Price Action Lab spoke with legendary investor Felix Grandluckmeister on his secrets of success. Felix Grandluckmeister ‘s fund, RNDTrading, has had only 6 down quarters in the last 31 years, which is considered a unique performance.

Note: Please read our disclaimer before reading the interview.

PAL: Thank you for the interview, Mr. Grandluckmeister. Everyone is talking about your unique performance in the stock market with only 6 down quarters in the last 31 years. Can you give us a few hints about your edge?

Grandluckmeister: Thank you. I will not try to make up any stories about edges or brag about my skills. I was just lucky. My performance is due to pure luck.

PAL: But how can this be? Only 6 down quarters in 31 years is so rare.

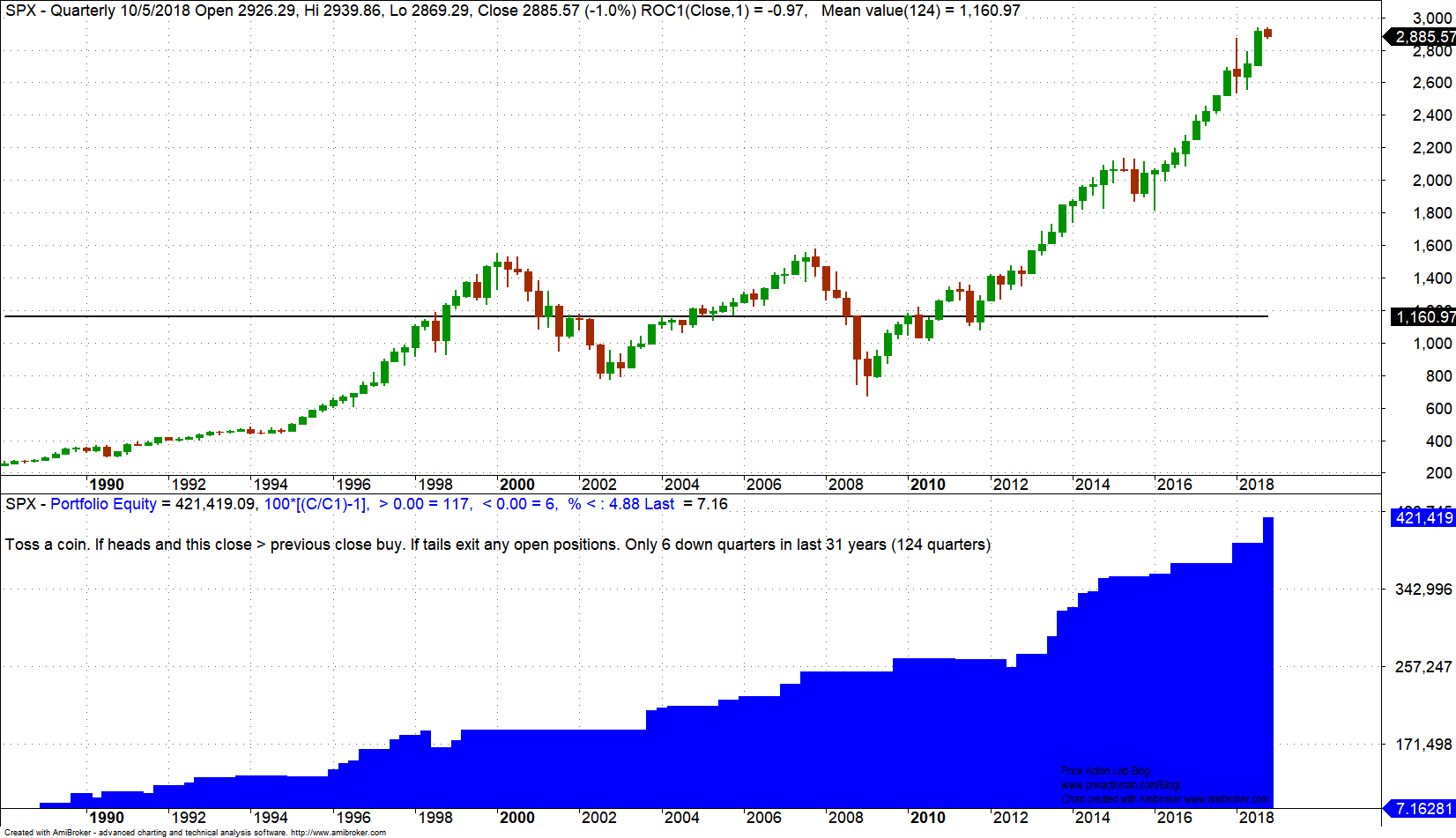

Grandluckmeister: Let us go to your computer over there and write a three-line program that will test the following strategy in S&P 500 quarterly data since 1988: we toss a fair coin, and if heads show up, we buy at the close, provided this is an up quarter. If tails show up, we sell any open positions. We repeat the full price history.

PAL: Here is the code.

Grandluckmeister: Now make it execute random runs.

PAL: It started executing. Oh, here it is. After a few runs, we have an equity curve with only 6 negative quarters. This is amazing!

Grandluckmeister: Nothing amazing here for those who understand statistics. It’s only amazing to those who have no concept of randomness. Look at that equity curve at the bottom: only 6 negative quarters in 31 years, although this is a random result. If you have a sufficiently large population of fund managers, a few lucky ones will always emerge by randomness. I will not be surprised to see a random result with no negative quarters either. It’s just statistics.

PAL: But there is a widespread notion that consistent returns require some edge.

Grandluckmeister: Consistent returns may be due to edge or luck. Luck is also some variant of edge. Some people are just lucky.

PAL: In most interviews, fund managers claim to have achieved their performance through the use of fundamental analysis, technical analysis, or even some combination of both.

Grandluckmeister: Of course, they do not lie about using those methods but overestimate their impact on their results. Both fundamental and technical analyses suffer from confirmation bias and are essentially random trading methods. In the markets, causalities and even associations of price action are hard to establish.

PAL: Are you saying that everyone is fooled by randomness in the markets and survivors, especially the lucky ones, attribute their success to their skills, although, in reality, they were just lucky outliers of a random process?

