Strategy ETFs are gaining attention. Below are examples of strategy ETFs we track.

In the Price Action Lab Report of this week, we introduce a section for strategy ETFs due to their growing use in diversification strategies. We plan to add to the list more strategy ETFs in future reports.

The first ETF in the table above, the iMGP DBi Managed Futures Strategy ETF (DBMF), is gaining attention for use in diversification strategies due to the convexity managed futures can provide. Below is a daily chart from the inception date.

This ETF is up 23.2% year-to-date, and the maximum drawdown has remained low.

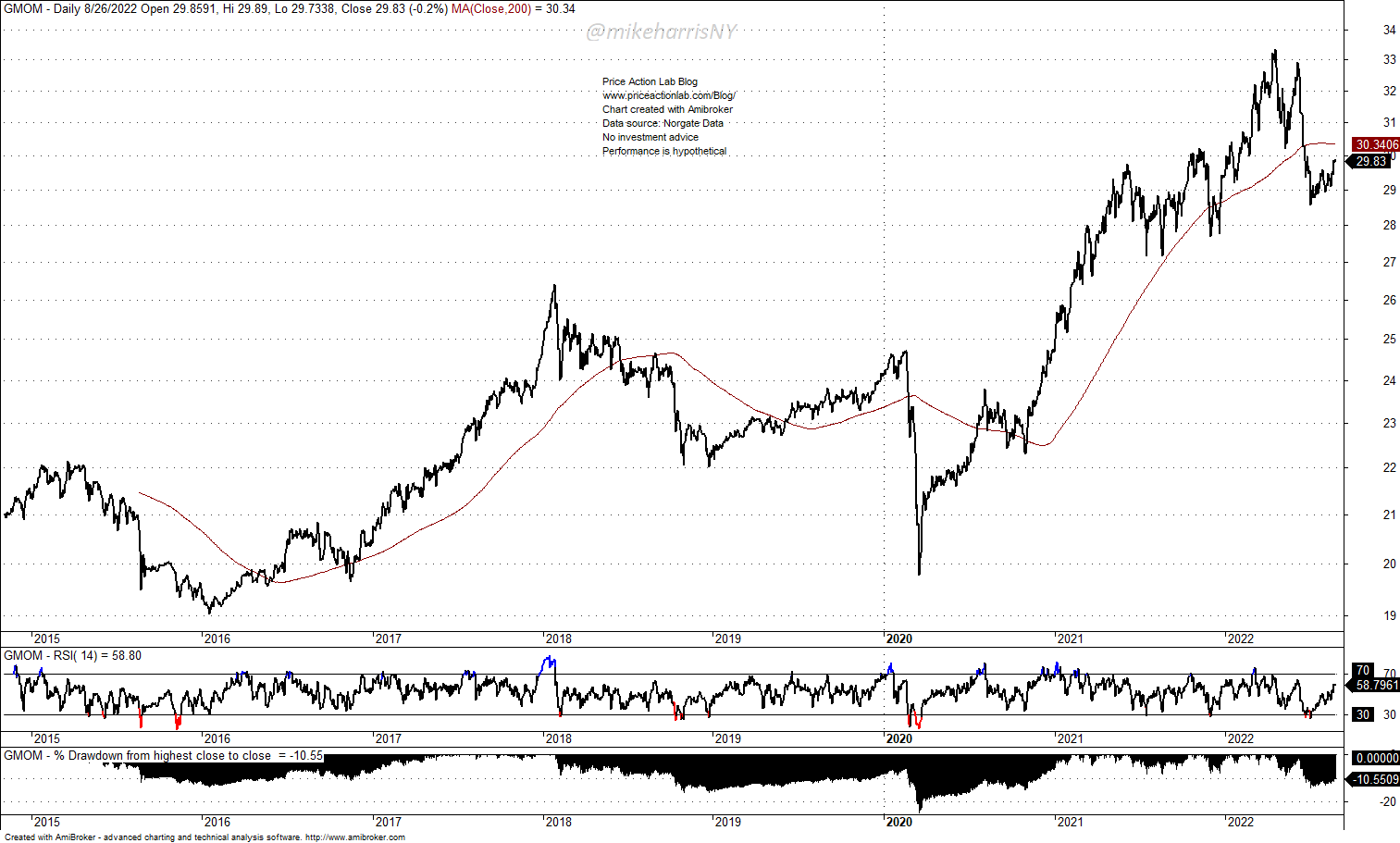

The Cambria Global Momentum ETF (GMOM) is another interesting strategy ETF that can provide convexity to a passive index portfolio.

Although the S&P 500 is down 15% year-to-date, GMOM is slightly up by 1.4%.

