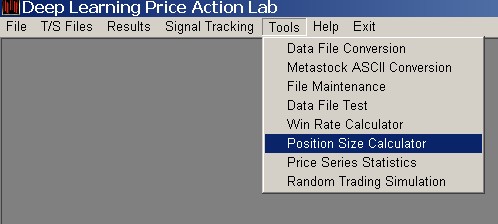

From the main program menu click Tools and then Position Size Calculator.

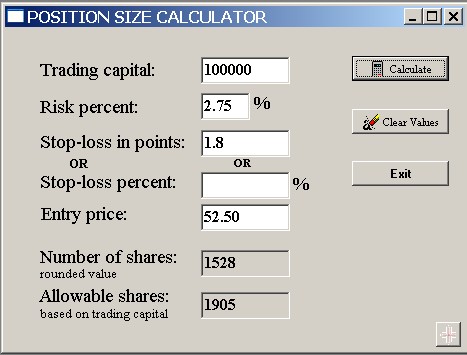

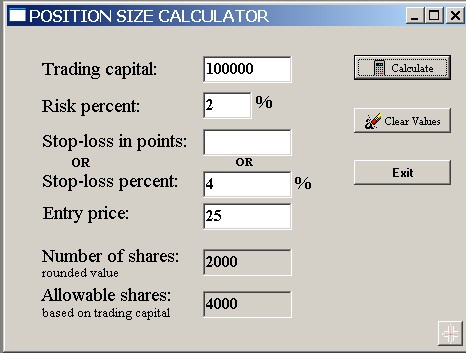

The calculator determines the number of shares for given trading capital value, risk percent per trade and stop-loss value either in points or as a percentage of the entry price. The calculation requires the approximate entry price in the case of percent stop-loss. Results are rounded to the next integer value.

This is an example of number of shares calculation for a 100K account, 2.75% risk per trade and 2 points stop-loss. The entry price is $52.50.

This is an example of number of shares calculation for a 100K account, 2% risk per trade and 4% stop-loss. The entry price is $25.

The equations used are as follows:

For stop-loss in points: N = (R x M)/(100 x SL)

where N is the number of shares, R is the risk percent per trade (fixed), M is the trading capital and SL the stop-loss in points.

For stop-loss percent: N = (R x M)/(SL x P)

where N is the number of shares, R is the risk percent per trade (fixed), M is the capital at risk, SL the stop-loss as a percentage of the entry price and P the approximate entry price.

Allowable shares = M/P

Note: the calculator can be used in the case of contracts (futures or Forex) provided that the stop-loss corresponds to the amount at risk