Grandluckmeister: You got it!

PAL: There are so many good books written about fundamental and technical analysis. Do you think people are wasting their time reading them?

Grandluckmeister: I am not to say what people should or should not do. But they must understand that the associations made between economic data and stock fundamentals are very weak, or even random. For example, why are people buying stocks paying 25 or even 40 times earnings? The ceiling could have been set at 10 or even 5. There is no clear association between the performance of the stock market and the economy. The latter is the real world; the former is speculation, greed, and fear.

PAL: What do you think about quants and quant funds?

Grandluckmeister: This is something new, and we need to have more data to assess the performance. In my opinion, most quant funds are not using any real edges but only fit their formulas on market data. They may get crushed at the end by randomness. Some lucky guy that tosses a coin on the other side of the trade could be the winner. Also, note that markets have gotten more efficient and alpha is hard to extract.

PAL: So what is an edge?

Grandluckmeister: Edge has two components: initial luck to build a track record and then large AUM.

PAL: Could you elaborate a little on this?

Grandluckmeister: If you are lucky to build a cushion for a few years, then you can grow AUM and trade size. Squeezing out the market’s weak hands and profiting from them becomes easier. You do not need any other edge. All these good people with large funds that have outperformed the market are maybe overestimating their skills while underestimating the effect of purchasing power.

PAL: Are you saying that large AUM is the only true edge?

Grandluckmeister: You got it!

PAL: Thank you for the interview!

Disclaimer: This interview is a work of fiction. Names, characters, businesses, places, events, and incidents are either the products of the author’s imagination or used in a fictitious manner. Any resemblance to actual persons, living or dead, or actual events is purely coincidental.

If you found this article interesting, I invite you to follow this blog via any of the methods below.

Subscribe via RSS or Email, or follow us on Twitter

If you have any questions or comments, happy to connect on Twitter: @mikeharrisNY

Charting and backtesting program: Amibroker

Market signals from systematic strategies are offered in our premium Market Signals service. Stock signals are offered daily in our Premium Stocks report. For all subscription options click here.