notes

1. If a data-mining method exhibits stochasticity by generating different results each time it runs with the same data and parameters then results have low statistical significance. DLPAL does not use pre-programmed strategies as is the case with some other commercial programs that work based on a database of patterns they apply on each case. DLPAL identifies patterns in price action.