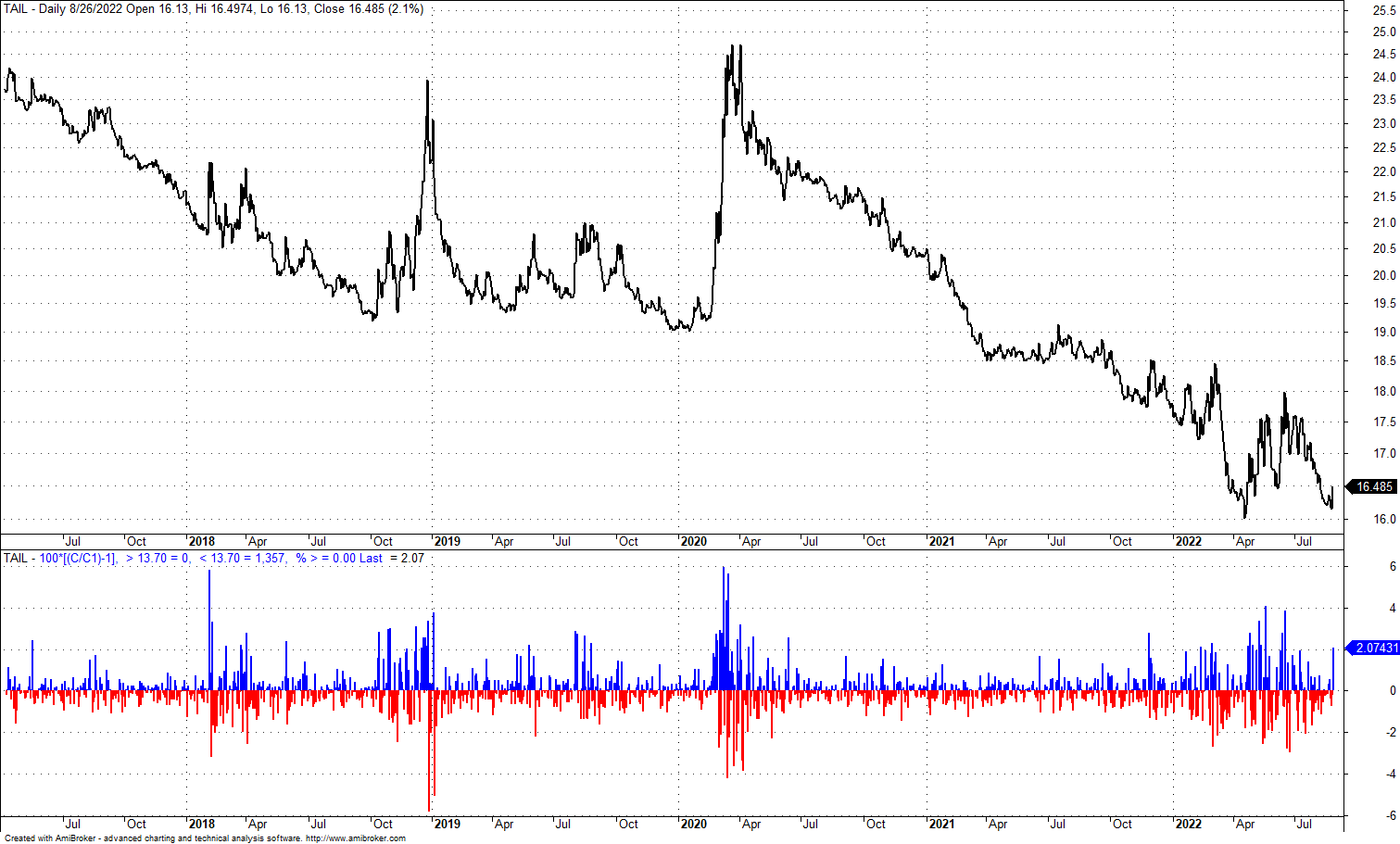

The Cambria Tail Risk ETF (TAIL) is another interesting strategy ETF but it is down 7.3% year-to-date, despite the correction in stocks.

A tail-risk strategy ETFs will gain during extreme tail events, as in the 2020 crash. During that period, TAIL gained about 25% in 20 trading days.

After a spike and some clustering, volatility usually crushes and there is a reversion to the mean. There have been no large spikes in volatility this year, but rather what has been dubbed a “pain trade.” As a result, there has been no significant increase in TAIL.

Due to the cost of tail insurance, tail risk strategy ETFs may decay in price over time. But a small allocation may be beneficial for protection from rare extreme events.

Strategy ETFs are interesting vehicles, but caveat emptor: the price history is relatively short and we need more data to evaluate performance and determine that they deliver what they are designed for. New issues and assets invested in those strategy ETFs will grow, and liquidity will increase.

Disclaimer: The premium articles are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the premium articles. Under no circumstances should the premium articles be treated as financial advice. The author of this website is not a registered financial adviser. The past performance of any trading system or methodology is not necessarily indicative of future results. . Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data