Strategies with a trade input delay are often useful in short-term trading because the delay can act as a filter of price corrections. DLPAL determines the best value of the delay for the strategies it discovers based on the range of values specified by the user. With the delay option activated, often more strategies that satisfy the performance criteria set in the search workspace can be found. If a delay is not used, some strategies may suffer an immediate correction after forming and generate more losers than winners due to profit taking. The delay often acts as a filter to corrections, allowing prices to recover before a position is established and resulting in a higher profitability for a system.

When specifying a delay in a search workspace, the results may include strategies with and without delay. The following are recommended:

A. Using a delay in the range of 1 – 5

B. Creating separate models for strategies with and without delay and adding those to system tracking.

A. Using a delay slows down the search process because DLPAL must determine the historical performance of each candidate strategy for each value in the range specified for the delay.

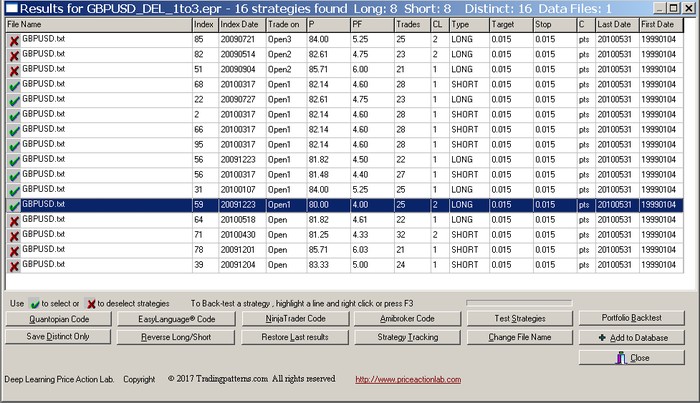

B. Clicking the Trade On column label in search results workspace allows sorting strategies according to delay values. Different systems may be added to system tracking by selecting patterns with and without delay, or according to delay values. In the following example for GBPUSD, only strategies with delay 1 are selected to save and/or add to system tracking:

More information about strategies with a delay in trade input can be found in the introduction of this manual.