A crash in two stocks from the consumer defensive sector brought back memories of the 1987 crash. After 35 years, these price moves were not expected.

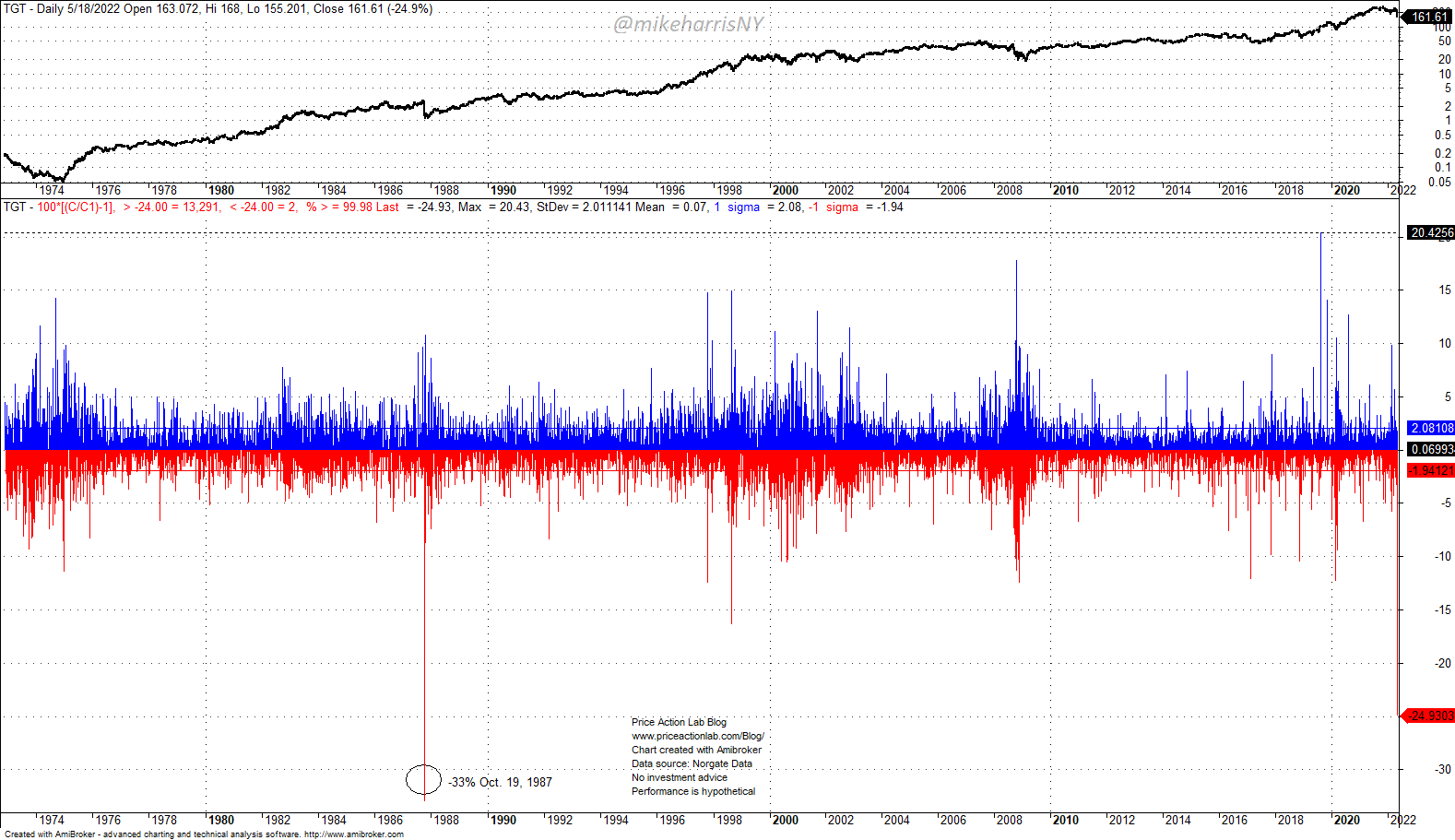

The stock of Target Corporation (TGT) crashed 24.9% yesterday, Wednesday, May 18, 2022, due to plunging profit margins.

The daily loss yesterday was the largest since a 33% loss on October 19, 1987. It brought back memories from 35 years ago. Is such a huge daily drop justified? I have no idea but this is not a sign of a healthy market. Something is definitively wrong and it may have to do with market microstructure in addition to downside momentum. But events of the size of the 1987 crash in 2022? I suppose some things never change.

