DLPAL allows searching for strategies that are profitable across a number of instruments, also called “common strategies” in the software. This feature provides another powerful validation method in the sense that the significance of strategies that are profitable across several instruments is higher. This is true due to the fact that common strategies perform well not only with one instrument – something that can be the result of selection bias – but across many instruments and as a result any selection bias is reduced as a function of the number of the instruments involved.

How it works

Checking the option Common Features Only instructs the program to look for strategies in each instrument on the workspace that are also profitable in all other instruments. When the program finds a strategy in one instrument that satisfies the criteria set on the workspace, it also backtests its performance in all other instruments using the parameters of the original instrument (target, stop, etc.). If in all cases the profit factor calculated is greater than the minimum profit factor for common strategies (default is 1.00) then the strategy is reported in the results. DLPAL allows specifying the Minimum Common % for common strategies. If it is set to 100, each common strategy must have the minimum profit factor specified. This value can be set to anything between 0 and 100. For example, if the value is set to 75, then all common strategies reported will have the minimum profit factor in at least 75% of the instruments tested.)

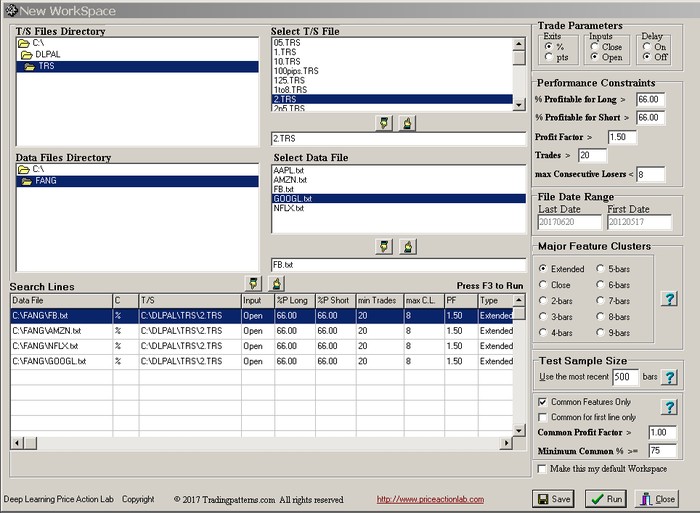

Example: Identifying profitable strategies across FANG (FB, AMZN, NFLX, GOOG) stocks .The search workspace setup is shown below:

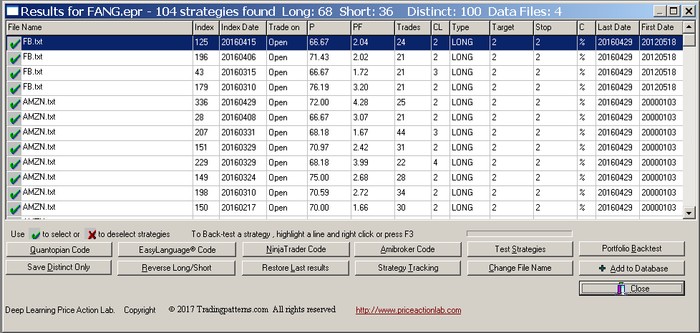

The results for common strategies are shown below. In this case, 104 strategies were found:

Notes

(1) The chances of finding common strategies decreases with the number of instruments and the Common Profit Factor value are increased.

(2) When this option is selected, all data files on the workspace must have the same point value in the case point stops are used. For example, when using currency pairs with point stops (pips), EURUSD and USDJPY have different point values. These must be adjusted in the historical file before the search for common strategies so that a point stop of 0.01 in EURUSD (100 pips), for example, also corresponds to the same number of pips in USDJPY.

(3) Checking the option Common for first line only will find common features for the symbol in first search line only.