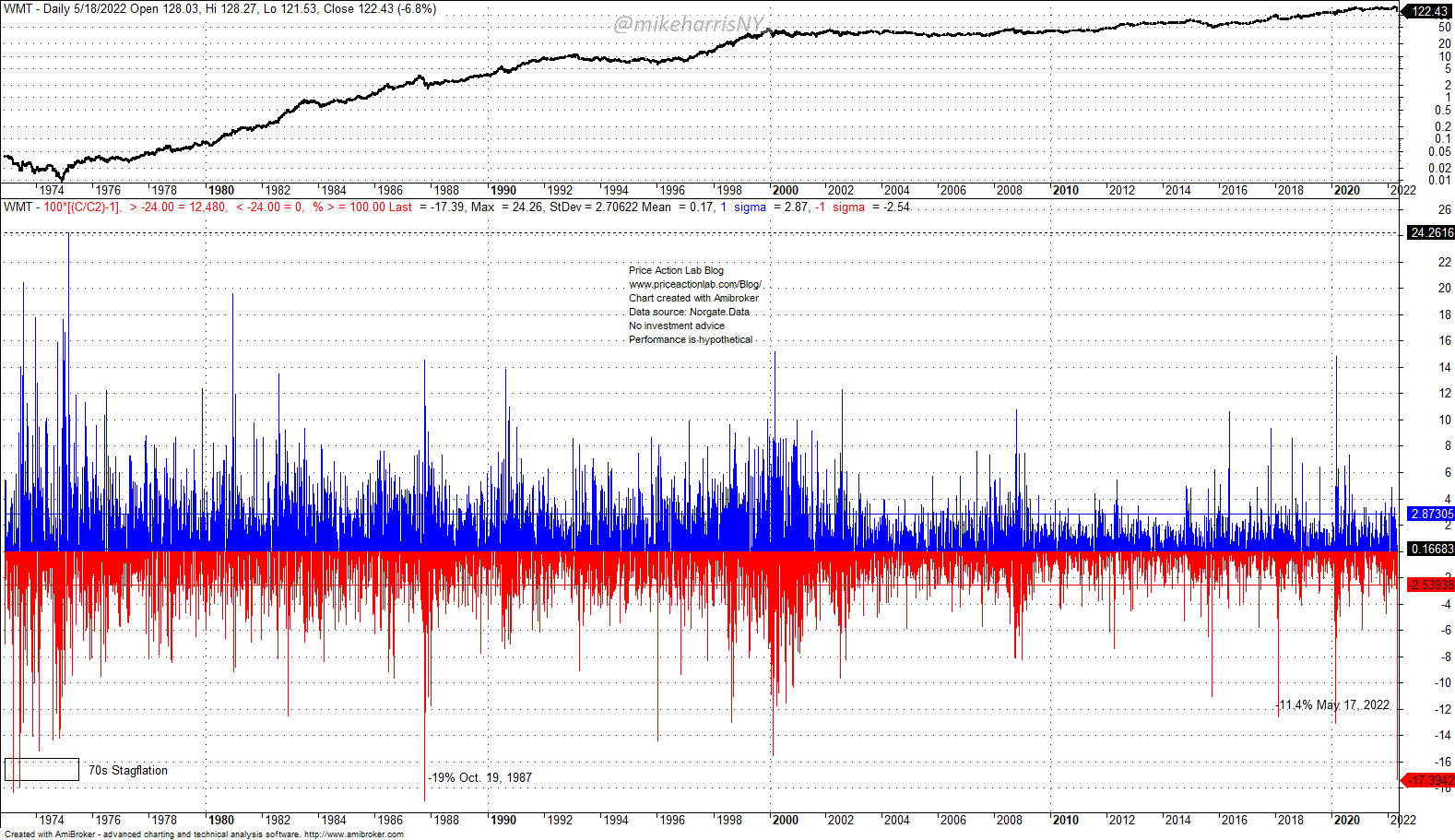

The Walmart stock chart below is interesting because the price history goes back to the 70s stagflation period. The stock (WMT) has plunged 17.4% in the last two days. This is the most since 19% on October 19, 1987, meaning this was another tail event reminiscent of the 1987 crash.

Comparable losses occurred during the stagflation period in the 70s, as marked on the above chart.

Losses comparable to those of the 1987 crash and 70s stagflation period. These are not good signs for the market. There are accelerating selling pressures that are causing left tail events.

Premium Content 10% off for blog readers and Twitter followers with coupon NOW10

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data